Buy now pay later (BNPL), is one of the most talked about financial services trends in recent times. You have the option of selecting a BNPL service such as Amazon Pay or LazyPay among the many others that are now available. It’s easy. You needn’t talk to anyone or negotiate or wait for any longer than needed; within less than a minute, one can order their favourite chocolate cake on Swiggy via LazyPay, without paying from their account.

The industry

According to Rajat Deshpande, co-founder and chief executive officer, FinBox, “BNPL is a simpler product to understand and more convenient to use (than credit cards). In the case of credit cards, one has to first apply and then wait for approval, application is not at the point of transaction.”

This immediate access to credit, with no questions asked, is perhaps a big lure for users. BNPL is a form of transaction that gives you the option of delaying the payment by a few days, weeks or months without any additional cost. This is a payment solution and it gets implemented through various modes and now even products. There are exclusive BNPL cards such as Slice, Uni Pay and LazyCard that allow you the convenience of paying only a third of your outstanding spend on the card in a month. Virtual cards are also gaining some ground with flexibility and customization of payment solutions.

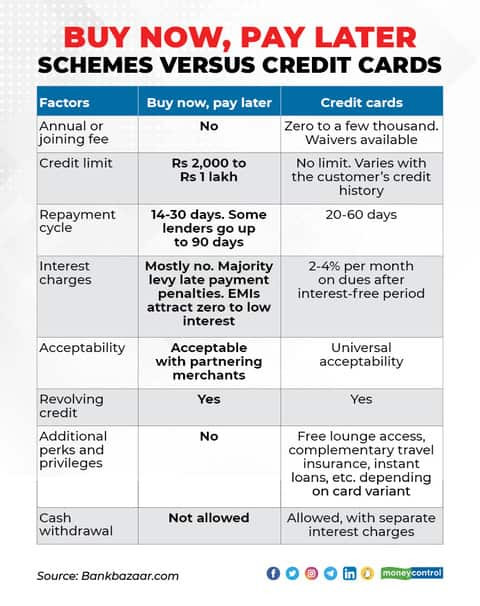

The objective is clear though: convenience and stretching monthly liquidity. The ticket sizes on these transactions may be low, but for someone who is trying to manage monthly cashflow and liquidity, the convenience is irrefutable. Unlike credit cards, there are no annual fees and the credit limit can be as high as Rs 10 lakh without a formal credit score.

According to Amit Das, co-founder and chief executive officer at Think360.ai, “The nature of the business has moved from being just a non-banking finance company to becoming a technology enabled solution, this automatically means boundless scale of application. Estimates of 35-40 million customer market size is being talked about currently.”

Access to customers in tier 3 and tier 4 towns is also an opportunity that adds scale for the technology enabled BNPL industry, Das adds. Industry experts estimate that around 60 percent of the current users are credit card customers, thus, underlying the choice of convenience.

The business

A company that operates in this space must get the technology right. “Ours is a technology business where we can use data analytics and intelligence to build trust. Technology also allows for different payment channels to get implemented, ultimately catering to the ‘digital first’ customer.” Says Anup Agrawal, Business Head, LazyPay.

It is about scale, reach and expanding the market. The starting transaction sizes, especially in case of embedded e-commerce linked BNPL, can be as low as Rs 200-500. Credit is extended for a few days and, once repaid, the limit is extended. As limits get enhanced, one can go for larger spends, moving into the area of unaffordable goods. Nevertheless, at the moment, it’s the high-velocity, small-ticket, quick spends that are more popular. According to Agrawal, “There are several use cases for this payment solution. Average ticket sizes are slowly going down, which is a trend we expect to continue.”

BNPL providers get their revenues both from customers and merchants. For users, going beyond the no-cost period could result in harsh penalties going up to 30 percent in annual interest (for BNPL cards) till the amount is repaid. Penalties are a form of earning for BNPL providers. On the other hand, just as in case of deferred payments at merchant outlets, supported by non-banking finance companies, BNPL companies are likely to have subventions like deals with e-commerce providers and retailers that help them earn on individual transactions.

“This is an opportunity for any kind of payment linked transactions you can think of, as for a technology-based business, the reach is limitless,” says Das.

The customer

For users or customers, this is about convenience and it is about access to credit. If used with care, it’s a useful tool for cash flow and liquidity management. The looming red flag starts to get waved if and when convenience overlaps excessive credit. Customers need to be careful about two things, to not spend unless you have the money sitting idle in your bank already and secondly to always, without exception, repay on time.

It is easier said than done, not just because affordability is rarely ever calculated methodically by consumers, especially at the point of sale, but also because deferring payment is a more intuitive action as compared to re-paying on time, even if you have the money. Unless you have reminders put, re-payments can easily get missed out. With BNPL, putting reminders for several small sized repayments is not exactly feasible. The company may send out reminders, but what if you miss that notification?

According to Deshpande, “People are not yet as educated about credit and this is required. Although, fraud in this segment is fairly limited, one has to understand that credit is serious business; it’s not just a deferring of payment, it is like taking a loan. ”

Deshpande argues that in India, as more independent companies take on the BNPL segment, market competitiveness is also likely to rise and evolve. Along with this evolution, customer education becomes just as important, he added.

Agrawal says, “For our business, customer education and awareness is a part of the decision-making process and without this one cannot build a sustainable business.”

You may intend to use BNPL to manage liquidity, but it can just as easily nurture a false sense of affordability. As you keep repaying on time, your credit limit expands; that is just how the algorithm works. This does not mean that the expanded limit in anyway defines the limits of your affordability. The latter is what you need to consciously monitor. Too many BNPL transactions across too many e-commerce sites can not only lead to a confusing state of financial affairs but can potentially lead you to being in debt. This debt will not come cheap and your interest rates can be anywhere between 30 percent and 36 percent per annum.

One way of avoiding excess debt is setting your personal limits below the ones provided for your BNPL transaction. For example, you may always want to ensure spending only 40-50 percent of your eligible limit and repay at least a few days before the due date. Also, do not forget to check the fine-print on penalties in case of late payments.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.