Edelweiss Financial Services Ltd has kick-started the 2023 non-convertible debenture (NCD) calendar with a Rs 400-crore public issue.

The company is a frequent issuer, and it currently has around Rs 15,500 crore in outstanding debt securities as liabilities (as on March 2022).

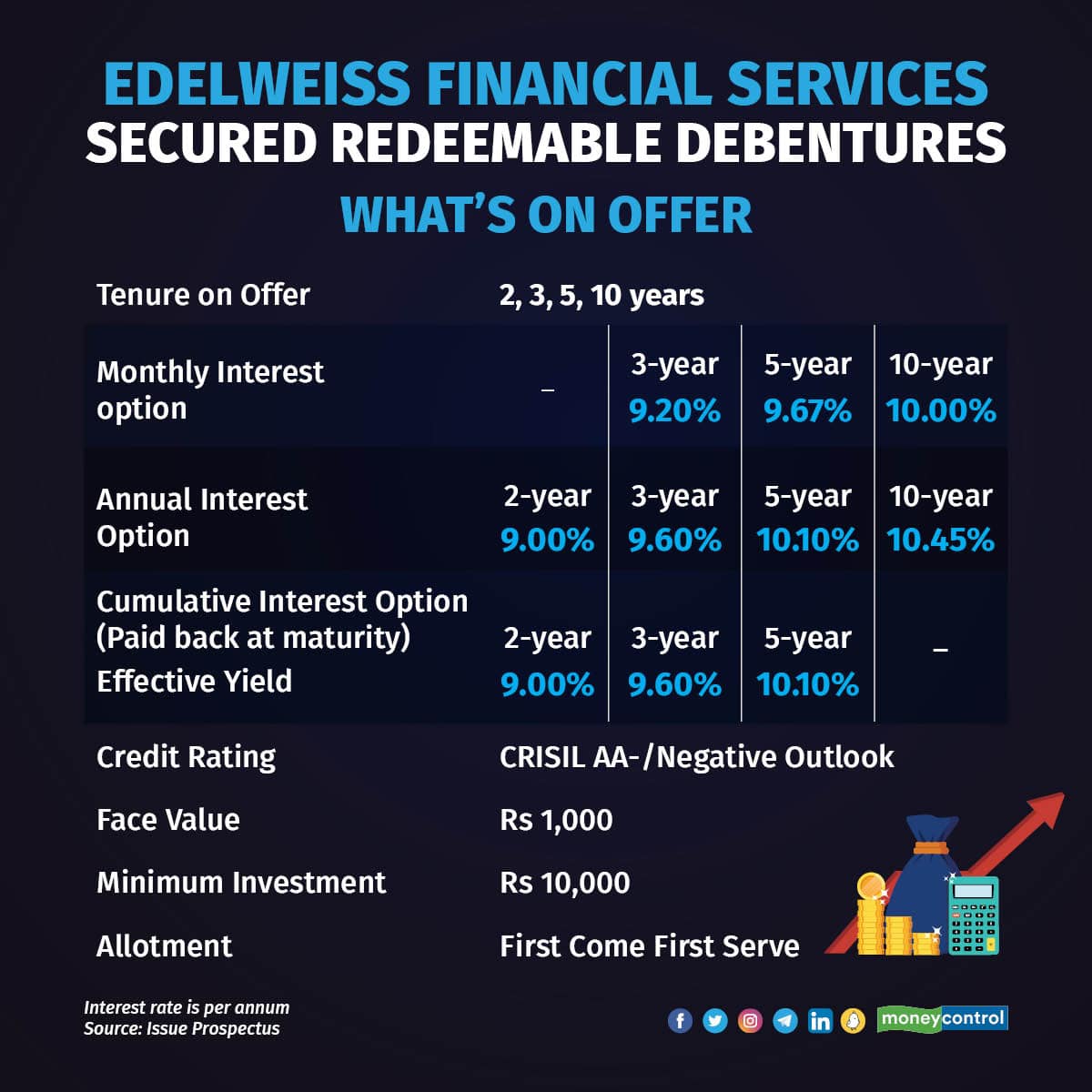

Investors will have to choose from 10 series of debentures spread across a tenure of 24 months to 120 months. The coupon offered ranges from 9 percent a year to 10.45 percent a year with monthly, annual and cumulative interest pay-outs.

