Gold prices have turned volatile in the past one month on expectations of a series of steep interest rate hikes in the US.

The US Federal Reserve raised its key interest rate by 50 basis points on May 4. Hundred basis points are equal to one percent point.

Gold prices have been volatile despite the ongoing Russia-Ukraine conflict. But that does not mean gold should be ignored as an asset class. Here’s why:

Why is gold not sticking to the script?

Gold prices started rising in 2018 and then shot up after the Covid-19 pandemic was declared and the global economy was locked down. From December 2019 to August 2020, gold prices on the multi Commodity Exchange of India went up by 49 percent.

Experts predicted gold’s good run would continue after the Russia-Ukraine war started. However, that did not happen. Gold prices have been volatile in the months of March and April.

Gold prices took some support after the US fed rate hike came on expected lines. Gold traded at $1,890 per ounce in the international market whereas in India it traded at Rs 51,096 per 10 gram on MCX. However in India too, gold demand has been weak. India’s gold jewelry demand fell by 26 percent to 94 tonnes in the quarter ended March 31. Since 2010, barring the pandemic periods, this is only the third time that gold demand in the January-March quarter has dropped to below 100 tonnes.

Somasundaram PR, regional CEO, India, at the World Gold Council, called it a “strategic timeout of the Indian consumer.”

“Fewer auspicious days, coupled with a sharp rise in gold prices, meant fewer weddings and a pause in retail demand, with households postponing gold buying in anticipation of a price correction,” he said.

But there may be a possibility of rise in gold demand going forward. Gold sales on Akshay Tritiya surpassed the sales registered in pre-covid times by 25%, as per news reports.

Experts said sticky inflation and fears of extended volatility in the stock markets may support gold prices. If interest rates are increased at a slower-than-expected pace or economic growth is hampered by the interest rate hikes, there may be more takers for gold.

“In times of inflation and volatility, the value of gold increases,” said Vijay Singhania, chairman of TradeSmart. “The war in Ukraine, coupled with the severe steps taken by China to control the virus and supply chain nightmares across the globe, is creating an environment of limited visibility. Under such a condition, gold as a safe haven comes into play.”

Singhania expects gold to trade at Rs 53,500 to 53,700 per 10 grams in a year’s time.

Should one buy gold?It’s best to invest around 5-10 percent in gold at all time, as an asset we must diversify into, at all times. Although long-term returns from Gold have been reasonable, that's not what you invest for, advises Chirag Mehta, Chief Investment Officer at Quantum Asset Management Company. More so, in present times when the US Federal Reserve has just increased its key interest rate by 50 basis points. A hundred basis points is equal to 1 percent point.

Mehta explains that the US is firmly positioned to hike interest rates. Due to the rise in real interest rates there, money might get withdrawn from emerging economies around the world, to be invested back in the US. This strengthens the US dollar and weakens gold prices. “But if an aggressive interest rate hike regime weakens the growth, then the US Fed might again resort to cutting interest rates, a year down the line perhaps. Any U-turn in policy will be positive for gold prices,” he says.

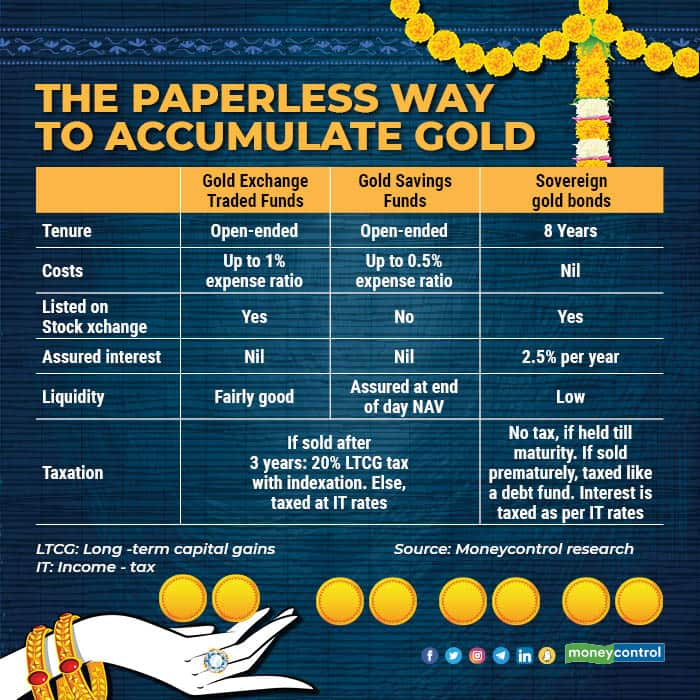

Buying gold can be a good idea if the metal has fallen below 5 percent of the overall portfolio. As much as 10 percent of a portfolio can be allocated to gold. However, Moneycontrol advises well-regulated financial products such as gold exchange-traded funds (ETF), gold savings funds (mutual fund schemes) and sovereign gold bonds (SGB) for this purpose.

Three classic ways to buy gold in a paperless, effective way

Three classic ways to buy gold in a paperless, effective way

Also read | Why this financial advisor advises against buying gold on Akshaya Tritiya

Parul Maheshwari, a Mumbai-based certified financial planner, said, “Investors looking for liquidity should buy gold ETFs and gold savings funds instead of SGB, which scores low on liquidity.”

Paperless gold absolves investors of the headache of storing gold. And it’s liquid – money is available when needed.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.