Average assets under management for the 43-player mutual fund industry rose 3.55 percent quarter-on-quarter to Rs 24.46 lakh crore in January-March this year, according to data from the Association of Mutual Funds in India (AMFI).

In comparison, total AUM for the industry in October-December stood at Rs 23.62 lakh crore. In FY19, average AUM rose 6.12 percent year-on-year.

Though growth has slowed down, fund managers said participation from retail investors is 'strong', given the volatility in the market. Also, continuous flows from systematic investment plans (SIPs) helped the industry to register growth in AUM.

Asset managers said joint investor awareness campaigns by AMFI and fund houses have driven growth for the industry.

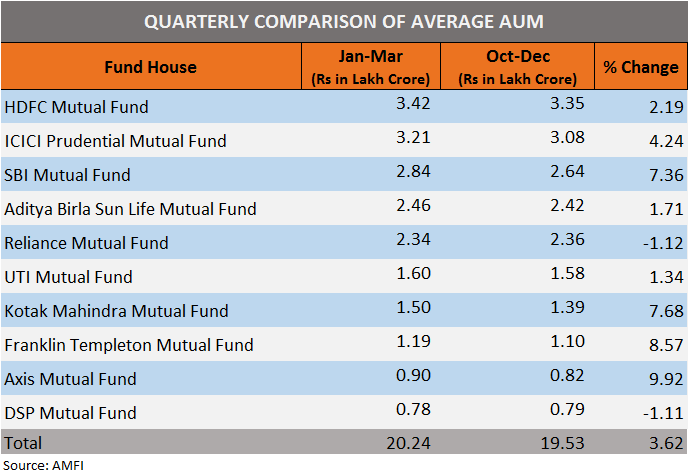

Among the top 10 asset management companies, HDFC Mutual Fund, with a 2.19 percent rise in assets, continued to remain the top fund house with an AUM of Rs 3.42 lakh crore.

ICICI Prudential Mutual Fund stood second with average assets rising 4.24 percent QoQ, followed by SBI Mutual Fund (7.36 percent) and Aditya Birla Sun Life Mutual Fund (1.71 percent).

Among top 10 fund houses, only two mutual funds registered a drop in the average AUM: Reliance Mutual Fund and DSP Mutual Fund.

Despite a 1.12 percent fall in the average AUM, Reliance Mutual Fund retained fifth position. With a similar fall in AUM, DSP Mutual Fund stood tenth.

Total AUM of top 10 asset management companies rose 3.62 percent to Rs 20.24 lakh crore. Top 10 fund houses constitute almost 83 percent of total industry AUM

In the past, the Securities and Exchange Board of India's Chairman Ajay Tyagi has expressed concern over the growing concentration of AUMs among a few top houses.

Of the 43 fund houses, as many as 33 mutual funds witnessed growth in their asset base in the January-March quarter of 2018-19, while 10 saw a decline in their AUMs.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.