On June 9, the Reserve Bank of India (RBI) released the web publication of ‘Deposits with Scheduled Commercial Banks as on March 2023’ on its database on the Indian Economy (DBIE) website.

Let’s look at the key takeaways from the database.

Growth in term deposits

The deposits with scheduled commercial banks (SCBs) grew by 10.2 percent during 2022-23 (10 percent in 2021-22).

Since May 2022, the RBI has hiked the repo rate, the rate at which it lends money to banks, by 250 basis points (bps) to control rising inflation. One basis point is one-hundredth of a percentage point.

With monetary tightening, the return on term deposits had a higher differential from saving deposit interest rate and accordingly, a much higher share of deposit amount was mobilised under term deposits 73.2 percent as compared to 44.4 percent in 2021-22. The share of term deposits in total deposits increased to 56.9 percent in March 2023 as compared to 55.2 percent a year ago.

According to data, private sector banks attracted 45.6 percent of incremental deposits and 53.7 percent of households’ deposits during 2022-23. Their share increased further to 32.8 percent in total deposits as at end-March 2023 from 31.5 percent last year. “Investors preferred investing in the private banks because of higher interest rates offered compared to leading public sector banks,” says Harshil Morjaria, a Mumbai-based certified financial planner, who works with ValueCurve Financial Solutions.

Also read | Fixed deposits or debt mutual funds: Which one is better for you?

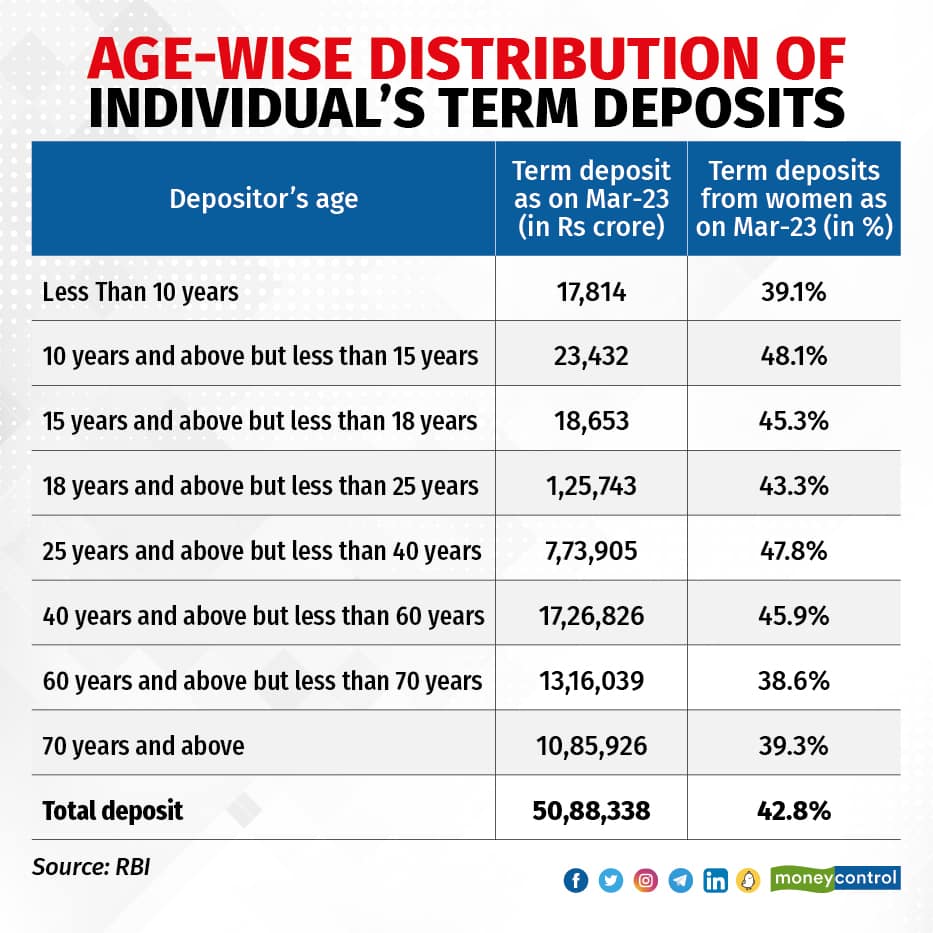

Senior citizens contributing to total deposits

Senior citizens contributed about one-fifth of total deposits as at end-March 2023. Their shares in total term and savings deposits stood at 22.2 percent and 21.3 percent, respectively.

The share of women senior citizens in total deposits with SCBs stood at 7.2 percent. The contribution of female customers in total deposits increased to 20.5 percent in March 2023 as compared to 19.8 percent a year ago. Here’s how senior citizens can earn risk-free income by investing up to Rs 1.1 crore.

Surge in short-term deposits

The share of short-term deposits with a maturity period of ‘1 year to less than 3 years’ soared up and stood at 64.2 percent as at end-March 2023 as compared to 50.4 percent a year ago.

Though it is a good time to invest in long-term FDs, do not go overboard. “Keep your short-term emergency funds in your bank FD and ladder some money in FDs. Laddering helps overcome reinvestment risk,” says Anup Bhaiya, Founder of Mumbai-based Money Honey Financial Services.

Depositors should apply the laddering strategy if they have trouble choosing the exact maturity period for the fixed deposit. Using this strategy, depositors can grow a high amount of corpus to withdraw at regular intervals.

According to the laddering strategy, individuals need to purchase multiple fixed deposits for a series of different tenures. Since all the FDs do not mature on a single date, they can get the aggregated amount of each FD over time.

Term deposits under the interest rate bucket of 6 percent to less than 8 percent recorded a significant surge in their share to total deposits and moved to 57.6 percent as at end-March 2023 from 12.6 percent in the previous year.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.