Domestic institutional investors have solidified their presence in the equity market at a time when the sentiment seems to be wobbling due to tariff-related uncertainties, with mutual funds, insurance companies, and banks collectively buying aggressively a net of Rs 2 lakh crore worth of shares so far in 2025.

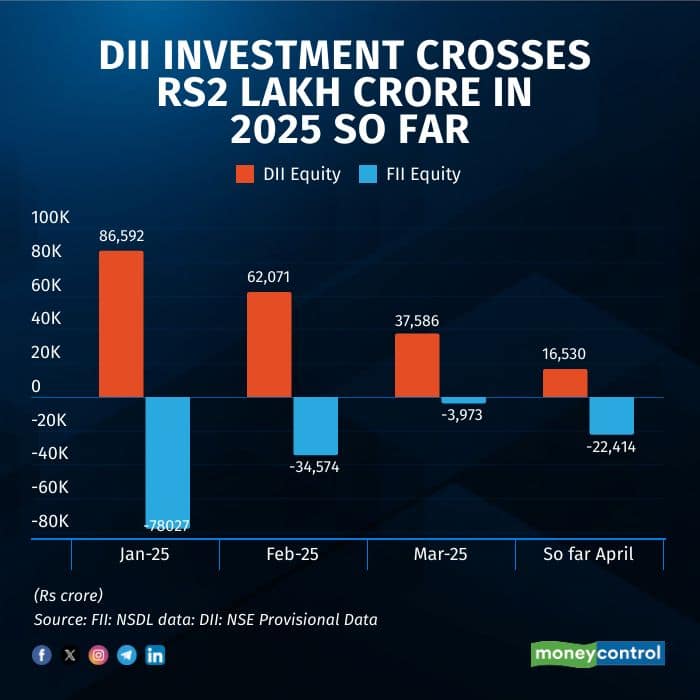

This sustained flow of domestic money follows a record year of net inflows in 2024. The year-to-date DII investment comes at a time when Foreign Institutional Investors (FIIs) have remained net sellers to the tune of Rs 1.4 lakh crore. Notably, in January and February alone, DIIs absorbed significant FII selling pressure, with net purchases of over Rs 86,590 crore and Rs 62,000 crore, respectively—underscoring their growing influence and market leadership.

Within this DII inflow so far this year, mutual funds accounted for over Rs 1 lakh crore in net purchases, followed by insurance companies with investments exceeding Rs 43,000 crore. Contributions from new pension schemes stood at over Rs 8,820 crore, while banks were net sellers, offloading more than Rs 1,036 crore so far this year.

Experts also said DIIs remain confident in India’s long-term growth narrative, which continues to shine despite global headwinds. With a projected GDP growth of over 6.5 percent, India remains one of the fastest-growing economies worldwide.

According to Prashanth Tapse, Senior VP - Research at Mehta Equities, “Despite global disruptions and trade pressures, India is well-positioned to fuel global growth. DIIs maintain a long-term outlook, focusing on sustainable earnings, which reinforces their commitment during periods of volatility.”

So far in 2025, Indian markets have witnessed heightened volatility, with benchmark indices Sensex and Nifty down over 4 percent, and broader market indices BSE Mid and Smallcap down declining more than 15 percent.

Nikunj Saraf, VP at Choice Wealth has noted a strategic DII shift toward mid and smallcap stocks - accounting for 36 percent of recent flows - as well as increased allocations to sectors like IT, pharma, and rural-focused businesses, reflecting a bottom-up investment approach. Significantly, the DII-FII ownership gap has narrowed to just 1.09 percent, underlining the rising influence of domestic investors in shaping market direction.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before making any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.