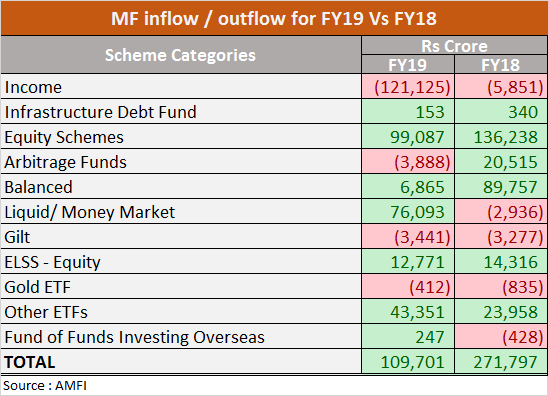

Despite a challenging FY19, the 43-player mutual fund industry saw net inflows of Rs 1.10 lakh crore. However, the net inflows more than halved from the Rs 2.71 lakh crore registered in FY18, according to the data on the Association of Mutual Funds in India (AMFI).

Fund managers attribute the fall in net inflows to lower inflows in the equity fund and outflows from debt categories.

Equity fund inflows dwindle

Inflows into equity funds (including ELSS and others) fell by 37 percent from Rs 1.71 lakh crore in FY17-18 to Rs 1.07 lakh crore in FY18-19

Asset managers claimed slower inflows in equity schemes could be on the back of volatile equity markets in FY19. Amid intermittent bouts of volatility during FY19, Sensex gained 18.77 percent.

They also pointed out that the correction in mid and small cap segment and market concerns over NBFC credit events may have led to a negative impact on flows in the last financial year.

Debt funds suffer

The outflows from debt funds (including income and gilt funds) shot up to Rs 1.25 lakh crore in FY19 as against Rs 9,128 crore registered a year ago.

Fund officials attributed the rise to the credit event in September, tightness in liquidity, interest rate hikes by RBI in the early part of FY19 which led to a lower interest in debt funds.

In September last year, IL&FS had defaulted on repayments. Presence of IL&FS and its subsidiaries in the portfolios of debt funds had led to a sharp fall in their net asset values, prompting investors to pull out their investments from debt funds.

However, AMFI Chief Executive Officer N.Venkatesh believes investors will turn to debt funds if the RBI continues its dovish stand and reduces repo rate by 50 basis points, later this year.

Liquid funds surprise

Liquid funds, which witnessed outflows in the last six months of FY19, managed to end the year with net inflows. In FY19, this category registered net inflows of Rs 76,000 crore.

In comparison, liquid funds had registered net outflows of Rs 2,936 crore in FY18.

Liquid fund assets went up by 32 percent from Rs 4.60 lakh crore to Rs 6.07 lakh crore during the review period.

In the last six months of FY19, liquid funds category was the most hit category and had registered significant outflows, particularly after IL&FS default surfaced in September.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.