Ruchi Agrawal | Nitin Agrawal | Nandish Shah | Anubhav Sahu

Moneycontrol Research

Highlights

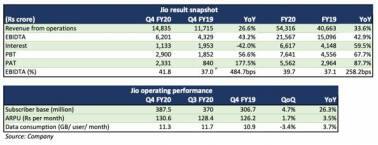

- Robust numbers for Jio led by higher ARPU, customer additions and operational efficiencies

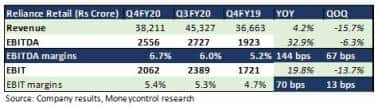

- Despite declining revenues, retail saw EBITDA margin rise 144 bps

- Dip in crude prices hurt the refining segment

- Company reported steep inventory losses during the quarter- Rights issue to pave the way for zero net debt status very soon

------------------------------------------------

Reliance Industries Ltd (RIL) (CMP: Rs 1,467, Mcap: Rs 9.3 lakh crore) reported a mixed bag of numbers for the fourth quarter, and the whole of, financial year 2020. The telecom business (Jio) reported a strong performance led by higher ARPU (average revenue per user). Despite the hit from the lockdown, the retail segment was able to maintain margins. However, a sharp plunge in oil prices amid the current coronavirus turmoil coupled with lower demand and margins impacted the company’s performance in the refining, petchem and oil & gas segment.

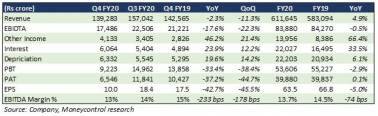

Consolidated result snapshot:

Segment performance:

Key negatives

The Q4FY20 result has come against the backdrop of a sharp correction in commodity prices and demand destruction due to the COVID-19 induced lockdown.

The sharp fall in global crude oil prices impacted realizations in both the domestic and export markets for RIL. This led to a substantial drop in revenues and EBIT in the refining and marketing segment in FY20.

Gross refining margins (GRM) at $8.9 per barrel (bbl) for Q4 were down sequentially (Q3 FY20: $9.2 per bbl). However, GRM continued to outperform the benchmark Singapore complex GRM which stood at $1.2 per bbl during the quarter (Q3 FY20: $1.6 per bbl).

The oil price fall also led to sharp inventory losses of about Rs 4,245 crore. This one-time loss dragged profits. Demand destruction in regional markets coupled with a dip in prices led to decreased revenues in the petchem segment for FY20 as well as Q4 FY20. There was a sharp dip in segment EBIT in Q4. This was mostly due to lower margins in Paraxylene, PET, Polypropylene and Polyethylene.

The oil and gas segment saw a steep dip in revenues and its losses widened. A slowdown in exploration activity coupled with a natural decline in production led to lower volumes in both conventional domestic fields and US shale.

Key positives

Pain in the oil-to-chemical business was partially offset by a strong operating performance in other divisions. Jio witnessed year-on-year (YoY) growth of 3.5 percent in its ARPU driven by price hikes in Q3 FY20. Higher ARPU and net addition of 80.8 million subscribers in the year led Jio to post a strong 26.6 percent year-on-year (YoY) growth in its net revenues. Jio subscriber base stood at 387.5 million.

Its earnings before interest, tax, depreciation and amortisation (EBITDA) margin witnessed a significant YoY expansion of 484.7 bps in the quarter gone by. The expansion was driven by higher ARPU, operating leverage and cost efficiency.

Coming to Reliance Retail, it expanded its stores footprint and added 496 stores during Q4FY20 and 1,553 in FY20 taking the overall count to 11,784 stores covering an area of 28.7 million sq ft. Revenues of the retail vertical rose 4.2 percent YoY during the quarter.

The margin profile in the retail segment improved both YoY and QoQ. Economies of scale, cost control measures and better supply chain management aided operating margins during the March quarter. Operating profit grew by 33 percent YoY.

Further, the company’s media business (Network18) also reported a 19 percent YoY rise in revenues. The segment saw EBIT profits to the tune of Rs 351 crore compared to losses of Rs 52 crore in the previous year. An upsurge in news consumption led to growth in ad revenues for the segment.

The biggest positive on the RIL’s result day, however, was the announcement of a rights issue. The company has proposed to raise Rs 53,125 crore, the biggest equity fund-raising in the Indian capital markets. We believe that proceeds from the rights would help expedite the deleveraging process. The company expects that in the current quarter (Q1 FY21), it should be able to raise Rs 1,04,000 crore on account of the rights issue, the Facebook investment and earlier investments by BP Plc. As per our calculation, this presents a debt reduction of 32 percent. The rights issue by itself would accelerate the deleveraging cycle by reducing aggregated debt by about 16 percent.

Outlook

The overall weakness in the core energy and chemical businesses was in line with global trends. The steep fall in crude oil prices amid the COVID-19 pandemic has hurt oil and petchem businesses across the globe. Substantial inventory losses ate away profits. However, the businesses have completed most major capex and should see faster recovery, post demand revival.

There are couple of growth drivers for Jio. It is expected to continue to see the benefits of price hikes. Additionally, the current COVID-19 outbreak offers a significant opportunity to the company. During the lockdown, the company is extending the validity of small recharges, which may bring down ARPU. However, as subscribers use more data during the lockdown, these will not only offset the impact of validity extensions but also improve ARPU. Further, JioGigaFiber services are getting good traction from its customers.

We expect the current lockdown will lead to reductions in about half of RIL’s core retail revenues, mostly in consumer electronics and fashion & lifestyle. Fashion & lifestyle, which accounts for around 14 percent of the company’s core retail revenues, is RIL's highest-margin retail business, and it will have a disproportionate impact on EBITDA and revenues. Some of this impact should be offset by higher grocery revenues and potential rental adjustments with mall operators.

However, an important factor to watch would be how the lockdown is lifted. Reliance Retail will likely be better positioned amongst peers due to its higher exposure to Tier 3 towns, which have suffered relatively less from the epidemic.

We also feel that Jio Mart will be a game changer in the e-commerce business and can potentially pose serious threat to existing e-commerce players.

Lastly, the company has been managing its debt very well. Within months of creation of the wholly owned subsidiary (WOS) for all its digital initiatives to create the largest digital platform company in India – Jio Platforms - RIL announced that Facebook has picked up a 9.99 percent stake in the latter. FB’s investment of Rs 43,574 crore ascribes an enterprise value of Rs 4.62 lakh crore ($65.95 billion) to Jio Platforms. The premium valuation is an indication that the acquirer expects substantial growth potential in the business in the near future.

Now with the announcement of rights issue, the company appears to be on track to meet its goal of net zero debt by the end of the current fiscal year. The company already mentions that the Aramco deal (i.e 20 percent stake in oil/chemical business) is on track for due diligence and Jio platform has received interest from other global investors.

Overall, we believe that RIL’s deleveraging cycle will gain momentum with the capital-raising through the rights issue. There is immense value unlocking potential in the consumer facing businesses. In the coming days, Reliance will emerge as a much leaner business conglomerate and is set to enhance shareholder value in the process.

For more research articles, visit our Moneycontrol Research page

Disclaimer: Reliance Industries Ltd. is the sole beneficiary of Independent Media Trust, which controls Network18 Media & Investments Ltd.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!