The Nifty IT index, which represents the larger information technology (IT) companies in India, reached a record high of 44,085 on November 26.

Over the last one year, the Nifty IT Total Return Index (TRI) has gained 40 percent while the Nifty 50 TRI delivered 24 percent.

Naturally, sectoral mutual funds that invest predominantly in IT and related businesses mirrored this, delivering 40 percent returns on average over the past year.

Demand slowdown

IT stocks have rebounded over the last 15-18 months, after posting negative returns in 2022.

Meeta Shetty, Fund Manager at Tata Mutual Fund, says, “In 2022, the IT sector faced challenges such as rising inflation and interest rates, which hit the global market sentiment. IT companies witnessed a slowdown in demand, which, coupled with fears of a global recession driven by the Russia-Ukraine conflict, cast a shadow over the sectoral outlook.”

Also see: New-age tech stocks turn favorite among mutual funds. Check out their top picks

IT stocks have gained momentum lately following Donald Trump’s victory in the 2024 US presidential election. This, experts believe, will lead to higher discretionary spends by US businesses, which would benefit Indian IT companies.

Says Nirav Karkera, Head of Research, Fisdom (an investment advisory): “Over the past year, the IT sector’s performance has been driven by robust order books and better-than-expected earnings, with leading firms like Infosys and TCS securing significant deals that boosted financial results.”

Despite global uncertainties, the sector benefitted from resilient demand across industries such as banking, healthcare, and retail which continued to prioritise digital transformation, Karkera added.

Near-term pressures

While near-term pressures such as wage hikes and geopolitical risks may impact margins, the sector's long-term prospects remain strong due to rising global IT spends and India’s leadership in technology services, explained Karkera .

“However, post the run-up in IT stocks over the last one year, valuations are nearing the highs we saw during the pandemic, suggesting there is not much room for further expansion,” said Shetty.

Also see: MF, PMS and AIFs are betting on these mid-cap stocks. Check if you own any

Nonetheless, Shetty expects the earnings growth of IT companies to recover over the next two to three years, even if valuations do not appreciate much hereon. “The sector’s growth is expected to come more from earnings rather than increase in stock prices,” Shetty added.

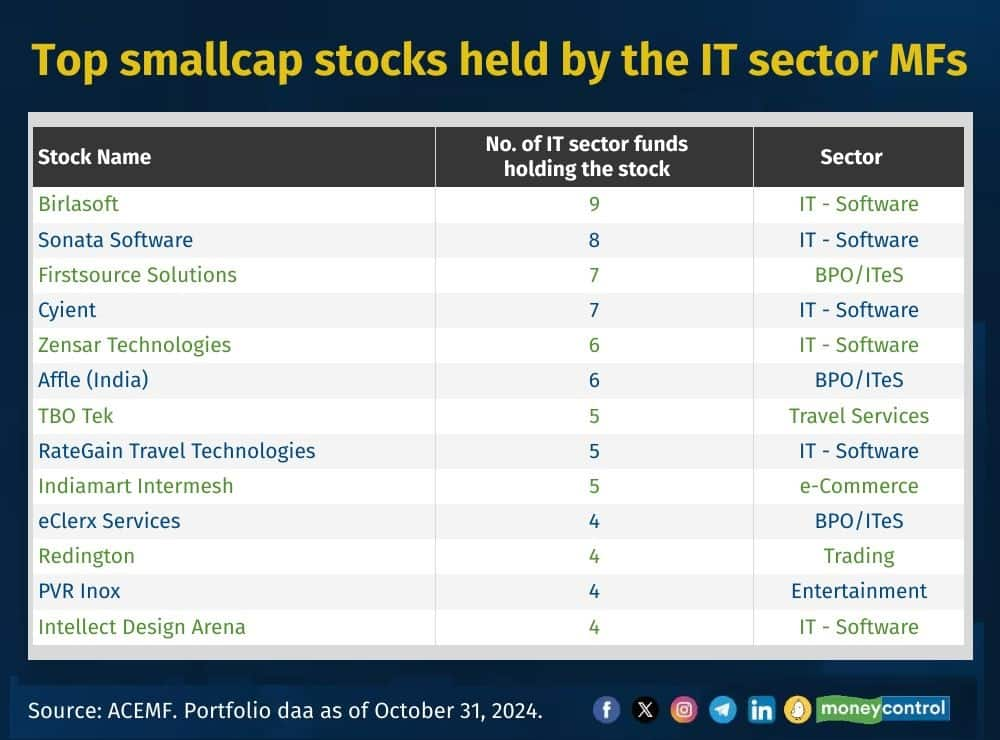

Currently, there are 25 mutual funds belonging to IT and related sectors. Of these, 12 theme-based funds also invest in related online sectors, including telecom, retail, fintech, and entertainment.

Here are the top smallcap IT stocks held by these mutual funds as of 31 October 2024.

IT sector smallcap stocks

IT sector smallcap stocks

Disclaimer: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.