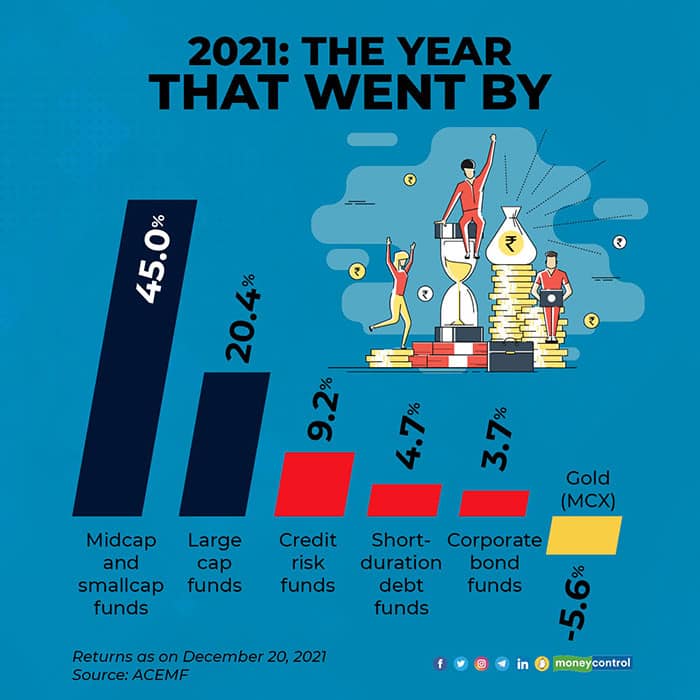

The year 2021 was good for mutual fund investors, especially those who invest in inequities. Mid- and small-cap equity funds gave more than 40 percent returns so far this year. Large-cap funds lagged, but they too gave an impressive 20 percent return, on average, as per data by ACE MF.

Equity mutual funds saw net inflows of Rs 71,593 crore till November as per ACE MF data. Thematic and sectoral funds put together received the highest net inflows of Rs 21,768 crore among equity funds. Value funds and equity-linked savings schemes (ELSS) saw net outflows of Rs 5,018 and 3,810 crore, respectively. Financial advisors often say that to make a robust investment portfolio, investors must diversify across large-cap schemes as well as mid-and small-cap funds.

Speaking of diversification, investors appear to have put behind their fears of debt funds. Last year, debt funds and credit markets were rocked by the onset of Covid-19 that froze the liquidity and also, in part, led to the collapse of Franklin Templeton’s debt schemes.

The year 2021 was different though. Credit risk funds gave an impressive 9.2 percent return so far in 2021. As per the rules laid down by the capital market regulator, Securities, and Exchange Board of India (SEBI), credit risk funds must invest at least 65 percent of their assets in AA-rated and below-rated assets.

Overall though, it was a tough year for debt funds from a returns perspective. Due to low-interest rates, debt fund managers found it tough to earn returns. As per data from ACE MF, short-term debt funds gave a 4.7 percent return. Corporate bond funds (these funds invest at least 80 percent of their assets in bonds that are rated ‘AA+’ and above) had an even tougher time; they managed to give just a 3.7 percent return in 2021.

Rising equity markets and hopes of a global recovery also pulled down gold prices and returns from gold exchange-traded funds in 2021. But experts remind us that gold must be looked at as a hedge to our portfolios, instead of an asset meant to generate higher returns.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.