Ganesh Chaturthi and Onam mark the beginning of festival season in India. Very soon, we will celebrate Navratri and Diwali as well. As the joyous season is ushered in, costs also tend to spiral as you tend to spend on clothing, new household stuff you wish to buy, mobiles, jewellery and vehicles among other things. Conducting the festivals too would be an elaborate affair for many. The ideal way to spend for the festivities – or for any other financial goal for that matter – is by saving regularly. But many families tend to go for personal loans to tide over their festive buying expenses.

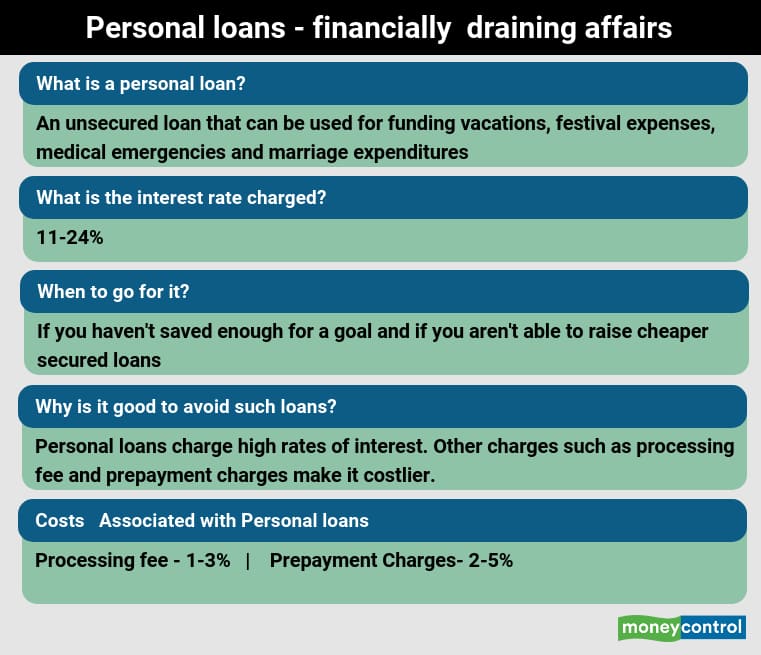

However, you must realise that that these loans are liabilities and need to be paid back. Apart from banks that are only too happy to offer your personal loans, many fintech companies these days offer a variety of loans. And since these loans are offered within seconds to applicants, there is an inclination to go for one. Repayment of personal loans is a financially draining affair as they come with high interest rates and charges.

It would generally be advisable to stay off such loans and fund any festive purchases with you own money. But if you still fall short of money and need to borrow, you must do so quite sparingly. Here is what you must understand before taking any personal loan.

Rate of Interest

Personal loans are unsecured, given that there is no collateral asked for by the bank before sanctioning. This results in a high rate of interest being charged. “Depending on the lender and the credit profile of the borrower, interest rates on personal loans range between 10.65 per cent and 24 per cent,” says Gaurav Aggarwal, Director & Head of Unsecured loans, Paisabazaar.com.

Many times, lenders quote a flat rate of interest to make it look cheap. Loan applicants should always ask for the rate of interest on monthly rest basis. Here is how these rates work during the tenure of the loan. A flat rate of interest may appear low, but makes the borrower pay more than the interest paid on a monthly rest basis. The interest rate charged on a monthly rest basis is known as the annual percentage rate (APR). Carefully go through the fine print and find the exact rate of interest you are likely to pay for the personal loan you wish to avail.

While taking a loan at the lowest interest available may be the general course of action, there are situations wherein you may have to go for higher rates. For example, a lender may offer lower interest for loans that are to be repaid in less than 24 months, and higher rate for loans that need to be repaid over a longer term. Ideally, it is better to pay off loans as early as possible.

Given the short tenure and low rate of interest, you may end up choosing the short-term loan. But that means you would be paying higher equated monthly instalments (EMI). Let’s understand this with an example. For a loan amount of Rs 3 lakh the EMI works out to Rs 10253 for three-year tenure at 14 per cent interest. If the term is raised to four years, then, at 15 per cent interest, the EMI works out to Rs 8349. By opting for four-year term the borrower pays an extra interest of Rs 31644.

“Though short-term personal loans are better compared to long-term loans, you should not ignore cashflow management. Ideally, you should not pay more than 35 per cent of your take-home salary towards EMI. If you have to use substantial amount of your monthly income to pay off your personal loan, then there is a possibility that your cash management may go for a toss and you will end up borrowing again,” says Satyam Kumar, founder and executive director of LoanTap Financial Technologies. If you are comfortable paying a higher EMI, you should go for the three-year term. But if your existing income does not support higher EMIs, then you could take the four-year loan option.

Be extremely prudent with taking such loans as you could get into a debt trap.

If you have a good credit score and you have been a client of the lender, then there is a chance that the rate may be lowered a bit.

Processing fee

Borrowers are expected to pay a sum towards the costs incurred by the lender to process the loan application. It covers both the expenses incurred by the lender and the commission payable to a agent, if any. The processing fee varies from lender to lender, and can be up to three per cent of the loan amount. Large lenders, however, keep the processing fee to around one per cent. In the case of smaller non-banking finance companies, the processing fee can be higher. You either pay the processing fee upfront or it get it added to the loan amount, so that your EMI is adjusted accordingly.

The processing fee can be negotiated in most cases. If the sourcing agent agrees to reduce her fees, the bank will likely give up a part of the processing fee.

For pre-approved loan deals, which are offered only to clients with a robust repayment history, the processing fee can be negotiated downwards substantially. “Do not go blindly with what your bank and agent tells you about the processing fee. Do compare it with what other lenders are charging. You can negotiate it well if you have a good credit score,” says Rachit Chawla, CEO, Finway.

Prepayment Charges

It is good to prepay your high-cost loans. Reduce your liabilities as and when you get a sudden windfall, say, your annual bonus.

But repaying early is penalised with foreclosure charges. “Many lenders do not allow prepayment in the initial months of the repayment period of personal loans – say up to 12 months. These being fixed rate loans, lenders do levy prepayment charges,” says Satyam Kumar. Personal loans come with prepayment charges of two per cent to five per cent.

Foreclosure charges are mentioned clearly in the terms and conditions of the personal loan that you sign. Read the term sheet of the loan before you sign and give your acceptance. If you are applying for the personal loan on a mobile app or using a website, do not blindly ‘tick’ the ‘terms and conditions checkbox’ in a hurry to complete the process. Do read the terms and conditions before accepting them. “You can negotiate the prepayment charges before taking the loan. Once you accept the terms of the loan and the loan is disbursed, the prepayment charges cannot be negotiated,” says Chawla.

Moneycontrol’s take

Personal loans are not cheap at all due to the battery of costs associated with them. Take a personal loan only as a measure of last resort. And negotiate with your lender as much as you can. “Borrowers should first enquire with the lender with whom they have an existing relationship, as lenders often offer relatively cheaper interest rates, lower processing fees and better service terms to their existing customers. Many lenders also offer lower interest rate and/or waive off processing charges during the festive season. Additionally, lenders may also charge lower interest rate and/or processing fee to those with higher credit score,” says Gaurav.

Repayment of loans should be your priority as loans hurt your wealth accumulating process. Be prudent with the use of credit and repay loans as per schedule.

Ultimately, the best way of meeting your festive expenses is to save up and invest regularly, without taking the EMI burden on yourself.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.