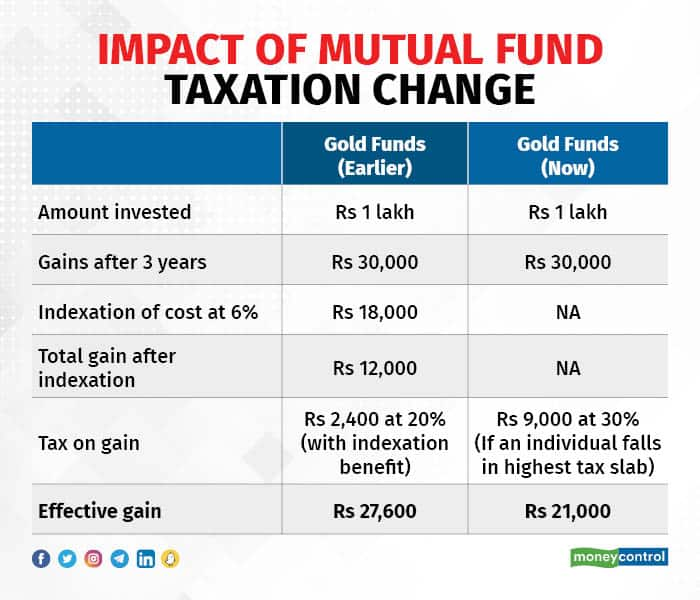

Your investments in gold or silver exchange-traded funds (ETFs) and fund of funds will no longer have benefits of long-term capital gains (LTCG) tax and indexation and will be taxed at the marginal tax rate from this month.

This is because the Finance Bill 2023 has mandated that capital gains from mutual funds with less than 35 percent invested in equities would now be taxed at the investor's income tax slab rate, irrespective of how long they are held.

Note that this change will not affect investments made till March 31, as they will continue to enjoy indexation and LTCG tax benefits.

Also read | These equity funds were winners in FY23

Apart from mutual funds, there are other ways of taking exposure to these commodities, such as in the physical or digital form. We look at how debt taxation will impact returns from gold/silver funds, and which would be the best way to take exposure to these precious metals.

Gold funds still hold promise

India’s first gold fund, Nippon India Exchange-Traded Fund Gold BeES, was launched in March 2007. Today, it is the biggest fund based on the commodity with assets under management (AUM) of over Rs 7,200 crore, as of February end.

Experts say that the government removing the tax benefit on the gold funds would lessen the pull of such schemes as retail investors will gravitate towards physical gold.

“However, many factors will still determine the outcome and impact on gold ETFs as physical gold continues to have shortcomings in terms of storage and insurance costs,” said Vinayak Magotra, Founding Member, Investment product at Centricity Wealthtech, a wealth-tech platform.

The expert sees Sovereign Gold Bonds (SGBs) gaining impetus after the debt taxation changes.

Source: Finnovate

Source: Finnovate

Launched in 2015 under the Gold Monetisation Scheme, SGBs are government-backed securities in denominations of 1 gram of gold and further multiples.

Also read | Equity or debt funds, SIP is an all-weather friend

SGBs are eight-year period instruments with a buy-back option after the fifth year. In secondary markets, these bonds are available with different residual maturity and can be matched with your goal horizon.

“After debt taxation becomes unfavourable for gold funds, investors have the option of investing in SGBs. They get an interest at the rate of 2.5 percent per annum, payable semi-annually, while this interest is taxable. However, if the investor holds the SGB until maturity (eight years), there will be no capital gains tax applicable,” said Nehal Mota, Co-founder, Finnovate, a hybrid wealth-tech platform.

A key benefit of SGB is that it offers coupon income other than capital gains (in case of price increase), which is an added advantage, however, investors are locked in for a period of five years and is, therefore, an illiquid instrument.

Experts say that gold ETFs offer far better liquidity, convenience, safety and efficiency over the underlying physical gold markets. The impact costs are a fraction of the underlying physical market. For retail investors, this is a boon.

“Gold ETFs are regulated by SEBI and the strict regulatory oversight makes them safer, more efficient with the highest quality. Impact costs i.e., buying and selling costs for physical gold or silver are materially higher than that for gold and silver ETFs,” said Vikram Dhawan, Head Commodities and Fund Manager, Nippon India Mutual Fund.

