It’s natural for investors to ask ‘how much will I get in return?’ Many of us tend to do this on our insurance products as well. The general tendency of the common man is that any financial product one purchases, they want return from it. But how do you contemplate earning from an insurance policy that is, well, meant to insure you?

In April 2018, Delhi-based Sridhar K Maji, 30, took advice from his friend and bought a life insurance policy. But he didn’t buy a pure term life insurance policy. He bought a return of premium (TROP) policy with sum assured of Rs 1 crore for a term of 30 years. The policy requires him to pay Rs 21,000 a year for the next 3 years.

“The insurance agent who sold me this policy told me that my family ‘will get protected right from day#1’. So, if I die before I reach the age of 60, my nominee will get a lump sum amount,” says Sridhar.

Unknown to him though, Sridhar walked into a trap. The agent elaborated that not only will his nominee get a lump sum in case Sridhar dies, but Sridhar “would not be making a loss.” Here’s how. A pure term plan pays the nominee an amount, only if the policyholder dies during the policy’s tenure. But an ordinary term plan policy doesn’t pay anything to the nominee if the policy holder - Sridhar in this case - doesn’t die. The policy that Sridhar bought was a Term Insurance Return of Premium plan (TROP). This plan pays back all the premiums that the policyholder would pay throughout the policy’s tenure.

He knew that the TROP wouldn’t pay any interest. In simple words, his agent explained to him, it would mean that Sridhar would make “no losses”.

Sridhar TROP policy entailed him to pay a premium of Rs 21,000 per annum. The policy term was of 30 years. As per the policy conditions, if nothing happened to him, he would get Rs 6.3 lakh (excluding taxes and other charges) back in the year of 2048; the sum total of all the premiums he would pay till the time the policy matures. That looks like a big amount. But did he miss the woods for the trees?

Return of premium is zero percent return

If a financial instrument returns the exact same amount that you invest in it, then your financial product has given you zero percent returns. Still, you might think its okay because you haven’t made a loss. Think again.

If he would have purchased a pure term plan instead of a TROP policy, the pure term policy would have cost him the premium of approximately Rs 9,000 for a cover of Rs 1 Crore for 30 years. Instead, Sridhar has paid Rs 21,000 on his TROP. Hence, he paid extra Rs 12,000, per annum, for the same cover while buying TROP policy. Over 30 years, Sridhar will end up paying a total of Rs 3.6 lakh.

Moneycontrol ran some numbers to see if you really didn’t make a loss. Not only he paid an extra premium but he also missed out on the opportunity cost. The extra premium of Rs 12,000 could have been invested towards retirement planning product like Public Provident Fund (PPF), National Pension Scheme (NPS) or any G-sec funds.

If he would have invested Rs 12,000 every year in an equity mutual fund scheme, he would have got back around Rs 32 lakh at the end of 30 year, assuming an equity fund grows at a compounded rate of 12%. That is Sridhar’s real loss.

Amol Joshi, Founder, Plan Rupee told Moneycontrol that company charges a higher premium as they segregate the amount between the basic premiums and remaining, they invest basically in G-sec to earn higher interest. However, people should ideally create their own insurance and investment plan. They should buy pure term insurance instead of buying TROP policy and they should invest the remaining amount in various investment avenues like Public Provident Fund (PPF), Fixed Deposits (FD), National Pension Scheme (NPS), G-Sec and mutual funds and try to manage their investment amount by themselves. Thus, this way one can make more money at the end. “Moreover unlike in TROP policy, people are not bound to make huge payments till the policy term. They can invest this extra amount as per their financial goals," he said.

Why TROP policy comes with a higher rate of premium?

As we know that the sole purpose of a term insurance plan is to get financial cover in the event of the death of the insured. As there is no investment component and only the death benefit is paid on the death of the life insured, a pure term plan has very low premiums. However, under a TROP Plan, if the insured survives the policy term, a sum of all premiums paid (less applicable taxes, rider premiums, underwriting extra, if any) or a higher amount depending upon the plan and insurer is paid.

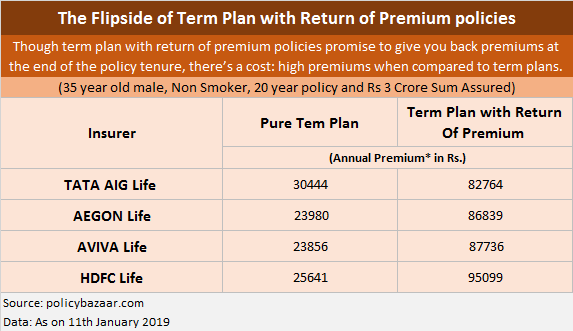

Mahavir Chopra, Director - Health, Life & Strategic Initiatives, Coverfox.com says that as the insurer is accumulating the premiums received on behalf of the insured person and is going to pay the same amount back at the end of the policy term, a higher premium is charged to meet the administrative charges, TROP premium management expenses. “These additional expenses and the promise of returns make TROP demand a higher premium making it roughly 2 to 3 times costlier than a pure term plan,” said Chopra.

Joshi says that TROP policy superficially gives you an idea of getting your premiums back. In reality, it is not the way you think of it. Every product comes with a cost, and let say, if a company will return you the same premium as charged against pure term plan then what will they earn at the end. “Hence, to manage the base premium expenses of the policy (which is the premium amount of a pure term plan) and recovering that amount throughout the policy term, insurance companies charge a higher premium in case of TROP policy,” he said.

What should you do?

Instead of opting TROP, you should always go for a pure term insurance plan. However, while planning to purchase this pure protection product you need to keep few things in mind.

When you decide the cover amount think about your life stage and the number of family members who need to get protection. Understand their lifestyle and accordingly, decide the policy cover. Thus, this cover amount should determine your family needs. Also, if you have any liabilities like short term loans, personal loans, car loan, or home loan add that amount with overall life cover. This will prevent the burden of EMI repayment from falling on your family against the uncertainty.

So when it comes to finally decide on what plan you need to purchase, irrespective of the type of insurance company you select to take pure term insurance cover, go with an insurer having higher claim settlement ratio. Higher the claim settlement ratio, better are the chances of availing the sum assured.

Also, keep in mind that you should plan your after retirement days too. As we have seen Sridhar was only bothered about protecting his family till retirement. But, what about after retirement when you won’t get regular income and your household expenses will remain the same? Hence, it makes sense to choose your term plan wisely and plan it in such a way that your family get well protected even after retirement.

Priyesh Shah, Certified Financial Planner, CoinBazaar.in told Moneycontrol that one should smartly select the plans when it comes to term insurance. “If you follow wrong advice, your family might have to pay the price if the policy had some terms which would affect the claim & if you follow professional advice you get the appropriate insurance for you which will certainly secure your family,” he said.

To have a behavioural unbiased approach, you should never think of saying that you are going to make INVESTMENTS in the life insurance product, rather, you should simply say that you are PURCHASING an insurance product to safeguard your family from uncertainty. Also, it is always advisable to take guidance from a financial adviser or financial planner, do not buy insurance product on your own.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.