Nitin Agrawal

Moneycontrol Research

Maruti Suzuki India (MSIL), the country’s top car maker with a market share of close to 57 percent in the passenger vehicle segment, continued to post steady results. The company posted strong topline and realisation growth with operating margin expansion despite rising raw material (RM) prices.

Today, MSIL has a virtual monopoly in the passenger vehicle market in India led by a strong dealership network, brand loyalty on the back of competitive prices and resale value. With a slew of new launches including refreshers, strong order pipeline, product rejig toward premium products and leadership position in the Indian market, the stock will continue to enjoy the fancy of investors despite the premium valuation.

Quarter in a nutshell

Strong volume and ASP growth

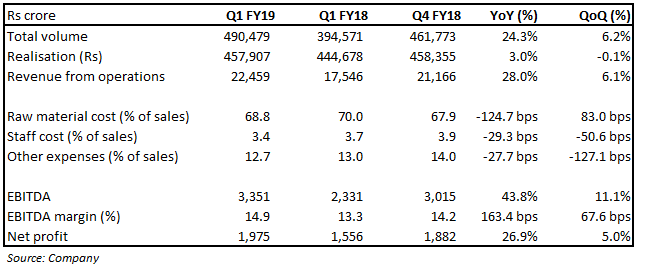

MSIL reported strong volumes with over 24.3 percent year-on-year (YoY) growth led by new launches and healthy demand from rural areas. Volume growth was also aided by the lower base of last year owing to transition towards GST.

The compact cars segment witnessed a 50 percent YoY volume growth backed by demand for the new Swift, followed by van and utility vehicle (UV) which grew 25 percent YoY and 15 percent YoY, respectively. UVs now contribute close to 14 percent of total domestic sales.

Strong volumes led to a 28 percent YoY growth in net revenue from operations. Realisation grew 3 percent YoY adding to growth in net sales.

EBITDA margin improvement – Staff cost and other expenses ease pressure

Volumes along with a favourable product mix and cost reduction efforts also aided earnings before interest, tax, depreciation, and amortisation (EBITDA) growth of 43.8 percent YoY. This resulted in an expansion of 163.4 bps YoY and 67.6 bps quarter on quarter (QoQ) in EBITDA margin. Raw material prices, staff cost, and other expenses also declined as a percentage of net sales.

Is it a stock to own for the long-haul?

Industry tailwinds

Strong demand is coming from the rural market on the back of strong monsoon, increase in minimum support price (MSP) and government’s focus toward rural areas ahead of the elections. Currently, the retail volume is growing at a rate of 15 percent.

Further, the demand in urban markets also continues to be very strong on the back of higher disposable income and very low penetration of cars in India.

Strong product pipeline

MSIL has planned a slew of launches over the next three years. MSIL has a track record of more success than failures over last four years. Except for S-Cross, all other launches from FY12 till FY18 witnessed strong customer demand. The company’s 9 new models have reached the crash test stage and would be launched soon.

Premiumisation trend continues

MSIL has been able to identify customer preference patterns and has worked accordingly. The company has successfully reoriented its product portfolio dominated by small cars to premium products, which cater to the changing customer preference. New Swift and Swift Dzire have received very strong traction from customers. In fact, the company sold 1 lakh units of new Swift within 145 days of its launch – fastest in the industry.

Strong distribution network – a moat

MSIL’s leadership is indicated by its strong distribution network. This distribution network is a moat to the company, which gives it a competitive advantage in an otherwise highly competitive industry. Moreover, in the strong quest to cater to the premium segment, the company is expanding its Nexa network. It currently has around 250-300 Nexa outlets and plans to expand it to 400 by 2020.

Getting ready for EV

The company is gearing itself for the next big disruption by electric vehicles (EV) in the automobile space. It has made an announcement to invest Rs 1,200 crore in setting up a Li-ion manufacturing unit in India. As per the management, the indigenous development of the battery could bring the prices of EVs down substantially. In fact, the company has started its survey on EVs in India.

Capacity expansion

MSIL has a huge order backlog, indicating strong demand from customers and the need for capacity expansion. The company has clearly chalked out a capacity expansion plan. Gujarat plant’s phase I has already started production and is expected to produce 250,000 units this year and second phase would start from January 2019. The management expects to expand the capacity of this plant to 1.5 million.

Change in royalty

In FY18, the royalty payment remained at 5.4 percent of net sales compared to 5.8 percent last year. For Q1 FY19, royalty was higher at 5.5 percent due to the unfavorable exchange rate. The management indicated the royalty payment has been revised downward for all new models starting Ignis and the company has received approval from Suzuki board. As per the agreement, the company would now pay royalty in Indian rupees (INR) than in Japanese yen (JPY) and after a certain volume is achieved, the royalty rate would come down.

Valuation at elevated levelsMSIL currently trades at 33.6 times FY19 and 29.7 times FY20 projected earnings. While valuations leave little room for upside, we are comfortable with the business and advise investors to accumulate the stock on dips.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!