Lenders to Vodafone Idea have been a worried lot with the telco struggling to manage cash flows in the wake of subscriber losses and a mounting debt pile with AGR dues owed to the government on top of it. The cabinet approval for a moratorium of four years on AGR and spectrum dues has come as a huge relief for banks with a large exposure to the telco.

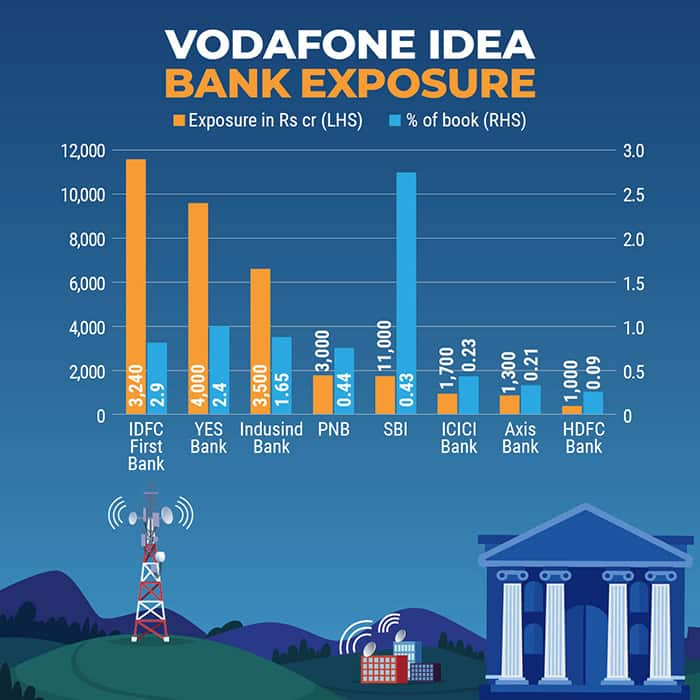

The banking sector has a total exposure of around Rs 29,000 crore to Vodafone Idea. While the country’s largest bank, State Bank of India, has the highest exposure of Rs 11,000 crore, mid-sized banks such as IDFC First Bank, Yes Bank and IndusInd Bank, rank high in exposure to Vodafone Idea as a percentage of their total book size.

Servicing debt

CLSA estimates Vodafone Idea will see $11 billion in cash flow savings till FY25, which will give the telco elbow room to service its debt. It will also cut the urgency on the company to raise tariffs for survival in a fiercely competitive telecom market.

UBS, in its report, said that the cash flow savings will also give Vodafone Idea the ability to increase capex, which is essential to stop market share loss.Speaking to Moneycontrol, a top banker with exposure to Vodafone Idea said: “Banks’ fate is tied to the performance and survival of the telco and that’s the reason why the lenders had also requested the government to provide some relief to the telecom sector, which is struggling with huge debt and the added AGR burden.”

IDFC First Bank’s Vodafone Idea exposure stands at 2.9 percent of its lending book, while YES Bank’s is at 2.4 percent and IndusInd Bank’s at 1.65 percent. The three banks account for around Rs 11,000 crore of Vodafone Idea’s total debt. ICICI Bank, Axis Bank and HDFC Bank have also extended loans to the telecom service provider.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.