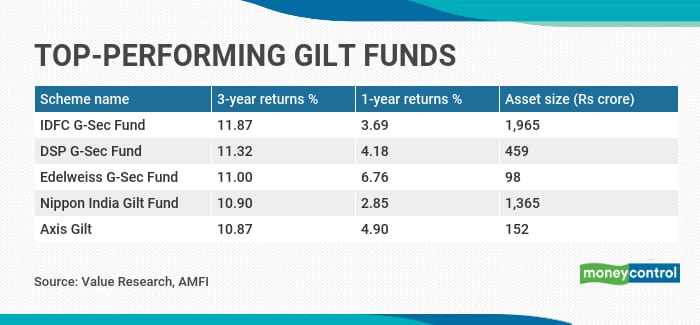

The Reserve Bank of India (RBI) cut rates to revive the economy in the last year or so. The key beneficiaries were funds focused on government securities. G-sec schemes or gilt funds have given close to 10 percent annualised returns over last three years.

The 10-year G-Sec bond yields have fallen from about 8 percent to little over 6 percent in the last three years, resulting in gains for gilt funds. Given their inverse relationship with yields, bond prices have rallied during this period.

But, the conditions that favoured G-sec funds in the past may be changing. The spike in inflation over the past several months has left little room for RBI to cut rates any further.

Also listen: Simply Save | What should be your investment strategy when inflation is on the rise?

Moreover, the possibility of RBI increasing rates seem more likely. In recent months, the 10-year G-Sec bond yield have inched up by 29 basis points (bps).

Is it the right time to take profits off from G-sec funds?

The risk of rising interest rates and inflation

Financial advisors say if you had invested in a gilt fund with a 3-4-year perspective and are near the end of the period, taking some money off the table might be a good idea.

“To keep interest rates and yields low, RBI has been intervening. But beyond a point, the central bank will not be able to manage the market forces, on the back of rising crude oil prices and fiscal deficits,” says Ashish Chadha, a registered investment advisor.

“So, investors who are close to their goals can think about exiting or taking some money off the table,” he adds. Vikram Dalal, managing director of Synergee Capital Services, says interest rates are likely to rise because of inflation, as well as government’s large borrowing program amid the COVID-19 pandemic.

“The government’s GST collections for June were the lowest in 10 months. So, the government needs to raise funds to meet the deficits,” he adds.

As more funds are raised, the supply of G-sec papers increase. If supply is high and buying appetite is low, G-sec prices can feel the pinch.

For now, RBI has been participating in G-sec auctions, to keep yields under check.

Fund managers cut gilt schemes’ duration

Some debt fund managers have also been reducing the duration of their gilt funds. Marzban Irani, chief investment officer-fixed income, LIC Mutual Fund, points out the duration in his gilt fund has reduced significantly. Fund managers can also invest their corpus in Treasury Bills or T-Bills, which come with maturities of three months, six months and one year.

Why does duration matter? Long-tenure G-Sec debt securities are most sensitive to interest rate changes and yield movements, whereas shorter duration papers are relatively less sensitive. Check the modified duration of the scheme in the fund house’s monthly factsheet. If the duration matches with the remaining tenure of your fund, you can continue to stay invested. But if you think you’re going to need the money soon, now is a good time to exit. Or even rebalance your portfolio.

However, if you have a longer investment horizon of 8-10 years, you can stay put. “In 8-10 years, the volatility in gilt funds tends to even out and these funds can give reasonable returns, while steering clear of any risks of credit defaults,” Chadha says.

Also read: How you can profit from gilt funds’ fluctuating fortunes

Gilt ETFs are less flexible

In a regular gilt fund, the fund manager has some room to reduce the duration of the investments. But there is no such possibility in gilt exchange traded funds (ETFs).

Gilt ETFs fall in the category of passively managed schemes and track an index that is linked to a government security with five or 10-year maturity.

As there is no active fund management, gilt ETFs cannot reduce the duration and are most likely to bear the brunt of rise in interest rates and bond yields.

Investors with a shorter investment horizon can think of exiting.

Constant duration g-sec funds

For investors with far longer horizon, the 10-year constant duration gilt fund may be suitable. As the name suggests, these funds invest in G-Secs with 10-year maturities.

Such funds can go through periods of high volatility when yields rise, as these are required to invest in longer-tenure G-Secs. Investors with an 8-10 years’ view can stay put as the impact of volatility is lower in the long-run. But, those with a shorter investment horizon, can look at taking profits or exiting.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!