The Insurance Regulatory and Development Authority of India (IRDAI) has been on a regulation-revamping spree this year, across the life, general and health insurance domains.

The regulator’s revised rules for new health insurance policies have already taken effect from April 1, but insurance companies had been granted time till September 30, 2024 to ensure that existing products - the ones in force before the regulations were revised - comply with the norms, released in March and May this year.

Its directives on cashless authorisation within one hour of receiving the request and final authorisation within three hours of receiving discharge intimation have already come into force.

Insurers say the new rules have contributed to a 10-15 percent premium hike that most companies have effected this year, though high medical inflation of 14-15 percent is the primary driver. “The master circular (on health insurance business) is pro-customer. It provides greater clarity to customers on coverage and waiting periods. IRDAI is moving towards reducing friction in the health insurance space. But, it does come with a bit of price impact for customers,” says Star Health Insurance MD and CEO Anand Roy.

Here are the key provisions that will impact health insurance policyholders:

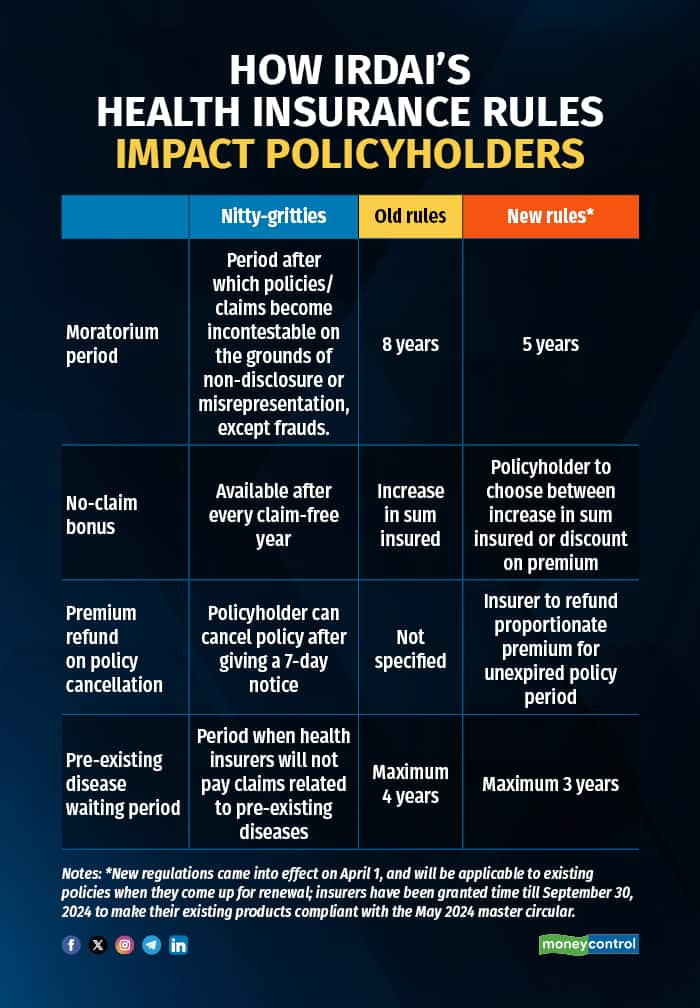

Dispute-free claim settlement after five policy yearsThe IRDAI has reduced the moratorium period for claims under health insurance policies from eight years to five years.

“After completion of sixty continuous months of coverage (including portability and migration) in health insurance policy, no policy and claim shall be contestable by the insurer on grounds of non-disclosure, misrepresentation, except on grounds of established fraud. This period of sixty continuous months is called as moratorium period,” the IRDAI regulations say.

So, if your policy has been in force for five years, your insurance company will not be able to reject claims citing failure to disclose your health status. Non-disclosure is one of the common grounds of disputes.

For example, not revealing pre-existing conditions such as diabetes, hypertension, asthma and so on at the time of policy purchase can result in claim rejection even if your hospitalisation cannot be traced to these ailments. Insurers not only repudiate claims but also cancel the policy citing non-disclosures in such cases.

However, if you have paid premiums continuously for at least five years, the chances of rejection on these grounds will come down, as such policies cannot be called into question in the normal course. And, if the claim repudiation is on the grounds of fraud, then the onus will be on the insurer to produce evidence to back its claim. “If someone has a history of cancer and fails to declare the same in her proposal form, it will qualify as a fraud, because this is a major health disclosure that would have affected the decision to issue the policy. The insurer will have to prove the accusation of fraud,” says Shilpa Arora, Chief Operating Officer, Insurance Samadhan.

On your part, if you feel your insurer has unfairly rejected your claim even after the moratorium period, you can escalate the matter to the insurance ombudsman offices.

If you do not file a claim in a particular year, which is commonly the case when policyholders are younger and fitter, insurers typically hike the sum insured at no extra cost.

IRDAI has now asked health insurance companies to provide policyholders an option to choose – they can either opt for increase in sum insured or discount on renewal premium. This will benefit policyholders who find renewal premiums unaffordable due to sustained rise over the years, particularly since COVID-19. Since June, nearly all companies have hiked their premium rates by 10-15 percent.

Premium refund on policy cancellationIf you happen to cancel your health policies any time during the tenure (typically one year, unless you have paid premiums for two or three years), after issuing a seven-day notice to your insurer. You will be entitled to a refund of proportionate premium for the balance period in such cases.

Policies for all age-groups, demographics, but there’s a catchThe insurance regulator has asked insurance companies to offer products to cover people of all age-groups, various kinds of medical conditions, those with disabilities, individuals across occupational categories and so on.

This, however, does not mean that insurers will have to mandatorily accept proposals of individuals such as, say, senior citizens. IRDAI rules have not eliminated any age cap or mandated coverage for those over the age of 65 years. Fixing premiums and issuing policies will still happen at insurers’ discretion.

Usually, premiums for senior citizens tend to be exorbitant due to their advanced age and health conditions, putting regular health covers out of their reach. Even now, post new regulations, insurers can reject such proposals if their underwriting (process of ascertaining risk and determining premiums) exercise indicates that it is too risky to issue policies.

It remains to be seen whether more insurance companies come forward to offer dedicated, tailor-made policies for senior citizens or other groups such as individuals with disabilities.

Shorter PED waiting periodsPrior to the master circular, the IRDAI had issued regulations for health insurance segment that came into force from April 1.

Health insurance policies come with waiting periods for pre-existing diseases of up to four years ( it is the timeframe after which your declared illnesses or health conditions become payable ). Now, this maximum waiting period has been shortened to three years. For existing policies, this new clause will be incorporated when they come up for renewal.

Even today, several insurance companies offer products with a waiting period of less than three years. In the case of some dedicated policies such as senior citizen plans, it can be as short as one year.

Greater clarity on PED definitionUntil IRDAI came out with the new regulations earlier this year, pre-existing diseases were defined as conditions or ailments for which policyholders had received treatment or diagnosis from a physician up to 48 months prior to policy purchase. Now, this timeframe has come down to 36 months.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.