Bhavana Acharya

Market news these days is anything but cheery. With the Nifty 50 and the Sensex clocking record slides, investments are bleeding red. But, in this gloom, there is one factor that equity fund investors can take comfort from – equity funds are doing a better job than indices are in limiting their fall. At least thus far!

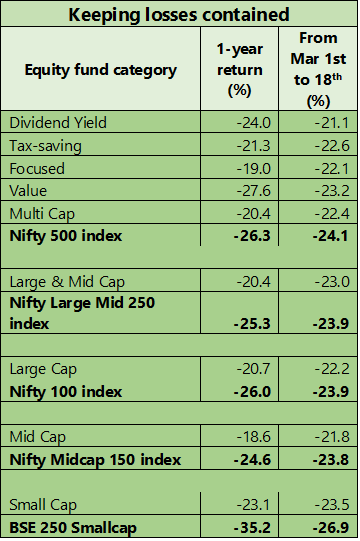

The losses equity funds have posted since the start of March 2020 are much lower than benchmarks such as the Nifty 100, Nifty 500, or the mid-cap and small-cap indices. Though a few weeks is a very short period to be judging performance, this is some comfort for the otherwise below-market performance several equity funds had been recording.

Containing downsides

Take the Nifty 100, a representative of the large-cap basket. From March 1 till date (18 March for this analysis), the index is down 23.9 per cent. The average for the large-cap fund category, in contrast, is a 22 per cent loss. For the category, this results in a 1.8 percentage point outperformance. Breaking it down fund-wise, close to nine in every 10 funds beat the Nifty 100, even on a TRI basis. Funds such as BNP Paribas Large Cap, UTI Mastershare, and Canara Robeco Bluechip Equity have all managed significant downside containment.

Or, consider small-cap stocks, where the crash has been especially hard even after two years of struggle. Every single small-cap fund has managed to keep losses below that of the small-cap index. Since March 1, the BSE Smallcap 250 index tanked 27 per cent. The average loss for small-cap funds was however contained to 24 per cent. Funds such as SBI Small Cap, Tata Small Cap, Axis Small Cap, Franklin India Smaller Companies and Invesco India Smallcap all beat the BSE Smallcap 250 by a margin of four percentage points or more.

Even focused funds, whose one big risk is that falls in concentrated exposure can decimate returns, have so far kept losses below the Nifty 500 across the category. Focused funds are typically multi-cap by nature, and exposure to top stocks in their portfolios easily go up to 8-9 per cent.

Considering these funds’ one-year returns at the market’s high in January 2020, most categories saw around just about 50-70 per cent beating their respective indices. Categories such as value funds were especially poor in their performance. In this market fall, though, the proportion of outperformers in each category has gone up.

Of course, some categories have done a better job than others due to both the nature of the category and the underlying benchmark. For example, large-and-midcap funds have not done as well in beating the Nifty Large Mid 250 index, with several have only just scraping past the index.

Cash, derivatives, and portfolios

So what helped funds protect their returns? One driver has been cash calls and derivative calls. Of the equity funds including ELSS, sector and thematic funds, about 12 per cent had equity exposure of 90 per cent or below. The remaining portion of the portfolio of these funds was either invested in cash-equivalents or in derivatives.

For instance, many of Axis’ equity funds hold a large extent in cash; their large-cap, multi-cap, mid, and small-cap funds all sported equity holdings of 80 per cent or thereabouts as of February. Other high cash holders include Tata Small Cap and HDFC Small Cap. While there is some merit in the argument that equity funds should be investing their AUM and not holding cash, in such markets, cash holding certainly helps. At this time, it serves two purposes – one, it limits losses and, two, it provides funds with a war chest to snap up stocks at attractive prices that a correction offers.

A few funds have used derivatives instead to hedge equity risks. Funds such as Parag Parikh Long Term Equity already have a stated strategy of using derivatives to hedge equity volatility. However, other funds – principally from ICICI Prudential – have taken to derivatives as well, which manages both declines and earns some arbitrage return.

Second and quite obviously, funds’ own stock choices make a difference. The banking and financial services sector, for example, makes up a large share of funds in most categories outside mid-caps and small-caps. Stocks in sectors such as healthcare, software, chemicals, and consumer goods have also fallen by a relatively lesser extent.

The ability of funds to contain downsides is not limited to this correction alone. Most equity funds do tend to fall less than indices do in market corrections. This holds especially true in volatile categories such as mid-caps and small-caps; these funds allocate to large-caps and other more stable mid-cap stocks to keep performance in check.

Downside containment is a critical performance metric as it plays into the fund’s long-term performance; the lesser a fund falls, the easier it is for it to recover when markets move higher.

MFs are buying

Though you may not have the risk appetite to be deploying fresh amounts into equity at these lows, know that domestic institutional investors are. Even as foreign institutional investors pull out, DIIs have been net equity buyers to the tune of Rs 37,362 crore in the month so far. You can, therefore, indirectly benefit from the lows by staying put and not pulling out at this time.

(The writer is Co-founder, PrimeInvestor)

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.