Sachin Pal

Moneycontrol Research

Highlights:

- Healthy volume growth across the board

- Realisations muted but margins improved sequentially

- Recent price hikes appear temporary- Sagar Cements could be the dark horse in the mid-cap cement space

-------------------------------------------------

The cement industry had a decent performance in Q3 FY19 as volumes continued to remain strong and the softening of input costs aided the earnings sequentially.

However, the muted pricing situation in a competitive market continued to undermine the profitability of majority of the industry players. The continued improvement in cement volumes across regions is most promising as it indicates that the much-awaited pricing power could return to industry once the capacity utilisation moves higher from current levels.

In the current market environment, we analyse the performance of some of the mid-size companies in the sector to check which ones are worthy of long-term investment at this juncture.

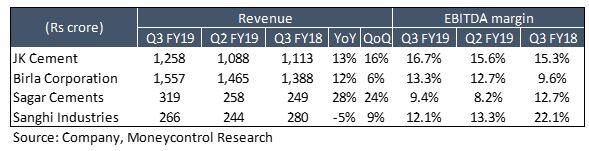

Q3 earnings snapshot

JK Cement’s revenues came in 13 percent higher as the grey cement volumes rose 6 percent Year-on Year (YoY) while the white cement volumes rose 19 YoY. Higher contribution from the trade sales aided the sequential improvement in realisations and margins. Operating profits came in higher 24 percent but lower other income as well as higher tax outgo led to a 17 percent decline in bottom-line.

Birla Corporation topline growth of 12 percent year-on-year (YoY) crores was driven by a combination of realisations as well as volumes. Firm prices in the central region along with higher contribution from the premium segment drove the realisations higher 4 percent YoY. The volumes also came in 6 percent higher YoY despite the kiln shutdown. Higher realisations along with cost efficiencies (power & fuel, freight, employee) lead to an improvement in margins both on a yearly as well as sequential basis.

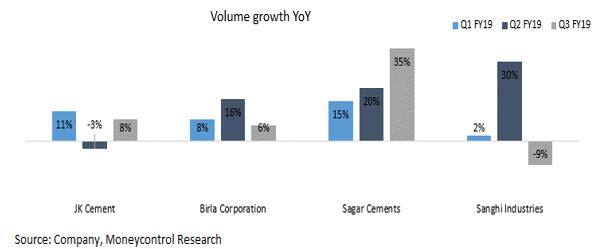

Hyderabad-based Sagar Cements benefitted from the strong demand in Andhra Pradesh and Telangana, which drove the 35 percent increase in cement volumes. The topline was, however, softer in comparison as the realisation continued to remain under pressure (down 6 percent YoY) amidst low capacity utilisation and high competitive intensity in the Deccan region. Savings from Waste Heat Reduction plant as well its hydro power plant helped the sequential recovery in EBITDA per tonne for the company.

Sanghi industries’ had another challenging quarter. Plant shut down hurt the quarterly volumes which declined nearly 9 percent YoY. The improvement in realisations (up 4 percent YoY) supported the topline but external sourcing of clinker along with rise in freight and power & fuel costs impacted the margins in the quarter gone by. The progress on the capacity expansion remains on track and the company is targeting to double its cement capacity by 2020.

Recent price hikes temporary

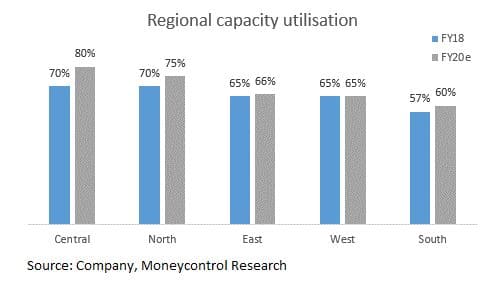

The demand in the cement sector continued to be robust as a majority of the companies in the sector reported 8-10 percent volume growth in the third quarter of this fiscal year. While the volume growth trajectory has been sustained for the past 12-18 months, the price action remains muted despite the sustained increase in cost pressures. The primary reason being - the demand remains skewed towards price sensitive institutional segments. Also, the capacity utilisation has moved higher but is yet to touch 75-80 percent in most parts.

On a regional basis, central region appears to be in a sweet spot as the companies in the region are witnessing higher volumes along with improving capacity utilisation (~75 percent in FY19) leading to higher realisations.

In Southern region, Andhra Pradesh and Telangana are seeing a good pick-up in cement demand driven by strong pipeline of infrastructure projects. However, oversupply in other states along with the lag in regional capacity utilisation continues to impact the cement realisations.

Other regions such as East, West and North are also healthy cement demand, but the large capacity additions will keep industry utilizations below 70 percent over the next 12-18 months.

The repeated attempts of price rise have failed as industry dynamics continue to be dictated by buyers and not suppliers. The steep price hikes in January & February price (15-40 Rs per 50 kg bag across most parts of India) was largely driven by southern region, where prices have declined 8-10 percent YoY over the past 12 months.

The stocks have surged following the positive newsflow on prices. In our view, current rally offers a good opportunity to book partial profits as the latest price movement also appears unsustainable and the price reversal appears likely in the coming months.

Outlook and Recommendation

We have a positive long term outlook on the sector as the demand momentum to anticipate to continue going forward and most players anticipate a volume growth of 8-10 percent over the next 12 months. However, the muted industrial activity in light of the upcoming general elections along with a slowdown in the economy (largely macro driven) could pose near term risks to the earnings of the companies operating in the sector.

Competitive intensity remains high as the industry leaders like UltraTech, Ambuja, ACC, Dalmia Bharat continue to operate at a capacity utilization of 70-75 percent and are more focused on shoring up volumes. While the prices are expected to remain stable, the ease in cost pressures (oil, coal, petcoke etc.) should help in margin recovery for the industry.

In the current market environment, we prefer companies with a strong market positioning and strict cost focus. Among the four companies, we are enthused by the volume growth displayed by Sagar Cements in recent quarters (up 25 percent on a YTD basis). The company has strong positioning in the Andhra Pradesh and Telangana and is expanding into nearby markets through the acquisition of Satguru Cements (Madhya Pradesh) and Jajpur Cement (Orissa). In addition, the cost structure is anticipated to improve as the company is setting up 18MW captive power plant and has also acquired 8 MW hydro power plant to bring down the power and fuel costs. While the ramp-up of volumes along with cost optimisation measures will be essential for its profitability in the near term, the improvement in pricing environment and reduction in net debt (537 crores at the end of Dec-18) would be the key trigger for earnings in medium to long term. We suggest long term investors to keep this stock on radar for accumulation on corrections as Sagar Cements (FY20 EV/ton of 50 USD and FY20 EV/EBITDA of 9.4x) could turn out to be the dark horse within the midcap cement space.

Also Read: Hyderabad Industries Q3 review: Mixed results not a dampener

For more research articles, visit our Moneycontrol Research page

Disclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed here

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!