Silver at a disadvantage

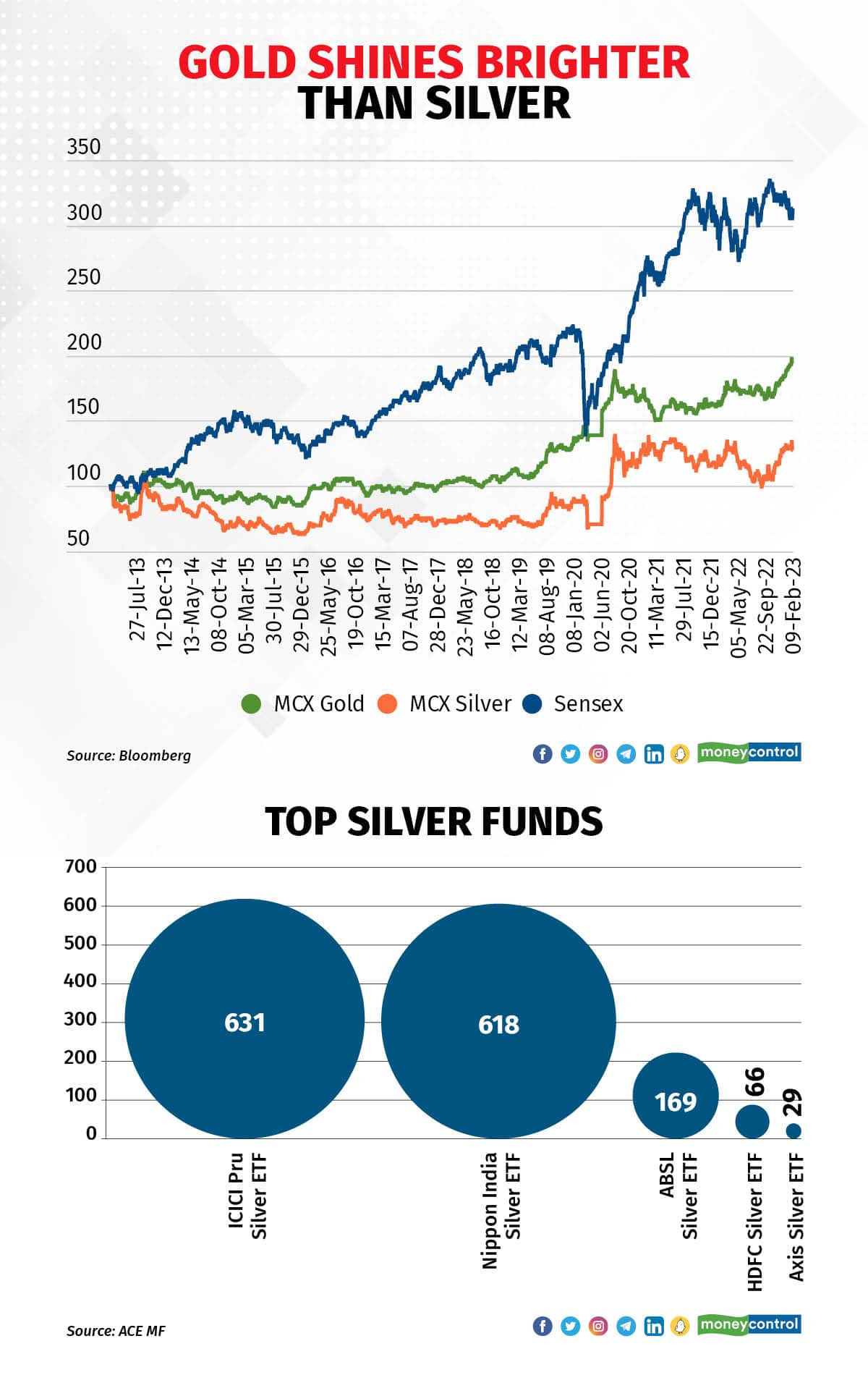

Silver mutual funds are among the latest asset classes to be introduced in India. The first ETF based on the precious metal was launched by ICICI Prudential Mutual Fund in January 2022.

Silver is an industrial metal and its demand picks up when the economy grows.

Notably, the government has not introduced any silver-backed quasi-sovereign bonds like SGBs as of now.

Investors can either invest in silver ETF, in physical form, or they can invest in exchange-traded derivatives contracts (ETCDs). Experts feel that the derivatives market may be a tough nut to crack for an average retail investor.

As per Finnovate’s Mota, the best way to take exposure to silver now can be through buying physical silver, as you continue to get a long-term capital gain of 20 percent with indexation benefit.

However, keep in mind that in the case of silver, which is over 80 times bulkier than gold, it is not feasible to hold it in a physical form beyond small quantities.

Also read | MC30-Curated List of Well-Managed Mutual Fund Schemes

Therefore, by investing through silver ETFs, investors need not worry about the purity or quality of the underlying asset and are also free from storage-related hassles. Also, experts say that liquidity and price efficiency are likely to be better as compared to traditional options.

Silver vs gold debate

Silver and gold ETFs invest up to 95 per cent of their corpus in physical silver/gold that tracks the prices of the commodities on the stock exchanges.

Over the last one year, gold ETFs have been among the best-performing mutual fund classes with returns of around 14 percent, as per data available with Value Research.

On the other hand, silver funds have delivered returns of 3.60 percent on a yearly basis.

“Silver is in high demand throughout industry, investments and jewellery; as a result, its price is more sensitive to economic swings than gold's, making silver a more powerful hedge against inflation when economies are on the rise. However, because of its lower demand than silver, gold is less impacted by economic downturns,” said Magotra.

Nippon India Mutual Fund’s Dhawan believes that gold is open to a significant and longer up move in prices if another credit or a geopolitical event unfolds.

Further, silver tends to underperform gold at times of economic uncertainties. However, on a historical basis, silver is undervalued relative to gold. The gold-silver ratio is well above 80.

“Silver ETF holdings are also at an almost three-year low. Implying that it too is under-owned. This sets up silver for catching up with gold if the aforesaid favourable scenario for gold unfolds, albeit at a higher beta,” said Dhawan.

What should investors do?

Silver is more a tactical allocation as opposed to gold, which is more a strategic allocation for portfolio diversification. Exposure to commodities such as gold and silver should be around 5-10 percent of an investor’s portfolio. Those with a lower risk tolerance may consider a smaller allocation.

Also read | Eight money mistakes you need to avoid in the new financial year

Prableen Bajpai, Founder of FinFix Research and Analytics, said, “While both precious metals have their own significance, for most retail investors, investing in gold is a sufficient investment. The demand and supply dynamics of gold is better understood and investors have a variety of investment vehicles to choose from. Investors who want to invest smaller amount at regular investors can consider gold mutual funds via SIP route while those who are looking to invest in tranches and avail a tax advantage can look at sovereign gold bonds.”

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.