Sachin Pal

Moneycontrol Research

The government’s push on agriculture, irrigation, housing and infrastructure development has kept the building material sector in focus over the last couple of years. Industry reforms and government policies have had a positive impact on organised players in the industry - from tiles to sanitaryware to pipes - as companies are witnessing an uptick in demand. We will delve into the results of four major pipe manufacturers - Astral Poly Technik, Supreme Industries, Finolex Industries and Jain Irrigation - which are trying to seize this market opportunity through multiple levers: brand development, backward integration and capacity expansion.

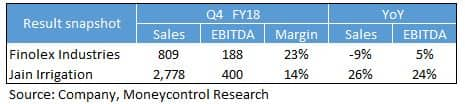

Q4 result snapshot

Astral Poly Technik’s standalone March quarter net sales rose 7 percent year-on-year due to a 10 percent increase in volumes. Earnings before interest, tax, depreciation and amortisation (EBITDA) margin improved 142 basis points to 17.7 percent compared to the management guidance of 14-15 percent. Lower raw material costs aided margins but this was slightly offset by higher other expenses.

International operations (Seal It Services) reported a 15 percent YoY growth in sales with the induction of new machinery at its US plants. Its US operations are expected to export high margin adhesives products to both UK and India in the current year. While EBITDA margin are still in the high single-digits, export of high margin adhesives products are expected to push EBITDA margin towards the management’s guidance of double-digit margin in FY19.

In the quarter gone by, the company started trial production at Ghiloth plant (Rajasthan) which has an installed capacity of 22,700 tonne. Commercial production will commence from Q2 onwards.

FY19 is expected to witness a volume growth of about 15 percent, backed by both capacity expansion and better capacity utilisation. Higher contribution from both Resinova Chemie and Seal It Services divisions are expected to aid margin. It also benefits from backward integration in the pipes business.

Supreme Industries’ Q4 sales were up 15 percent year-on-year (YoY) led by volume growth of 8 percent YoY. Industrial and consumer segments witnessed volume growth in high teens. Piping segment, which contributes more than 50 percent to the revenue, reported a high single digit volume growth. However, the packaging division reported a volume decline of three percent.

EBITDA margin improved YoY due to better margins in the piping and consumer businesses offsetting lower share of value added products and higher employee costs.

During the year, the company increased its installed capacity by five percent to 568,000 MT. The management is planning to add another 50,000 MT capacity in FY19 by incurring an investment of Rs 300-350 crore. Two new greenfield plants are expected this fiscal: one each in Telangana and Rajasthan. Over the long run, Supreme Industries intends to increase its capacity to 700,000 MT by FY21.

Finolex Industries reported a mixed set of numbers for Q4 FY18. Revenue declined 9 percent but operating profits increased 5 percent. Decline in revenue was due to a 6 percent volume shrinkage in poly vinyl chloride (PVC) resin segment. However, volumes in PVC pipes and fittings grew 12 percent YoY.

The increase in operating margin was aided by margin expansion in PVC resin segment (resulting from increase in PVC-ethylene di chloride spread) and inventory gains due to increase in crude oil prices.

Despite a lacklustre topline in Q4 FY18, the management seems confident of a double-digit volume growth and margin expansion in FY19. This will be mainly driven by non-agriculture division. In FY19, the company is planning to launch new products in the non-agriculture division, which should drive its revenue share higher from the current 30 percent levels. On the capex front, Finolex plans to add 30,000 MT of capacity every year at an investment of Rs 30 crore.

Jain Irrigation reported a robust performance in Q4 FY18 as sales jumped 26 percent YoY to Rs 2,778 crore. EBITDA increased 24 percent to Rs 400 crore. Performance was noteworthy as it reported the highest ever topline and operating profit in the last 12 quarters. Topline growth was led by hi-tech agri input product sales (up 34 percent YoY) and plastic division (up 29 percent YoY).

Interest expenses increased 16 percent YoY to Rs 133 crore on account of additional debt, which was used to fund the $48 million acquisition of US-based micro-irrigation dealers: Agri-Valley Irrigation and Irrigation Design & Construction. The company expects revenue growth in excess of 15 percent in the coming year. This will be aided by its agro processing division, which is likely to grow 25-30 percent YoY in the current fiscal. It had a low base in FY18 as sales were impacted by fire at its plant.

RecommendationFrom a valuation standpoint, Astral Poly Technik trades at premium valuation given its business moat, strong business fundamentals and historic track record. Supreme Industries and Finolex Industries appear fairly valued at 27 times and 21 times FY19 earnings, respectively.

Jain Irrigation trades at a discount to its peers due to the diversified nature of its business and lack of financial consistency. Earnings volatility should reduce going forward as the company has an order book in excess of Rs 4,000 crore. Current valuations offer a fairly attractive risk-reward ratio as the government’s thrust on rural segment (agriculture and irrigation) bodes well for the company. Its prospects seem bright but trade war concerns could impact its US business. Apart from positives mentioned above, the initial public offering of its food processing division (FY18 topline of over Rs 1,600 crore) will be another trigger which should play out in the medium term.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.