Nitin Agrawal

Moneycontrol Research

The performance of Tata Motors' domestic business in FY18 left shareholders elated, though the joy was outweighed by the subdued performance of Jaguar & Land Rover (JLR), which accounts for a significant portion of the consolidated financials.

The performance vectors of JLR are persistently deteriorating and expected to be under pressure at least in the near future.

Our quarterly result update note had pointed out that JLR is expected to face headwinds from rapidly evolving automotive technology and uncertainty in the UK and Europe in the near to medium term. This has forced the company to focus on cost efficiencies, technological advancements, and new product launches that would warrant huge capital expenditure (capex). This has been confirmed in the JLR analyst meet as well.

Below are the key take away from the meet:

Subdued demand outlook

As per the management, demand headwinds continue on the back of ongoing trade war, uncertainty on diesel vehicles in Europe and the UK exacerbated by Brexit, higher incentives in the US and major technology changeover.

The company has pegged the global industry growth at 2.6 percent compounded over FY18-24 in the segments JLR operates. In terms of geography-wise growth, China is expected to grow at 4.2 percent, North America at 1.2 percent, EU at 1.6 percent, the UK at 0.8 percent and rest of world at 4 percent. Further, the management expects SUVs to grow faster and therefore, it has planned more launches in that segment.

The management targets outperforming industry growth on the back of new launches. It has planned to launch 4 models from FY18 to FY23, including I-PACE and new Defender in development. Moreover, it is positioning its portfolio towards SUVs, which is expected to grow at a faster pace.

Further, the company plans to increase its retail network from 1,571 dealers to 1,800 dealers by FY23 to push volume.

Modular Longitudinal Architecture (MLA) – to provide flexibility

Due to uncertainty on the penetration of electric vehicles (EV), the company has planned to adopt a common architecture, MLA. This is an architecture which is agnostic to different propulsion systems. MLA will provide flexibility to offer internal combustion engine (ICE), mild hybrid electric vehicle (MHEV), plug-in hybrid electric vehicle (PHEV) and battery electric vehicle (BEV). The complete rollout is expected by 2025 while the partial rollout would be done in FY21.

EV preparedness

As per the management, JLR is fully prepared for the electrification of all its models. It plans to electrify all models starting FY20. In fact, the new MLS platform would give the required flexibility to the company to launch all kinds of electric vehicle

Margin outlook – driven by cost efficiencies

Operating margin has been on the downward trajectory and the management is aggressively focusing on it. It has guided to JLR’s margins improving from 3.8 percent in FY18 to 4-7 percent between FY19-21 and 7-9 percent in the long term. The management has indicated the margins are expected to be driven by lower manufacturing cost, cost efficiencies coming in from MLA platform, operating leverage, and better product mix tilted towards premium products.

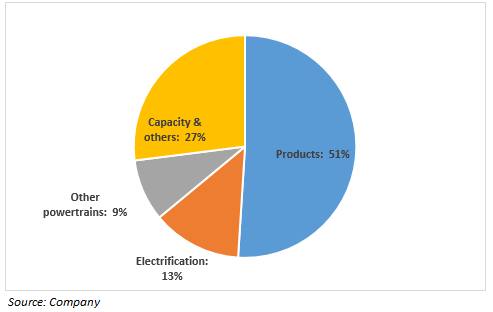

Huge capex requirementJLR has guided to £4.5 billion capex between FY19-21 and 12-13 percent of sales post FY21. In the long term, the company plans to use a large part of the capex on products (51 percent) followed by technology (22 percent) and remaining on capacity expansion and others. The high capex would keep free cash flow (FCF) under pressure, going forward.

For more research articles, visit our Moneycontrol Research page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.