How many times have we withdrawn from equity markets at the slightest sign of volatility? We want to see our money grow, but we aren’t willing to brave through the market volatility. Withdrawing prematurely is costly, and we’ll show you how.

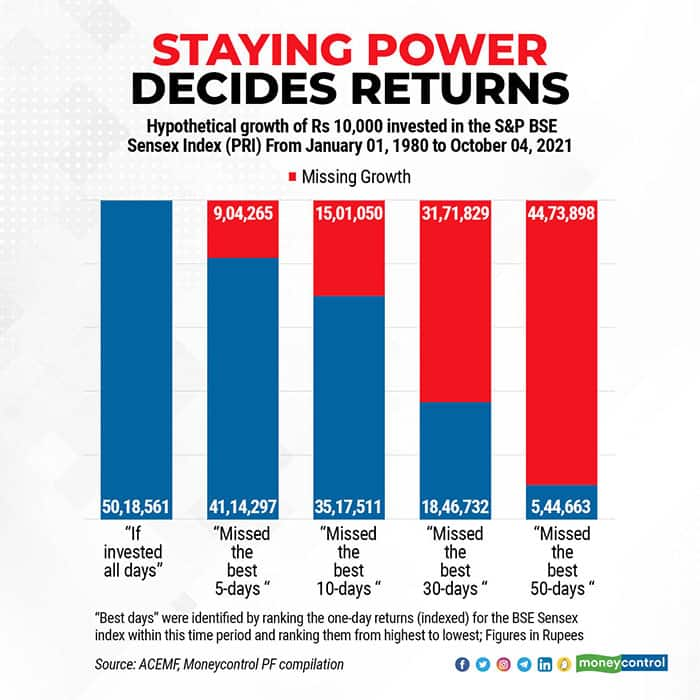

A Moneycontrol study shows that had you invested Rs 10,000 in the BSE Sensex in 1980 and stayed put till date, the amount would have grown to Rs 50.18 lakh. But had you missed the 50 best-return days, you would have lost out on a sum of Rs 44.73 lakh. That is a lot of money to lose, just because you panicked and exited.

Staying the course

Ups and downs are part and parcel of equity investing. Investors are not comfortable with market fluctuations. Many of us press the exit button not only when markets move downwards, but also when indices hit fresh highs.

Remaining invested across cycles is critical for achieving your desired goals. Many investors get scared of market volatility and frequently enter and exit markets. In fact, instead of investing more in equities, they take a big chunk of their existing corpus off the table.

But withdrawing your investment at any point in time, without a logical reason, may impact the potential long-term growth. Take a look at the graph. If you had invested Rs 10,000 in January 1980, and missed out on just five of Sensex’s best days, you’d have lost out Rs 9.04 lakh. Returns can be lumpy, as long periods of volatility can suddenly be replaced by mind-boggling rallies within short spans.

Take a recent example. On February 1, 2021, the S&P BSE Sensex rose 5 percent. If you were out of the market on that day, you still would have lost Rs 1.96 lakh, going by our previous Rs 10,000 example.

On the other hand, stay put with your SIPs irrespective of market gyrations, as corrections will actually help you to achieve higher returns in the long run. Thanks to rupee-cost averaging, SIP helps in purchasing more units when the prices are low and vice versa.

Portfolio rebalancing helps you stay on the right path

Should you never withdraw?

Certainly not. There is a difference between staying invested over the long term and periodic rebalancing of your portfolio. If you are nearing your financial goal, it is good to take some money off the table. Rebalance your portfolio, using various other asset classes: debt, gold, and real estate funds.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.