Large corporates spend enormous amounts of time fussing over their supply chain and how to manage their working capital better. Many tools have been built for the same, and these are been extensively used by them to extract value.

I often wonder why this has not been a bigger focus for mid-sized and smaller companies, for whom access to capital is harder. This is true for startups as well, who have received funding and are waiting to deploy it over a period. Why has there been limited traction from a wealth management perspective in these client segments?

Working capital cycle

In simple terms, if you can increase the number of days you have to pay when you purchase raw materials (inputs), or reduce the number of days it takes for you to get paid after you sell your goods or services, then you cut down on working capital needs. This could mean more cash, or reduced credit. Efficient working capital management inevitably leads to an improved balance sheet.

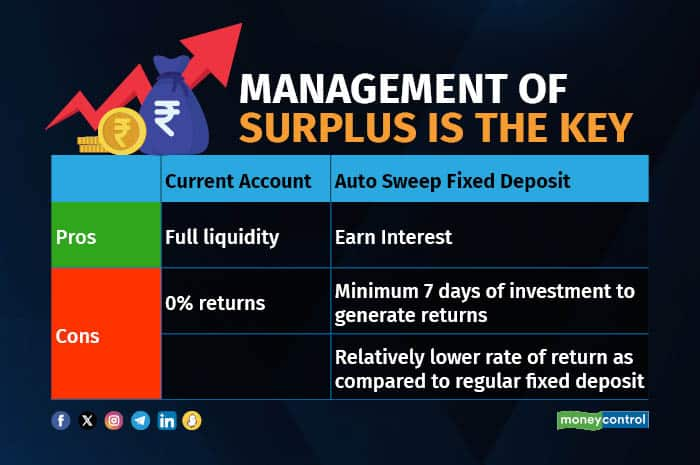

From a wealth management of cash flows perspective, the management of surplus is a key goal. Do we let them languish in non-interest bearing current accounts, place them in fixed deposits (FDs), or choose debt mutual funds (MFs)? If we invest, then what tenor is suitable?

Even before we decide which instrument to invest in, a better understanding of core and non-core surplus is important.

Core surplus is the amount which is not needed for a longer period of time (defined as greater than 6 or 12 months). Non-core surplus is more transitional / transactional in nature.

Non-core surplusUncertain cash flows with sudden payment requirementsYou may be better off leaving the surplus in the current account (if very short term) or in sweep-in FDs (which get auto-redeemed when payments need to be made).

A full range of investment options are available and should be used as appropriate.

Do note that while current accounts and sweep-in FDs usually disburse funds on the same day the request is given, most other investments take one or two days if the redemption request is given before the cut-off time. The trade-off for this usually is higher returns. So, emergency funds which could be needed suddenly should be kept in a current account, or a sweep-in FD.

But wherever you have the predictability of even one day, you can start evaluating options.

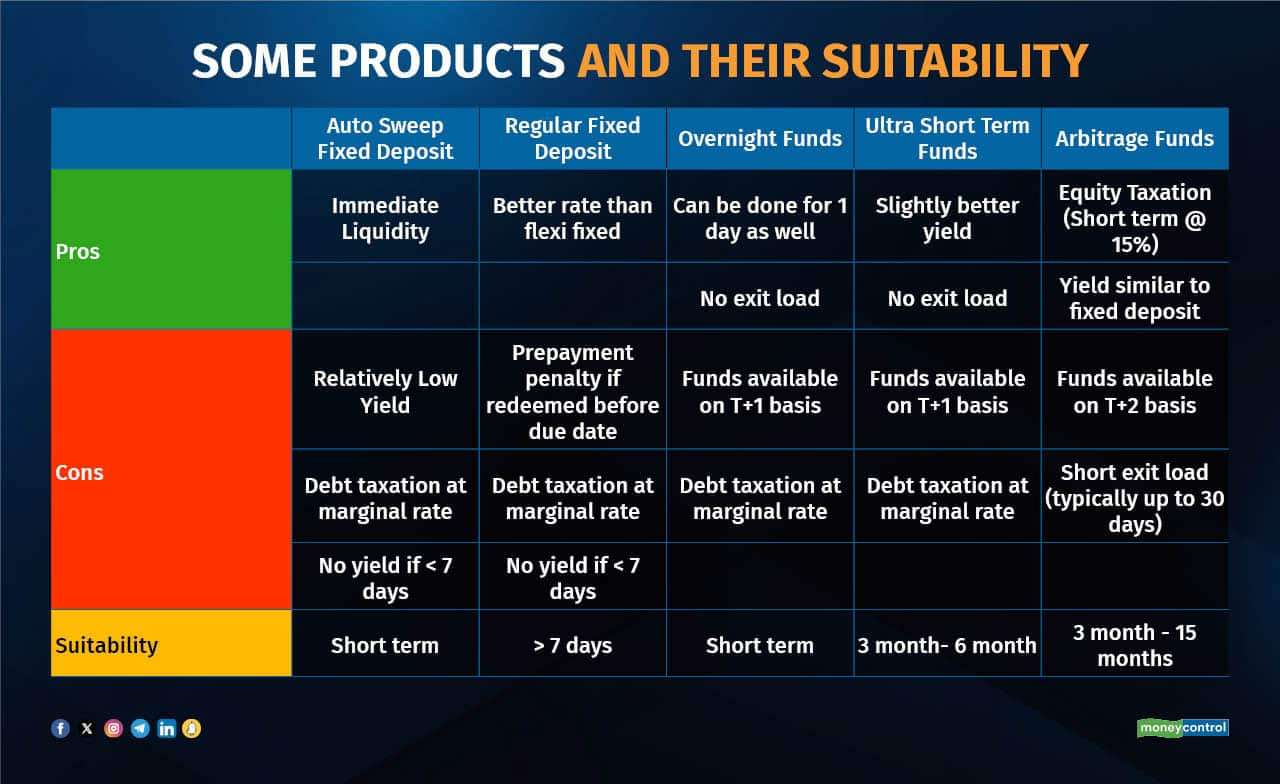

Some key elements one can look at are:

- Yield: higher the better.

- Liquidity: no exit load is better.

- Ease of getting funds when required.

- Taxation: equity taxation is lower.

While this table does not cover every scenario and product, it shows that there are products which are suitable for managing even short-term surpluses.

Core surplus (> 1 year horizon)There could be scenarios where surpluses could be for periods greater than one year. For example, there could be a funding runway of > 1 year for a start-up; or, where a business is closely held, the founder may choose to pay a lower corporate tax rate and invest through the company itself, rather than take the funds as salary, pay higher taxes per his bracket, and then invest.

Core surpluses which are unlikely to be needed for over a year can be invested in a wide range of instruments, including equity savings, asset allocator, and multi-asset mutual funds. These funds have a blend of equity, debt, and other assets (in case of multi-asset funds). These tend to have better returns than than debt, without the volatility of equity. For surpluses with a horizon of three to five years, one can invest in equity-oriented schemes as well, depending on one's risk profile.

In sum, if a business has surpluses — temporary or core — then the business owner can invest the same in numerous ways, while keeping one's risk tolerance in mind. It would be a win for the business as well as for the wealth management industry.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.