When 32-year-old, Mumbai-based Vishal Mishra applied for a home loan in 2020, banks rejected his applications. Newly married, his job was in jeopardy as Covid-19 had just set in. Mishra’s applications were rejected because his credit score was low – less than 650. He couldn’t figure out why.

After a meeting or two with Aparna Ramachandra, founder director of Rectifycredit.com, to diagnose his problem, he found out his credit score had been impacted because he had fallen behind in paying back equated monthly instalments (EMI) on two loans he had taken on account of delayed salaries.

Rectifycredit.com, a Mumbai-based firm that helps people repair their debt problems, set him on the path of recovery. It was a slow, uphill climb, but Mishra got help in time.

Finding credit counsellors in India isn’t easy. Although they aren’t new to India, they aren’t so freely listed. A ready database of such individuals or agencies isn’t available.

A simple Google search for ‘how to repair my debt’ lists several articles or reading material on how to improve your credit score, but doesn’t give out the names of credit counsellors in India.

Google for ‘credit counsellors in India’ and things get a bit better. But one still needs to do a bit of digging to get to know the people who advertise their services over the internet before one can dial in on them.

Also read | Why converting debt card buys into EMIs is not a good idea

In 2020, FREED, a platform that helps people resolve their debt issues, was started by Ritesh Srivastava who worked in this line for over a decade in the US. Srivastava co-owned and operated a debt relief company in the US and has resolved over $2 billion in consumer debt. After returning to India, he founded FREED in August 2020.

“There are hardly any debt relief platforms here in India. The problem of debt is rampant. Banks and lenders who have lent money to people have left them in a lurch and at the mercy of collection agencies. FREED’s intent is to help such borrowers who have an intent to repay and become debt-free,” says Srivastava.

Demand for loans

People are borrowing more.

According to Reserve Bank of India data, outstanding personal loans rose 84 percent to Rs 35.98 lakh crore in September 2022 from Rs 19.55 lakh crore in September 2018. Personal loans are those extended to buy a house, consumer durables and vehicles, education loans, credit cards and ‘others.’

Demand for loans and outstanding has gone up in recent years, as per RBI data.

Demand for loans and outstanding has gone up in recent years, as per RBI data.

Outstanding credit card amounts doubled to Rs 1.81 lakh crore in September 2022. FREED estimates the total unsecured debt in India at about $150 billion. Of this, it estimates roughly $15 billion to be in stress and default.

Debt and delinquency in India, as a FREED estimate

Debt and delinquency in India, as a FREED estimate

“Quite a few of the spends that we have noticed are aspirational. Phone calls from banks and fintech firms and easy availability of buy-now-pay-later schemes mean money is easily available for you to spend,” said Srivastava.

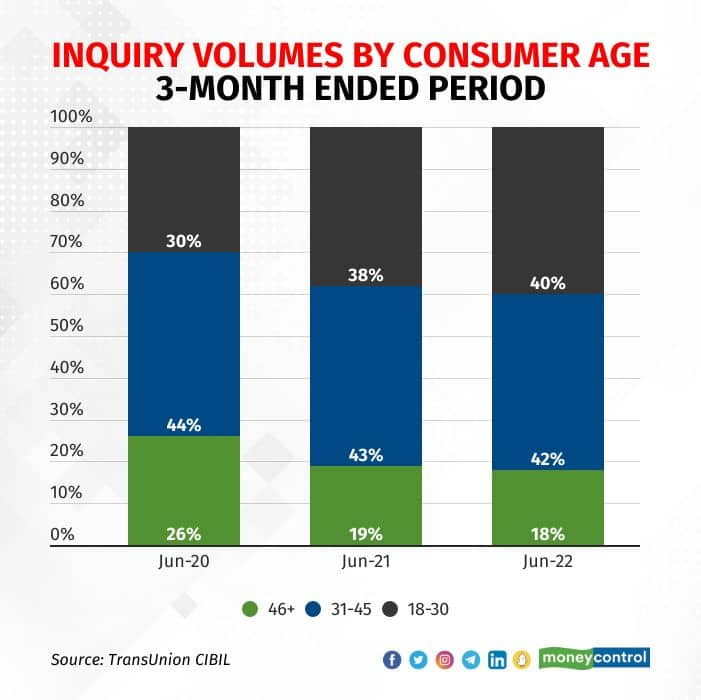

According to a TransUnion CIBIL report, almost 40 percent of credit score inquiries came from those aged 18-30 in the three months ended June 2022, up from 38 percent a year earlier and 30 percent in the June 2020 quarter.

Share of younger consumers is on the rise, as per CIBIL

Share of younger consumers is on the rise, as per CIBIL

Identifying red flags

Ramachandra says when one starts paying just the minimum balance on your credit card, that’s the first red flag.

Also read | Want to cover your credit card buys into EMIs? Keep in mind these factors, first

“Two consecutive EMIs bouncing is another sign,” she says.

Loan or credit card applications getting rejected is another classic sign.

Mission repair

Credit counselors help those who intend to repay their loans. Here, the intention is not to get the loans waived.

After FREED assesses a person’s debt, financial situation and income and expenses, it works out a savings schedule for the borrower’s debt relief programme. Every month, the debtor must set aside funds in a trust account that FREED opens – something like a systematic investment plan. As the money in this trust account grows, the debt starts to get settled, one creditor at a time.

