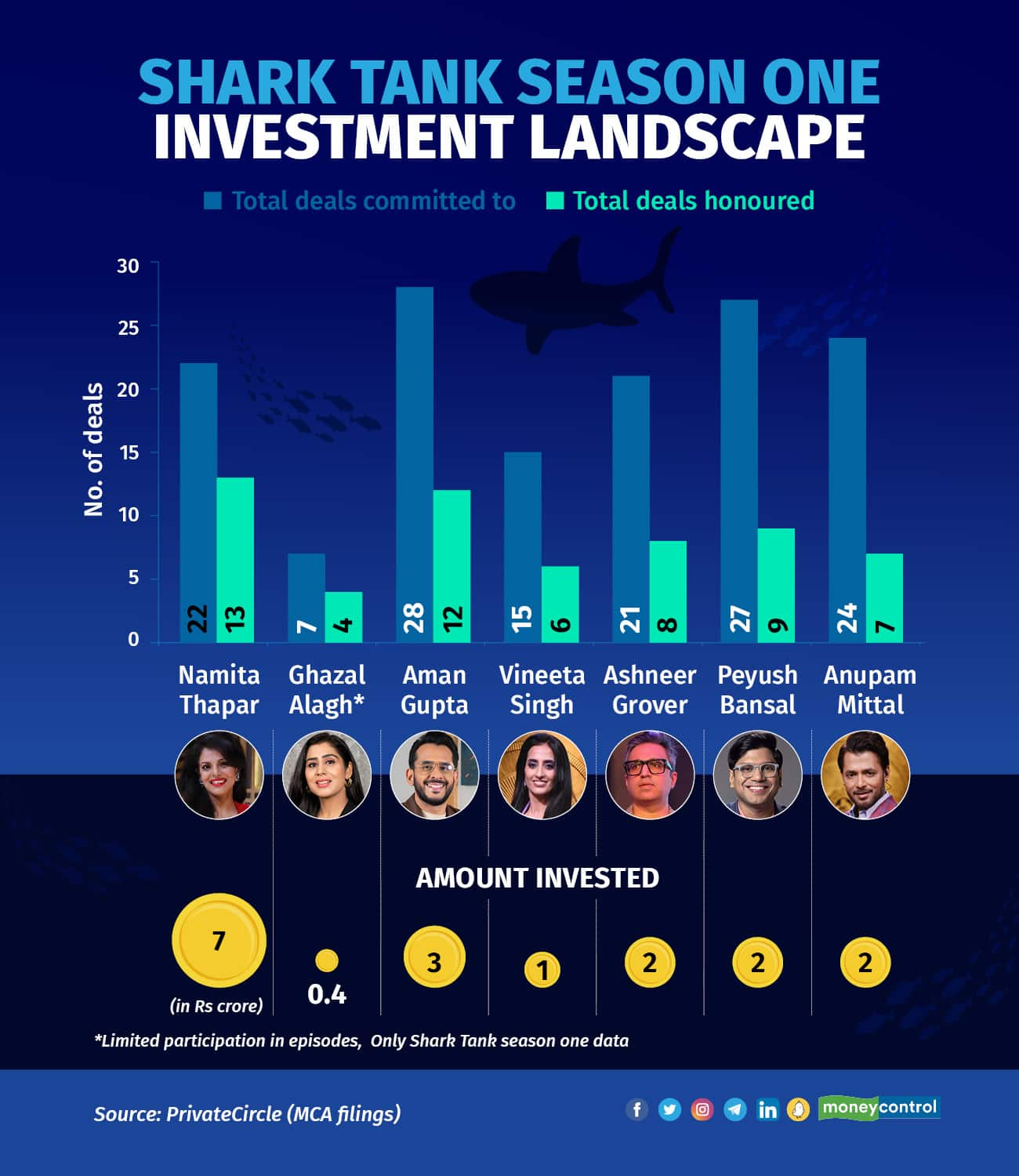

Namita Thapar, executive director of Emcure Pharmaceuticals, honoured the most number of deals as a shark (investor/judge) during the first edition of Shark Tank, a popular TV show. Her counterparts like Peyush Bansal and Anupam Mittal were at the bottom of a list compiled by PrivateCircle, a private market intelligence platform.

