In the quiet hills of Wayanad, a young man thought he hit pay dirt. A social media message promised quick cash in return for "renting" his bank account to strangers. In exchange for a one-time payment of Rs 8,000, he readily shared his account details, OTPs, and other credentials.

Weeks later, police knocked on his door, accusing him of money laundering. "We only realised it was a trap when the police came knocking," he said. He now faces potential criminal charges and an uncertain future.

His story echoes the plight of more than 500 young people in Kerala’s hill district who fell victim to the scam in September, news agency PTI reported.

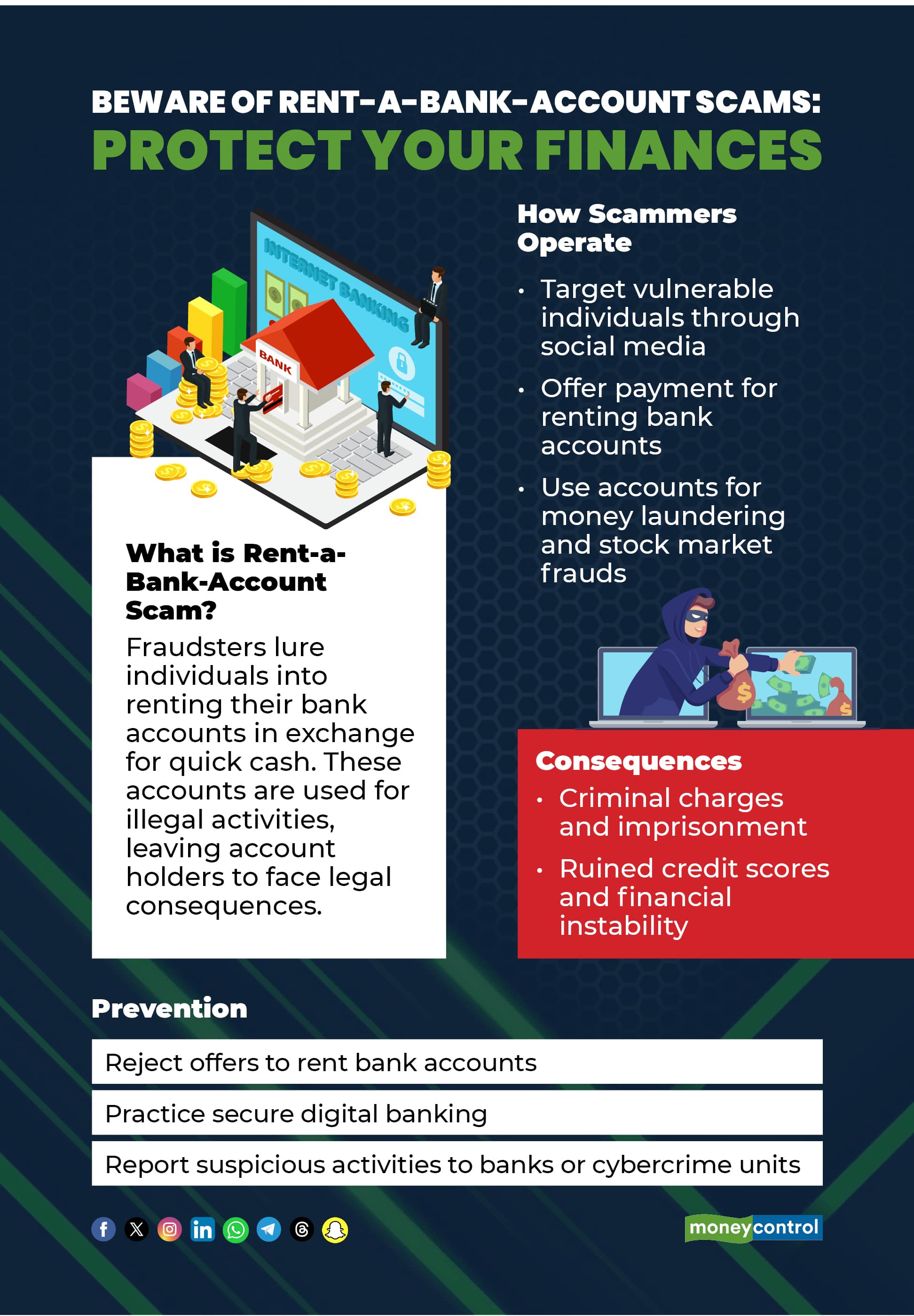

Understand the scamRenting your bank account is illegal, something that the government and the banking sector have repeatedly warned against.

Criminals offer a payment in exchange for “renting the account”, which is also referred to as “mule accounts". Lured by the prospect of easy money, these unwitting individuals are exploited to transfer illegally obtained funds.

Scammers target vulnerable people and often approach them through social media or direct messages, offering Rs 5,000 to Rs 10,000 for an account. Some even offer a cut — typically 1 to 5 percent — of transacted funds.

For short-term use involving large sums like Rs 1 crore, account holders might be promised Rs 50,000 to Rs 1 lakh a day. It allows scammers anonymity, who use the mule accounts to move illicit funds.

Also read | Dhanteras 2025: Tax guide for gold jewellery, coins, gold ETFs and SGBsHow criminals exploit these accountsCriminals use rented accounts for a variety of illegal activities, including money laundering and stock market fraud such as pump-and-dump schemes.

Account holders remain oblivious to the origins of the funds, which could stem unauthorised investments or could be proceeds of crime. By sharing passwords, PINs, card details, or OTPs, victims unwittingly enable these operations.

Legitimate entities never request such information, yet fraudsters pose as trustworthy parties to gain access, often via unknown apps, links, or QR codes.

Account holders are legally liable for the crimes committed in their name. Potential outcomes include criminal charges for fraud, money laundering, or related offenses, leading to imprisonment, fines, and a permanent criminal record. Regulatory bodies like the Securities and Exchange Board of India (SEBI) can impose penalties for facilitating illegal financial activities. Victims also risk ruined credit scores and financial instability, as banks may freeze accounts or report suspicious behaviour.

Also read | Gold shines this Dhanteras with 55% annual return; here’s tracking its 5-year journeyWarning from WayanadIn September, Wayanad's cyber police said more than 500 residents, most of them young men and women, were ensnared by out-of-district fraudsters. The criminals rented accounts for illicit transactions, leaving locals to bear the brunt of investigations.

Account holders faced police scrutiny, transforming promised windfalls into a nightmare.

Safeguarding against the threatReject any offers to rent your account. Practice secure digital banking. Avoid sharing sensitive information and steer clear of dubious online sources. If approached, alert your bank, the involved platform, police, or cybercrime units. Banks have been issuing alerts, warning against such scams.

Staying informed is key to avoiding traps that promise riches but deliver ruin.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.