Bitcoin prices have surged past $89,500, making a new record high, after Donald Trump's return to the White House. The biggest and the oldest crypto asset gained 30 percent in the past seven days as the US president-elect vowed to lift the regulatory weight from the industry.

Other crypto assets such as Dogecoin, Cardano, Cardano, Ether and Shiba Inu have also gained up to 150 percent over the past one week.

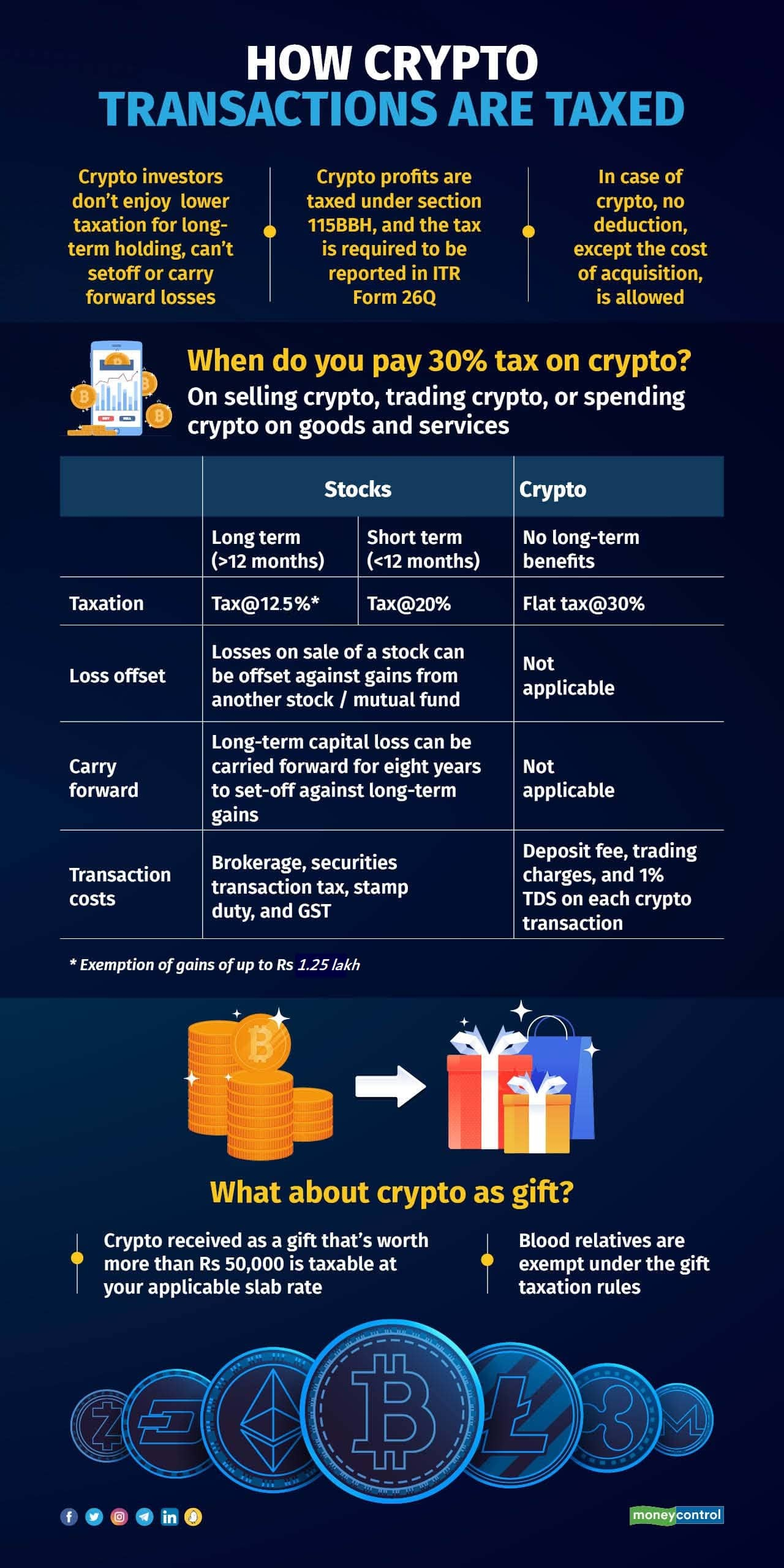

If you are looking to book profits in crypto assets, keep in mind that taxation on virtual digital assets (VDAs) in India work differently from traditional investment instruments such as mutual fund and stocks.

Capital gains on crypto assetsThe Budget 2022-23 had announced that gains arising out of VDAs or crypto assets be taxed at a flat rate of 30 percent irrespective of the individual’s income tax slab rate. In addition, a 1 percent tax deducted at source (TDS) was introduced on every transfer of such assets.

Unlike stocks and mutual funds, the losses from one crypto can’t be adjusted against gains from another and no carry forward of losses to future years is allowed.

Also read | Donald Trump win: Bitcoin outlook turns bullish, but Indian investors need to be cautiousThis means that if you sold one bitcoin at a profit and another one at a loss, you still owe 30 percent tax to the government on the profit you booked in one token.

However, one bitcoin moving from one of your accounts, or one wallet to another wallet, is seen as an internal transfer. So that's not seen as a commercial transaction. It only gets taxed when it changes hands from one tax entity to another.

While computing the income from the sale or transfer of VDAs or crypto assets, an assessee is allowed to only claim the deduction of the cost of acquisition.

In case of securities held in demat form, a principle called FIFO (First-In-First-Out) is used for calculating capital gains. According to experts, when it comes to calculating capital gains, the FIFO method is also recommended for all types of cryptocurrency transactions.

This method follows the principle that the assets purchased first are sold first, while the last assets purchased are sold last. For instance, suppose you bought one ethereum coin on January 1, 2024, and then bought two more ethereum coins on November 1. If you plan to sell two ethereum coins on November 12, the FIFO method would consider the first coin you bought in January and one you bought on November 1.

This method is applicable for all cryptocurrency transactions, including buying, selling, or exchanging one cryptocurrency for another.

Crypto taxes on payments, airdrop, NFTs

Once you receive crypto assets as a payment for services rendered, you would have to worry about what's the cost basis for that asset that you've got. So this is one area where remains some uncertainty, and tax advice is certainly recommended.

Also read | Equity fund inflows hit record high of Rs 41,887 cr in Oct despite weak markets: AMFIAirdrops are a marketing strategy, involving delivering crypto tokens, usually free, into investors' wallets. Airdrops are taxed at 30 percent in receiever's hands on the value determined as per the fair market value. Further, if you sell, swap or spend those tokens later, then 30% tax will be levied on the gains made.

The cost basis for these airdropped tokens is their fair market value in rupees on the date of receipt.

Also, income generated from the sale or transfer of non-fungible tokens (NFTs) is subject to a 30 percent tax, with deductions permitted only for the cost of acquisition.

Experts strongly advise investors to disclose all their centralised exchange wallets, international wallets as well as your DEFI (decentralised finance wallets) in the income tax form.

Ensure that all the TDS that has been collected on your trades by the exchanges - because it's been filed against your PAN card - that it's reflected accurately in your Form 26.

In the absence of offset of losses and carry of losses, Indian crypto investors are required to pay taxes annually with no way around it. Given the complexity over certain aspects of crypto taxation, investors would be better off in taking a chartered accountant or tax portal’s help in filing their taxes.

Also read | SIP book at fresh all-time high, tops Rs 25,000 crore for first timeDiscover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.