Value investing is coming back in action and savvy investors are taking a serious look at it again after a gap of almost a decade. Fund houses are also offering value funds with a twist.

Fund houses such as DSP, ITI, Canara Robeco, Axis and Quant have launched their value funds after the pandemic struck. As per Association of Mutual Funds in India, 22 value schemes managed Rs 75,627 crore in total as of February 28.

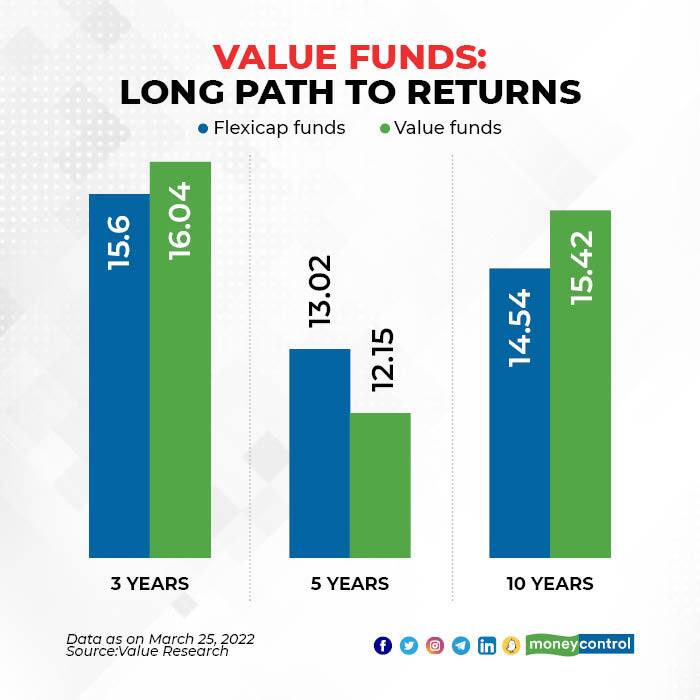

There’s good reason why fund houses and some distributors are enthused by value funds. Most value portfolios underperformed growth portfolios for several years in a row. But as the tide turned after COVID and investors started looking at yields on assets rather than future growth, stock portfolios built around value became increasingly favoured by investors. Over the year ended March 25, value funds have given 24.57 percent returns compared to 21.43 percent returns by flexi-cap funds, as per Value Research.

Due to tough market conditions in the many years leading up to March 2020 when COVID set in, fewer stocks were ruling the markets. Fund managers and investors who had styled their strategies and portfolios around such stocks gave good returns.

But COVID changed the markets. The infusion of liquidity and various measures to revive the economy led to a broad-based recovery of markets backed by the hopes of an economic revival.

“Savvy investors are now keen on buying stocks that may offer future growth in cyclical sectors which may not be top quality names but are quoting at attractive valuations,” says Arun Kumar, head of research, FundsIndia.com. Many value funds have also allocated money to cyclical names that may benefit in case of broad-based growth. Most Indian fund managers do not ignore quality altogether. Typically, stocks need to have a decent quality score before making it to the portfolio of a mutual fund scheme, he adds.

Experts also point out some schemes allocating money to stocks of public sector undertakings. “Just because some PSU stocks are trading at relatively cheaper prices, it does not become a value opportunity. Prospects of enhanced business quality, operating efficiencies and earnings growth over a period of time will decide if these are good value investments,” says Nirav Karkera, head of research at Fisdom.

After a rally in PSU stock prices with limited changes in fundamentals, they are less attractive than a year ago, he adds.

Value 2.0 with a twistFund houses have taken diverse paths while constructing their portfolios.

DSP Value Fund (DVF) launched in December 2020 has allocated 28 percent of the fund to stocks listed overseas and units of overseas mutual funds. DVF plans to maintain an allocation of two-thirds of the fund assets under management to such overseas investments. “Investing overseas brings meaningful diversification and has demonstrated better risk-adjusted returns in the past compared to portfolios invested in only Indian equities,” says Aparna Karnik, senior vice president and head of risk and quantitative analysis, DSP Mutual Fund.

Also, DVF has no exposure to domestic financial sector stocks. Financials are typically the largest allocation for most value (and diversified equity) funds.

ICICI Prudential Value Discovery Fund, the largest value fund with assets under management of Rs 22,574 crore has invested eight percent of the money in stocks listed overseas.

While the likes of DSP, HDFC, Nippon, ICICI Prudential opt to offer well diversified portfolios, mutual fund houses such as Axis, ITI, Quantum and JM offer more concentrated portfolios. ITI Value Fund launched in June 2021 has 21 stocks in the portfolio, the largest allocation to healthcare sector and holds 10 percent in cash. “Select businesses in the healthcare sector are quoting at attractive valuations and so is the case with some PSU corporate lenders which are expected to do well as the economy recovers and the extent of non-performing loans go down. We pick stocks with strong fundamentals and cash generation ability available at adequate margin of safety,” says George Heber Joseph, CEO and investment chief at ITI Mutual Fund.

After a strong rally in stock market, not many stocks pass our filters of a value investment, which makes us go for a concentrated portfolio, he says.

Focus on value has led to differentiated portfolios in some recently launched schemes. According to Morningstar, Axis Value Fund and Axis Flexicap Fund (this follows a growth-oriented strategy) don’t have much in common. Just about eight percent of their portfolios were common as of January 31. The number stands at 35 percent for the Canara Robeco Value Fund and Canara Robeco Flexicap Fund.

A bias towards larger companiesKarkera points out that most value funds hold a sizeable chunk of large-cap stocks. “After the recent fall, there should be many mid and small cap stocks quoting at relatively attractive valuations,” he adds. “Value investors generally prefer stocks of mature businesses that are going through temporary troubles at an attractive price,” says Ravi Kumar TV, founder of Gaining Ground Investment Services. Many mature businesses are present in the large cap space which makes many value funds allocate more to large cap stocks.

But not all value funds are large cap-focused. IDFC Sterling Value Fund has traditionally been investing in attractively valued small and mid-cap stocks. As of February 28, the scheme has allocated 67 percent of the money to them. Over last five years ended March 25, the scheme has given 15.14 percent to top the performance chart of value funds.

What should you do?There are times when value investing takes a backseat, especially in heady bull markets. Investors need to be more patient in value schemes, as compared to many other strategies. “Value does not outperform each year. Maintain style diversification in your equity portfolio by investing in both value and growth portfolios,” says Ravi Kumar TV.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.