Quant Mutual Funds’ portfolios reveal that it has investments in 14 stocks where it is the only mutual fund to have invested in the stock. Stocks owned by Quant Mutual Fund are in the spotlight today after Moneycontrol reported on Sunday that Sebi conducted search and seizure operations on the fund house. The operation was conducted across two locations – Mumbai and Hyderabad. Quant Mutual Fund is owned by Sandeep Tandon, with assets under management close to Rs 90,000 crore.

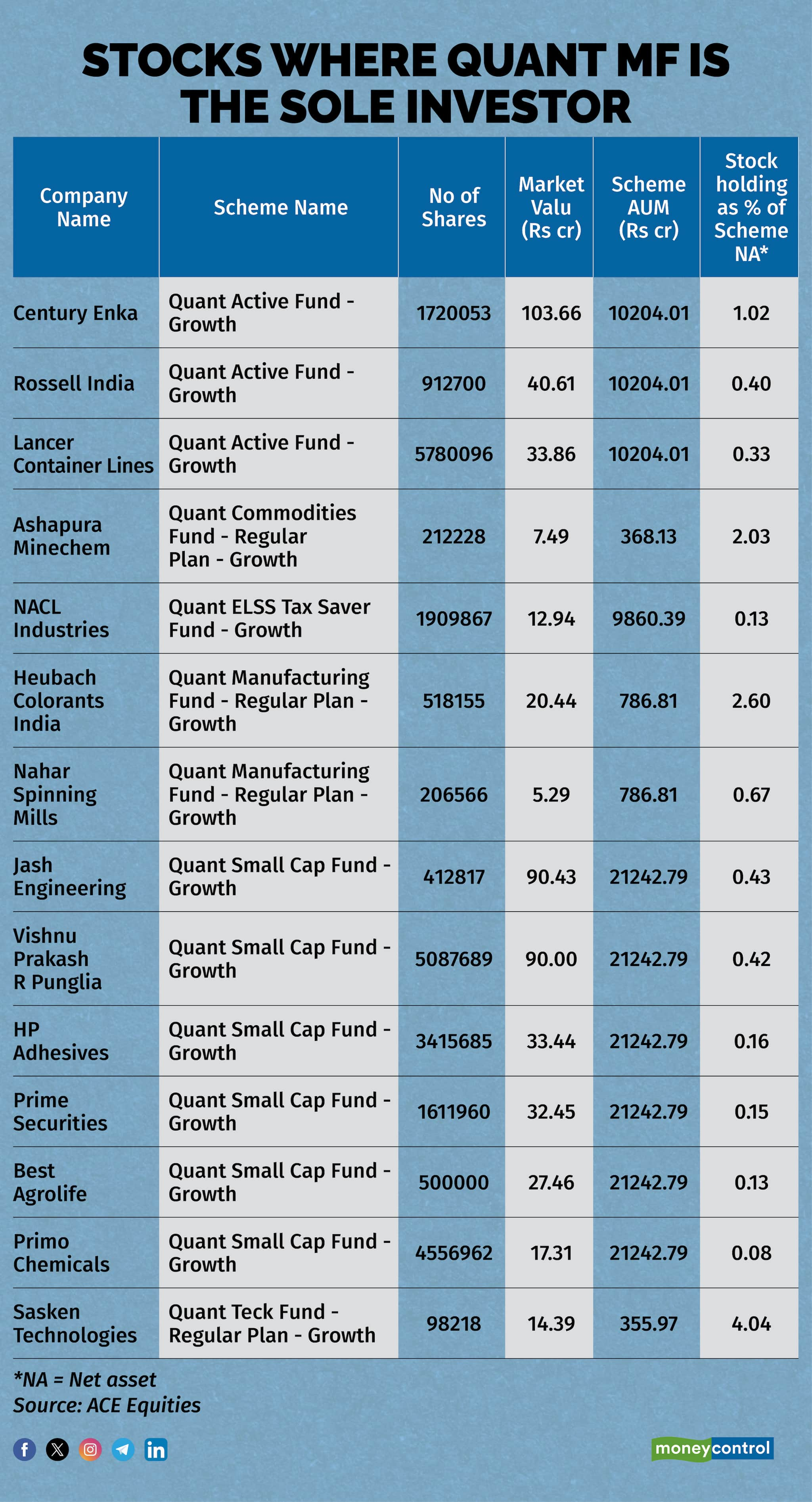

According to the shareholding pattern as of March 2024, there are 14 companies in which Quant MF is the only fund house that has a stake, even as all other asset management companies (AMCs) chose to stay away. These companies are: Century Enka, Jash Engineering, Vishnu Prakash R Punglia, Rossell India, Lancer Container Lines, HP Adhesives, Prime Securities, Best Agrolife, Heubach Colorants India, Primo Chemicals, Sasken Technologies, NACL Industries, Ashapura Minechem, and Nahar Spinning Mills.

In terms of the value of the stake, the largest exposure of the fund house is in Century Enka, in which it owns 17.20 lakh shares valued at Rs 103.66 crore. The shares are held under the Quant Active Fund Growth scheme, and the company accounts for a little over 1 percent of the total AUM of the scheme, which is pegged at Rs 10,204.04 crore. Quant Active Fund is also the only mutual fund shareholder in Rossell India and Lancer Container Lines. In Rossell India, the scheme holds 9.13 lakh shares valued at Rs 40.61 crore, while in Lancer Container Lines it has 57.80 lakh shares valued at Rs 33.86 crore.

Over the past year, Century Enka, Rossell India, and Lancer Container Lines delivered returns of 38 percent, 39.81 percent, and 28.3 percent, respectively. Further, the stake in Ashapura Minechem, whose shares have surged over 200 percent in the last one year, is held by the Quant Commodities Fund Regular Plan – Growth. The scheme owns 2.12 lakh shares valued at Rs 7.49 crore, representing 2.03 percent of its AUM.

The stake in NACL Industries is held through the Quant ELSS Tax Saver Fund Growth, with 19.10 lakh shares valued at Rs 13 crore, representing 0.13 percent of its AUM. Incidentally, shares of NACL have declined by 19 percent in the last one year. Quant MF’s Quant Manufacturing Fund Regular Plan - Growth holds Heubach Colorants India and Nahar Spinning Mills. In Heubach Colorants India, it holds 5.18 lakh shares valued at Rs 20.44 crore, representing 2.6 percent of the AUM, while in Nahar Spinning Mills it holds 5.3 lakh shares. Heubach Colorants saw a gain of 35 percent, whereas Nahar Spinning registered a marginal loss of 0.8 percent in the last one year.

Interestingly, the Quant SmallCap Fund Growth scheme, which has seen huge inflows in the recent past, is the sole investor in six stocks: Jash Engineering, Vishnu Prakash R Punglia, HP Adhesives, Prime Securities, Best Agrolife, and Primo Chemicals, with holdings ranging between Rs 17 crore to Rs 90 crore, representing 0.13 percent to 0.4 percent of the AUM. Further, among these stocks, HP Adhesives, Best Agrolife, and Primo Chemicals have shown negative returns of 7.74 percent, 42.2 percent, and 36 percent, respectively. On the other hand, Jash Engineering, Vishnu Prakash R Punglia, and Prime Securities have delivered positive returns of 59 percent, 94 percent, and 39 percent, respectively, in the last one year.

Meanwhile, the Quant Tech Fund Regular Plan - Growth is the sole investor in Sasken Technologies, holding 98,218 shares valued at Rs 14.39 crore, which is 4.04 percent of its AUM. Shares of Sasken Tech gained 76 percent in the last one year.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.