Ruchi AgrawalMoneycontrol Research

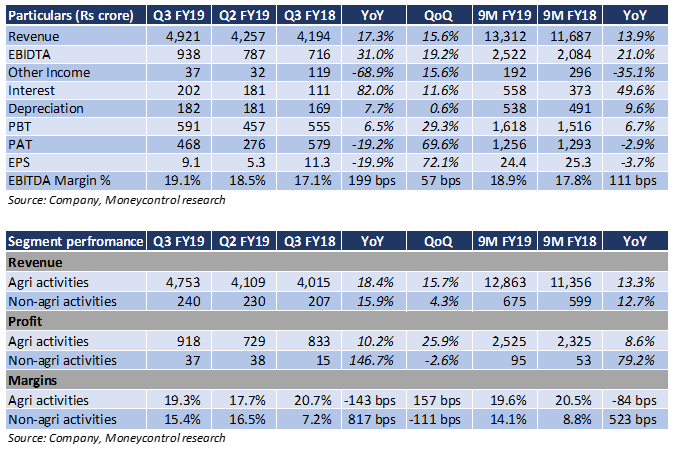

UPL Ltd reported a healthy set of numbers in Q3FY19, both on a year-on-year (YoY) basis and sequentially. Though the net margins were affected due to one-off exceptional expenses, the operating and gross margins reported a decent uptick.

Key positives

-Revenue saw a healthy 17.3 percent YoY uptick majorly driven by a higher volume and uptick in prices and a favourable currency impact.

-Volumes were up around 6 percent YoY aided by robust volume uptick in Europe and Latin America.

-The company took price hikes in most geographies to pass on the higher cost of raw materials. There was around a 7 percent YoY price revision led growth during the quarter.

-Favourable currency impact was to the tune of 5 percent YoY.

-Earnings before interest tax depreciation and amortisation (EBITDA) was up 31 percent YoY and EBITDA margins inching around 199 basis points upwards.

-Except India, the performance remained healthy in most geographies with 36.6 percent YoY growth in Europe, 26.5 percent YoY growth in LatAm, 21.5 percent YoY growth in North America and 12.7 percent YoY growth in RoW.

-There was a healthy gain in revenues in both agro business and non-agri business. However, while the non-agri business saw a strong margins growth, there was a slight blip of 143 basis points in the margins in the agri business.

Key negatives

-The cash flow position of farmers remained stressed in India due to a poor kharif yield and erratic rainfalls. This resulted in a negative impact on the domestic performance with revenue down almost 20 percent YoY.

- Stricter restrictions on sale of organophosphorus products in India also affected the domestic performance.

-The company incurred a gain to the tune of Rs 21 crore on account of mark to market difference on forex contracts related to borrowings and loans and advances.

-Exceptional expense of Rs 91 crore ate away the portion of the net profit of the company (-19 percent YoY) and led to a 100 basis point contraction in net margins. This expense is related to the acquisition of Arysta Lifesciences along with some litigation expenses in US and restructuring costs in LatAm.

Other notes

-The company highlighted that all approvals related to the acquisition of Arysta Lifesciences have now been received and the deal has been closed.

Outlook

After a healthy set of numbers, the stock has seen an uptick and is reaching close to it 52-week high. The stock has gone up almost 46 percent from its 52 week lows and is now trading at 18.7x 2020e Price to earnings.

The performance during the quarter appears healthy and one-off costs have affected net profits. We expect the performance to improve further owing to attractive line up of product portfolio. However, the company has substantial exposure in various geographies and anomalies related to weather conditions and exchange rates brings uncertainty to the company’s performance. Moreover, while the synergies related to the Arysta deal will start benefitting the performance post 2-3 years, we see expenses and higher leveraging to impact margins in the near term.

For more research articles, visit our Moneycontrol Research Page.

(Disclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed here)

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.