COVID-19 loomed large on Indians’ psyche in 2020, prompting them to buy more insurance protection. Despite the growing awareness around the importance of life insurance, however, India’s protection levels remained inadequate, a survey conducted by Max Life and Kantar has found.

Rise in insurance awareness, but dip in financial security

The life insurers’ annual survey to measure protection, awareness, ownership and security levels in the country reported a four-point rise in its India Protection Quotient. It rose from 35 in the previous edition to 39 now. According to the company, IPQ is the degree to which Indians feel protected from future uncertainties, on a scale of 0 to 100. It is based on the attitudes, mental preparedness around future uncertainties, awareness and ownership of life insurance product categories (term, endowment and ULIP, according to the company). “While there is improvement, I would still say that India’s protection coverage needs to be much higher,” says Prashant Tripathy, MD and CEO, Max Life Insurance.

The pandemic also prompted them to rush to actually buy life insurance covers. “The initial fear of the pandemic and its effects caused people to sit up and take stock of their risk coverage. For a few months, this did result in people talking about insurance and urgently reviewing their insurance covers – buying new ones, upgrading their existing policies,” says Mahavir Chopra, Founder, Beshak.org, a consumer awareness platform for insurance.

For the survey, over 4,300 respondents across 25 cities were polled through physical and online modes to gauge their attitudes towards life insurance and pure protection term insurance, in particular. The study, the third so far, was conducted between November and December 2020.

Not surprisingly, COVID-19 continues to dominate Indians’ list of concerns. Family members contracting the disease, financial security in case of the breadwinner’s death and cost of COVID-19 treatment figured in the top three list of concerns. Indians are now more concerned about likely inadequacy of their funds in case of critical illness in the family.

Millennials buy more life insurance as financial anxiety rises

It is not surprising that the sense of financial security has taken a beating across age groups due to COVID-19, but the drop is more pronounced in case of millennials. Security levels here refer to the degree to which Indians feel financially secure and prepared on a scale of 0 to 100. Non-millennials’ – or older individuals’ – security levels dipped from 60 percent to 58 percent compared to the previous edition of IPQ, while millennials’ fell from 61 percent to 57 percent.

It is not surprising that the sense of financial security has taken a beating across age groups due to COVID-19, but the drop is more pronounced in case of millennials. Security levels here refer to the degree to which Indians feel financially secure and prepared on a scale of 0 to 100. Non-millennials’ – or older individuals’ – security levels dipped from 60 percent to 58 percent compared to the previous edition of IPQ, while millennials’ fell from 61 percent to 57 percent.

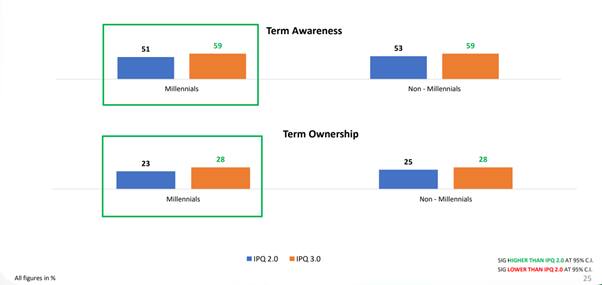

Millennials’ awareness of term insurance sees sharper jump

For their parents, in their younger days, life insurance simply meant a regular endowment or moneyback policy. But millennials appear to be displaying greater awareness of pure protection term insurance policies. Their term ownership is at par with that of non-millennials – or older individuals. But, it has seen a sharper growth. “Traditionally most of our parents have had strong social and joint family support – financial support was available to your family within your house whenever there was a serious disruption. Almost no one bought or sold protection based insurance 20 years ago. In the past 20 years, since liberalisation, people have started living as nuclear families - gradually realising the importance of having financial security for their families,” explains Chopra.

Women’s life insurance ownership lower

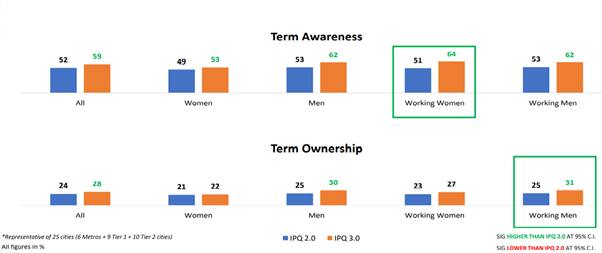

Working women’s life insurance awareness has grown at a faster clip compared to that of men, but they continue to score lower on ownership. They, however, feel more financial secure compared to men.

Working women now more aware of term insurance

Specifically on term insurance, the survey found that women’s awareness on term insurance is, in fact, higher than that of men. Yet, this does not reflect in term insurance ownership. “Urban India’s working women become more financially conscious, on par with men in protection index. However, working men still lead in ownership of term insurance; highlighting the divide in perception of the breadwinner,” said Tripathy.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.