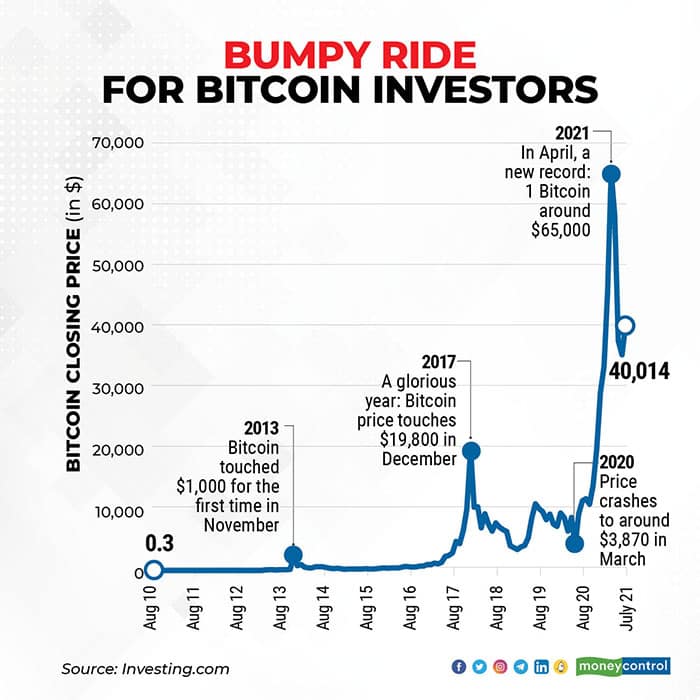

Bitcoin seems to be back in focus, again. Its prices are up 32 percent in just one week after falling about 53 percent from its peak between April 16 and July 21.

Bitcoin prices have been highly volatile. There have been multiple ups and downs since it was first launched in 2009.

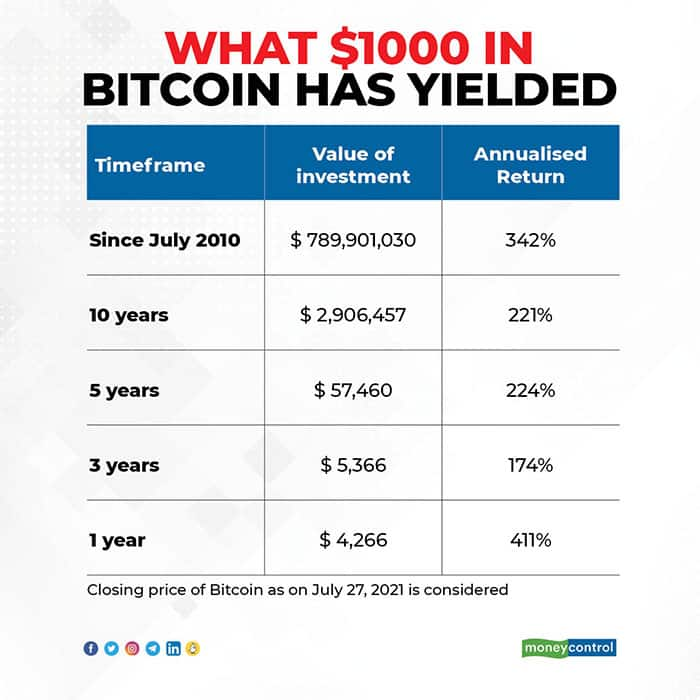

Investors who stayed on since inception have reaped incredible gains. For instance, had you invested in Bitcoin in mid-2010, your returns could be in billions, as the initial value of the bitcoin was close to $0.

If you decided to invest in Bitcoin a bit later, for instance after three or five years, and held on through the price gyrations, you’d have made annualised returns of 174 percent and 224 percent, respectively. Even if as a late entrant you joined the party only last year and invested a lump-sum, then, too, returns were extraordinary, i.e., 411 percent.

Also read: Millennials and cryptocurrencies: A story of missed profits, hard lessons and losses

Why Bitcoin prices rose last year

One main reason behind the surge of Bitcoin was the Supreme Court’s ruling that came last year. The other reason was that some large institutions had begun to back Bitcoin. For instance, PayPal now allows its users to buy and sell Bitcoins. It also allows its customers to buy items from its network of 26 million sellers, by paying in Bitcoins.

“Institutional support from payment giants such as PayPal and MasterCard, by integrating cryptocurrencies into their services, among others, has been the major driver of prices. The earlier skepticism has now given way to widespread acceptance,” says Sumit Gupta, Co-founder and CEO of CoinDCX.

Is it too late to invest in Bitcoin?

“In the recent rally, we are witnessing more inflow of funds from evolved investors in Bitcoin. If this continues, we might soon cross the all-time high by the end of the year,” says Gaurav Dahake, Founder and CEO of Bitbns, a cryptocurrency exchange.

As lucrative as that sounds, it’s not possible to accurately time your investments. Bitcoin, like all other cryptocurrencies, is the most volatile investment around. Invest lump-sum amounts during dips from time to time, as they can give attractive returns in the long run. Crypto exchanges such as Vauld send you a notification when the prices drop by 5 percent, 10 percent and so on. You need to set the notification of price drop with a percentage for an update on the mobile app. This alerts you in case you wish to cut your losses and exit.

Alternatively, you can opt for a systematic investment plan (SIP) to invest in Bitcoin.

You should invest what you can afford to lose in this high-risk asset. Diversify investments across multiple cryptocurrencies to reduce the risk. Overall, you shouldn’t invest more than 5 percent of your portfolio in cryptocurrencies.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!