In the most recent issue (October 2022) by the company, the highest coupon rate offered was 10 percent per year.

The latest NCD comes with a face value of Rs 1,000 and you can invest a minimum of Rs 10,000. You can invest and hold only in the dematerialised format. Hence, a demat account is required.

Coupon rates range from 9 - 10.45 percent with tenures from 2 years to 10 years on Edelweiss Financial Services’ non-convertible debentures.

Coupon rates range from 9 - 10.45 percent with tenures from 2 years to 10 years on Edelweiss Financial Services’ non-convertible debentures.

What’s good

Edelweiss Financial Services is a suitably well-capitalised, diversified business group in the financial services space across various cities in India. While a majority of its revenues are attributable to its wholesale lending business, the group comprises several non-lending businesses related to wealth management, asset management, capital markets, insurance and asset reconstruction.

The company has a highly visible and trusted presence in the banking and finance industry.

It did face earnings and asset quality pressure in 2020 and 2021. However, this seems to have improved and stabilised in 2022. Overall, at the group level, the net non-performing asset position was at 1.95 percent, as reported for September 2022. This compares with 1.8 percent, as on March 2022, and 5.84 percent, as on March 2021.

The company has a good liquidity position with cash and bank balances making up around 10 percent of its total financial liabilities.

This enables and provides for a sufficient interest cover on outstanding liabilities.

What’s not good

Rating agency CRISIL has maintained a credit rating of AA-, with a negative outlook, as it has identified stress in the asset quality of the wholesale lending book and negative pressures on overall profit margins.

Some associate businesses, like insurance, are still loss-making with long gestation periods.

High credit costs are another red flag citied by CRISIL in its rating rationale note. With interest rates continuing to edge higher and Edelweiss NCDs offering a 10 percent plus long-term interest, this upward pressure on interest costs is unlikely to ease soon.

Moreover, the financial services space, both lending and non-lending, is highly competitive. Unless costs are controlled, margins could remain under pressure.

What should you do?

According to Aditya Shah, CFA, and a Mumbai-based SEBI-registered investment advisor, “Undoubtedly, the yield is better than other comparable fixed deposits. However, one has to understand that the higher yield comes with potentially higher risk. In this case, it is the credit risk or the risk of non-fulfillment of financial obligations in future. Moreover, the highest coupon of 10.45 percent is for the 10-year bond, which has low liquidity. We prefer to stick to highest rated or AAA bonds for clients to ensure minimum risk.”

The long-term return for those in the highest tax bracket goes up to around 6.8 percent, after tax and for those in lower tax brackets, it is as high as 9.4 percent per annum.

Even after tax, the two-year debenture’s annual return, of around 8.1 percent, is fairly attractive. From your overall fixed income allocation, a 5-10 percent allocation can be tactically evaluated, provided you understand the risks. Else, it is best to give it a miss.

There are no guaranteed pay-outs in NCD issues and you have to decide, based on your assessment of the company’s ability to fulfil its financial obligations. In this case, the AA-/negative outlook rating is not the highest. Moreover, the inherent long-term business risks and overall competitive operational environment can change the long-term outlook.

For investors looking to add some regular income through debt allocation, this issue offers a good interest rate at a time when bank fixed deposit rates are low. However, evaluate the risks before locking in to long tenure bonds, despite the high interest offered. The near-term maturities can add to higher earnings efficiencies in your debt portfolio.

At the same time, a wide bouquet of maturities on offer means that you can choose the tenure that suits you. The bonds will be listed, which means you get the option of an early exit if you choose to or need to.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.