The data, based on MCA filings till July 12, 2023, showed that Thapar, after honouring 13 of the 22 deals she committed to, had a conversion rate of 59 percent which was the highest among the seven sharks who featured in the show’s first season.

Second on the list of best-performing sharks (in terms of the investment rate) was Ghazal Alagh from Mamaearth as she had a conversion rate of 57 percent after she funded four of the seven companies she had promised monies. Boat’s Aman Gupta was the third-best performing shark as he invested in 12 of the 28 startups he had committed funds to which translates to an investment rate of 43 percent.

"...(some) companies were not structured to accept money (because) they were not private limited companies. In one case it wasn’t event a proprietorship and had no tax records. We provided legal consultants and paid for it but even after nine months of following up we did not see them taking action," Alagh told Moneycontrol when asked why some deals fell through.

In a surprising move, the findings also showed that Mittal, who runs Shaadi.com, invested only in seven companies even after he committed to 24 startups which put him at the bottom of the table with a conversion rate of just 29 percent.

The data points were contrary to what Mittal had told Moneycontrol earlier. He said that the first edition of Shark Tank saw “the completion of over 70 percent of the deals that were committed to.” He added that deals take 6-12 months to close after a season but the first edition was aired more than a year ago, between December 2021 and February 2022 and his deals were yet to materialise.

Moneycontrol has also reached out to all the sharks for comments, the story will be updated as and when they respond.

Shark Tank season one investment landscape

Shark Tank season one investment landscape

After the first season, Shark Tank also aired its second edition and is now also accepting invitations for a third season, too.

Placed just above Mittal was Lenskart’s Bansal who had an investment rate of 33 percent after honouring just nine of the 27 deals he had committed to. One spot above Bansal was Grover who had a conversion rate of just 38 percent after he honoured eight of the 21 promised deals which put him in the bottom three, along with Bansal and Mittal.

Grover’s investment rate, as per PrivateCircle, was in stark contrast to him telling Moneycontrol that he had honoured 50-60 percent of the deals he had committed to while the rest had fallen through after they failed to meet internal thresholds.

He however took to Twitter to say his investments and conversion rates were higher than stated.

"I, Ashneer Grover, invested Rs 2.95 crores (across) 11 deals in Shark Tank Season 1. This makes me second highest deployer, only after Namita Thapar, who was highest both in terms of absolute and (percentage) closure. No surprises - Namita is a great pay master! Both Namita and I are the top 2 in terms of absolute, % deals completed and % commitment invested," Grover tweeted.

PrivateCircle also updated the data.

“Considering this new information, Ashneer’s total investment will become Rs 2.94 crore (including Revamp Moto, In A CAN and The Yarn Bazaar). In light of this changed legal entity, the total investment value for Anupam Mittal will increase by Rs 25 lakh, Rs 10 Lakh increased for Aman Gupta, and Rs 25 lakh jump for Peyush Bansal total,” a spokesperson for the platform said.

In a Moneycontrol report last month several founders alleged that sharks made offers only on air and that a majority of them were not fulfilled outside of the show. Refuting those claims, sharks said that deals were falling through because multiple founders changed their terms later, and asked for more money because they were talking to investors outside of Shark Tank who offered them more investments.

“Our findings show that some deals committed on the show may have fallen through because of concerns in company due diligence. Also, some startups seem to have passed on the Shark Tank deal to raise funding at higher valuations from other investors,” Sumanjan Kumar, Lead Financial Analyst at PrivateCircle, said in a media release.

In all, sharks committed a total of Rs 40 crore to 65 companies during the first season but invested only Rs 17 crore across 27 startups till July 12, 2023, which translates to a success rate of only 42.5 percentage, PrivateCircle said. The debt rounds were not taken into consideration for the study.

Meanwhile, 166 startups had pitched on Shark Tank India season 2, and 115 of them got a deal commitment on the show but only one of them has made investment filings till now. “It is possible that the due diligence is pending for the Season 2 companies and so we expect more startups to get committed funding from the sharks in the coming months,” PrivateCircle study concluded.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.