Also read | Tapping a mobile app to take a loan? beware of these frauds

Mumbai-based Seema Reddy, 27, missed a few EMIs on her loan in 2020. She had already taken a loan of Rs 2 lakh for her father’s medical treatment and was supporting her younger sister’s college education. But during Covid-19, she lost her job. Reddy also skipped payments on her credit card. All of this weakened her credit score and made her ineligible for another loan.

After six months of a strict savings regimen and controlled spending, Reddy paid off all her debts.

Also read | How to manage your debt in 6 easy steps

“My credit repair process taught me that if you ever want a loan, do not go to multiple banks. Every bank you go to will pull your credit report out. If there are multiple inquiries on your credit score, that’s considered a negative as it shows you are desperate and/or you are applying for too many loans,” she says.

Srivastava says regular counselling through the whole process is vital. After ascertaining a debtor’s financial hardships, the credit counsellors go through their lifestyle, study their income and expenses and ascertain how much of the liabilities can be realistically paid off. The onus remains on the debtor.

“We study his money box and guide him on how much he can set aside every month. And then guide him consistently. The idea is to keep him disciplined, make sure he stays on course. The borrower needs to keep his resolve to pay off his debts. If that doesn’t happen, if the debtor loses his resolve to graduate from the programme, nobody can help him,” says Srivastava.

Credit counsellors also help debtors negotiate with banks to convince them of the intent to repay despite financial hardships. The goal: reduce the loan liabilities, extend the tenure and get the account officially closed after paying a part – say 40-50 percent – of the original loan amount.

Debt counselling is not new in India. VN Kulkarni, a retired banker, tells Moneycontrol that Bank of India, his former employer, started a debt counselling centre in central Mumbai in 2007. Inaugurated by then RBI governor YV Reddy, Abhay Credit Counselling's centre in centra Mumbai soon became jam-packed.

“People came in crying. They didn’t know how to settle their debts, which in many cases, were very high. They were harassed by recovery agents. Some people told us they had no option but to contemplate suicide,” he says.

In 2017, entrepreneurs Abhishek Agarwal and Rajiv Raj started CreditVidya. Madan Mohan, who headed ICICI Bank’s Disha Credit Counseling, came on board as an advisor. Mohan, 72 and now retired, says it is important for debtors to stop taking more loans once they decide to enroll with a counseling centre.

“If there is a serious intent to repay loans, banks are willing to listen and settle. Banks are always open to getting something rather than nothing,” he says.

Is personal bankruptcy possible?

What if you don’t have money to repay debt and want to declare bankruptcy?

The Insolvency and Bankruptcy Code of 2016 has a provision to deal with individual bankruptcies. However, this hasn’t been notified. The path has been laid out, but the government has not legalised it.

Individuals who stand guarantors to corporate loans are subject to the processes laid out in the IBC. This has been operational since November 2019. Presently, companies can declare bankruptcy and the IBC and lenders then get to salvage whatever they can and move on.

Bindu Ananth, chair of Dvara Research, a policy research institute, explains that IBC for individuals is also meant to give deserving people a fresh start. Ananth was part of a working group set up by the Insolvency and Bankruptcy Board of India to suggest a path for insolvency resolution for individuals.

A fresh start here means that if the IBC court (the adjudicating authority overlooking a case) certifies that the debtor is truly broke and cannot return a penny to creditors, the debt is pardoned and the person can make a fresh start.

That doesn’t mean anyone can say they cannot pay. There are seven conditions that debtors must meet to be eligible for a fresh start process.

Among the conditions, their annual income must be less than Rs 60,000, they shouldn’t have assets in excess of Rs 20,000, and the aggregate value of the qualifying debt should not exceed Rs 35,000. Qualifying debt is one that the debtor seeks to get permanently pardoned, as well as other debt.

There are exceptions. Secured debt cannot be pardoned. Debt incurred three months before seeking a fresh start is excluded. Creditors can, also, contest claims because a debtor’s successful bankruptcy application would mean a total loss.

Whether a debtor declares bankruptcy or has the money to pay but the debt has gone out of control, Ananth says individuals can feel lost at the lack of information.

“There is no legal recourse, especially if the debtor has fallen behind on paying back unsecured debt (personal loans, credit cards, and so on). Lenders might resort to strong-arm tactics, but you have the recourse of the ombudsman. Ultimately, it is a commercial negotiation with banks,” says Ananth.

Way forward

Even when individual bankruptcy laws get notified, it will most likely be targeted at the poorest of the poor who have little in the bank account. Besides, it remains to be seen what shape IBC’s individual bankruptcy norms take when they get notified - whether IBC will continue on its path to serve the poorest of the poor or extend a helping hand to the middle class. Till then, credit counsellors can guide individuals out of debt.

Credit counselling, too, is no magic solution. Unlike the IBC – as and when it gets notified – it does not have legal backing. Credit counselling only clicks when there is discipline on the debtor’s part. And it’s a negotiation between the debtor and the lender.

For Mishra and Reddy, some counselling and a bit of discipline helped save the day.

(The names of individuals who have undergone credit counseling have been changed upon request)

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.