Sachin Pal

Moneycontrol Research

The second quarter of FY19 turned out to be another challenging quarter for Kajaria Ceramics as demand was impacted by multiple factors. Performance was noteworthy, considering it delivered double-digit volume growth in a muted demand environment. Moderate price hikes across product categories, along with strict cost control measures, alleviated cost pressures being faced by the company. The management is upbeat on growth and expects to deliver double-digit volume growth along with margin improvement in the second half of the current fiscal.

Decent quarter under challenging market conditions

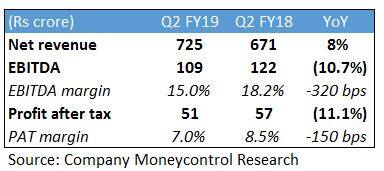

Revenue increased 8 percent year-on-year to Rs 725 crore. The same was aided by 11 percent volume growth on a low base last year. Demand was impacted by transporters strike in July and floods in Kerala in August and September.

Sharp rise in fuel costs (up 35 percent year-on-year and 5 percent quarter-on-quarter) and higher contribution from manufacturing weighed on earnings as earnings before interest, tax, depreciation and amortisation (EBITDA) declined 11 percent to Rs 109 crore in Q2 FY18. Contraction in EBITDA resulted in lower net profit, which declined from Rs 57 crore to Rs 51 crore.

Bath ware segment going strong

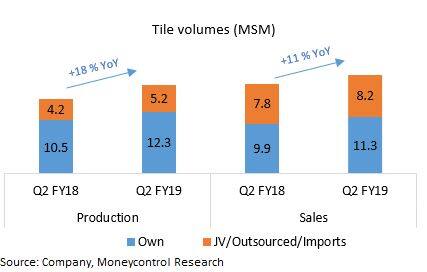

Volumes in Q2 came in at 19.5 million square meter (MSM) and growth was aided by a favourable base last year. Revenue growth for the segment was lower as realisations remained soft on account of increased competitive intensity from unorganised players. Revenue came in 7 percent higher at Rs 682 crore.

While the tiles business continues to be subdued, the bath ware segment (sanitaryware and faucets) expanded at a healthy pace. Revenue from bath ware jumped to Rs 44 crore in Q2 FY19 from Rs 33 crore in Q2 FY18.

Margin continues to face pressure

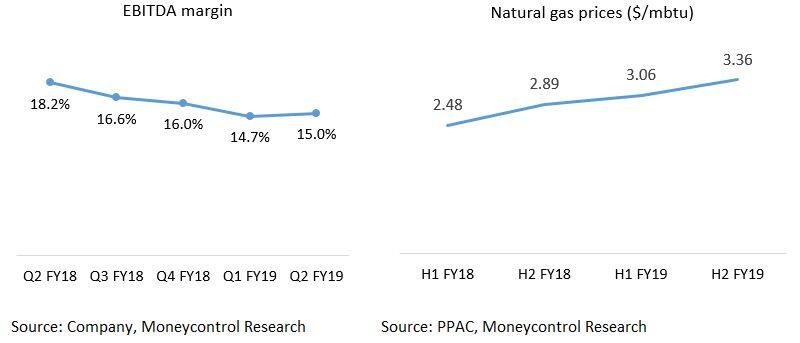

Operating margins for the industry have been under pressure as the price of natural gas has seen a steep increase (over 20 percent) in the past one year. Kajaria’s Q2 operating margin came in marginally better QoQ as the company undertook price hikes in July to ease margin pressures.

Increase in crude oil and a weaker rupee will continue to have a bearing on natural gas prices and keep a check on margin over the next few quarters.

Outlook and recommendationKajaria’s performance during the quarter gone by was impacted by a number of factors. However, its resilient operational performance indicates the management’s execution capabilities in a tough market environment.

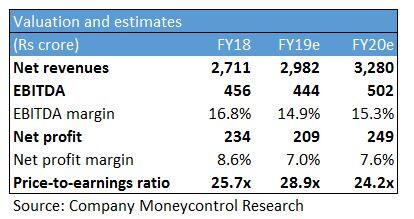

The market took cognizance of its subdued financial performance over the past few quarters and the stock price has more than halved since the start of the year. The stock seems fairly priced at current valuations (around 24 times FY20 earnings) and should be on investor radar as Kajaria enjoys market leadership and strong brand recall.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.