Eight months after Franklin Templeton mutual fund’s (FT MF) closed six of its debt schemes, and after the subsequent court battles, its unitholders will now vote and decide if these schemes should be wound-up or not.

While the legal question on whether approval from unitholders is mandatory for winding-up a scheme is being examined by the Supreme Court (SC), the fund house will seek consent from unitholders as per the directions of the Karnataka High Court.

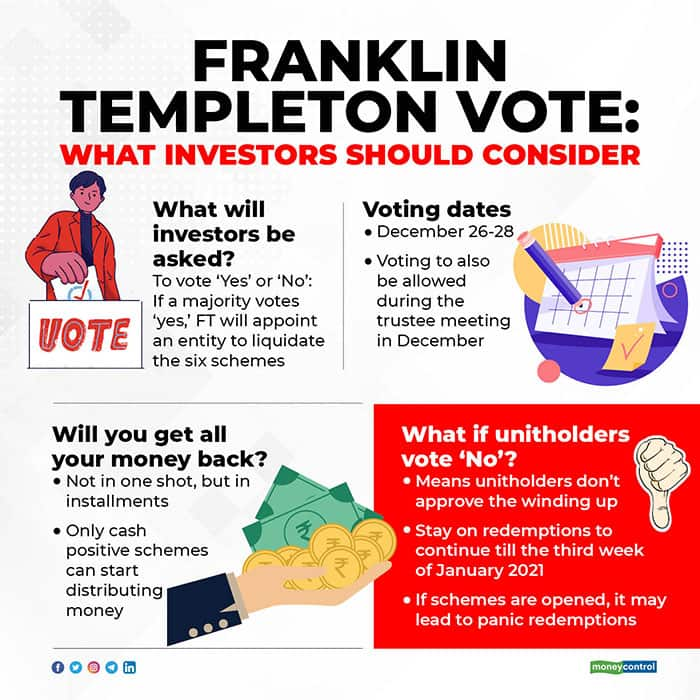

The unitholders’ voting will start from 9am on December 26, 2020 and go on till 6pm on December 28, 2020.

Each unitholder will get one vote for the scheme he/she is exposed to. If the investments are jointly-held, the first unitholder will get the voting right.

This will also be first time when unitholders of six schemes get a chance to question trustees (in a meeting to be held on December 29) on their decision to wind-up the schemes. Unitholders can also vote during this meeting (each scheme meeting may last one to one-and-half hours), but only if they get on the video conference, which will have a cap of 2,000 attendees.

What are your options?

If the vote is ‘yes,’ the fund house would then take steps to liquidate the holdings. But if investors vote ‘no,’ to winding up, the fund house says that it would be forced to open the respective scheme and be forced to sell securities at distressed valuations to meet redemption requests.

While FT MF would try to minimise losses, it cannot give any assurances. Also, there can be disproportionate distribution of cash as investors who redeem earlier, will get quicker access to cash in schemes.

However, schemes may not be opened immediately without SC’s direction.

"Whatever the results of the voting, it will have to be given in a sealed cover to the court, which may come into effect once SC gives direction," says Paritosh Gupta of Gupta Law Associates, counsel for Areez and Persis Khambatta – who were among the earliest unitholders to have petitioned before a court.

The next round of hearings at SC will resume in the third week of January, 2021.

Meanwhile, after the present vote, the fund house will ask unitholders to decide on whether they want to authorise the trustees with the winding-up process or allow independent consultant Deloitte. The fund house had reached out to unitholders to vote on this in May, 2020, before the matter became sub judice.

How soon can Franklin Templeton investors get their money?

Four of the six schemes are cash-positive, and held Rs 7,226 crore of cash, as of November 27, 2020. To be sure, schemes must distribute only the cash to investors right away. Later, depending on how the vote goes, the fund could also sell its investments, generate cash and then distribute it.

After the results of the second vote are out, unitholders of cash-positive schemes will get the proceeds in their accounts. So, even after a ‘yes’ vote in the first round, investors will have to wait a little longer, to start getting their money back (in instalments).

Franklin India Low Duration (48 percent of scheme assets in cash), Franklin India Ultra Short Bond (46 percent), Franklin India Dynamic Accrual (33 percent) and Franklin India Credit Risk (14 percent cash) are among the cash-positive schemes.

“The path for these four schemes is quite clear. Approving the winding up proposal in these four schemes, will give investors access to some cash that is being held in these schemes. So, there is no reason why investors should not approve the winding up process in these schemes,” says Amol Joshi, founder of Plan Rupee Investment Services.

Some of FT’s schemes don’t have cash, as yet

Investors of Franklin India Income Opportunities Fund (FIIOF) and Franklin India Short Term Income Plan (FISTIP) may have to wait for a little longer to get even their first instalment back, even if they vote ‘yes.’

These schemes haven’t yet generated cash as they are yet to fully repay the borrowing in the schemes. The outstanding borrowing in FISTIP stands at one percent of scheme assets. The borrowing in FIIOF stands at 18 percent of the scheme assets. With little borrowing left in FISTIP, the scheme may turn cash-positive by the time unitholders vote on the winding up.

Moneycontrol’s take

Vote for a ‘yes’. If investors vote ‘no,’ there is no certainty on what the fund house might do; much would depend on what the Supreme Court rules finally. In the worst-case scenario, it might open the schemes fully, which might necessitate selling of all the underlying securities at distressed prices and cause losses to investors.

Legal experts say that even if it is a ‘no’ vote, and there are stressed sales, the court and SEBI could direct FT MF to compensate investors for the hair-cuts on the investments. However, this would only be possible if SEBI finds FT MF is in violation of regulations in the forensic audit. This may also lead to a lengthy case, if FT MF seeks legal remedy.

If your investments are in the four schemes that are cash positive, chances are you will start getting your money soon after the second round of voting happens (hopefully, sometime early 2021). Those whose money is stuck in the remaining two schemes – FIIOF and FISTIP – would have to wait a little longer. Even in this case, a ‘yes’ vote makes sense. Here’s why.

The disclosures by FT MF indicate that the portfolio of FIIOF will fully mature beyond April 30, 2025. Only half of FIIOF’s portfolio will mature before April 30, 2025.

“FIIOF is meant to be a long-term fund. So, naturally the investments are long-term in nature. If some instruments can be liquidated at reasonable prices after the ‘yes’ vote, surely FT MF will do that,” says Vidya Bala, co-founder of primeinvestor.in

Vidya cautions that “a ‘No’ vote will create a flight for money and we don’t know at what prices the instruments held in the scheme will get realised.”

Unitholders will also gradually receive cash from maturities, coupon payments, part-payments or pre-payments in FIIOF – as was the case with the other five funds – once the scheme turns cash-positive and if the winding up is approved by the unitholders.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.