Sachin Pal

Moneycontrol Research

Highlights:

- Roofing and building solutions drove the overall topline

- Margins declined due to multiple factors

- Growing faster than industry

- Valuations attractive at 10x FY20 estimated price-earnings

--------------------------------------------------

Hyderabad Industries Limited (HIL), the building material solutions provider, reported a mixed set of numbers for the third quarter of FY19. While the revenues crossed the Rs 300 crore mark in a seasonally weak quarter, the margins came under pressure on the back of higher marketing and distribution expenses, increase in finance costs and forex losses. While the net profit was affected by multiple factors, the operational performance continued to be robust as the company continues to expand as well as diversify its revenue base through new product launches and expansion of dealer network.

Key positives

- Revenue growth of 16 percent year-on-year (YoY) was driven by higher topline across all business segments. The company continued to gain market share in the roofing segment as the growth rate was ahead of the industry.

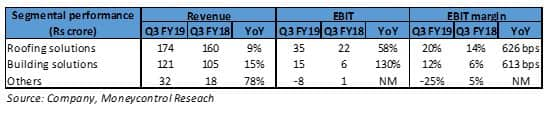

- In the roofing solutions segment, sales growth of 9 percent YoY was aided by 8 percent volume growth in fibre cement sheets. The building solutions recorded a sales jump of 15 percent YoY to Rs 121 crores. Sales jump in wet wall product sales (up 20 percent) as well as Dry wall products (up 11 percent YoY) drove the topline for this quarter. This was, however, offset by some weakness in thermal insulation materials (down 8 percent). While the Autoclaved Aerated Concrete Blocks and board volumes remained largely flat during the quarter, the panel volumes increased by nearly 10 percent.

- The demand outlook remains uncertain in light of the upcoming elections. However, revenue pipeline for HIL remains strong as the company has recently bagged new orders from CST station (roofing renovation) and BHEL.

- Charminar fortune (Non-asbestos, Green Roofing solution) continues to gain traction among institutions. The initial response for this product has been good and the management expects the sales pipeline to materialise in FY20.

- The building solutions segment has reached a capacity utilisation of 95 percent and HIL is considering the expansion of capacity from current levels.

Key negatives

- Margins in the pipes and fitting segment took a hit in the quarter as the company incurred marketing, advertising and distribution expenditures of around Rs 5 crores in Q3 FY19. This business continues to be in investment phase and the company expects the product segment to turn operationally profitable in FY20.

- Interest expenses for the quarter increased to Rs 7.2 crore (vs Rs 4.1 crores in Q2 FY19) as the company has taken additional debt to fund the Parador acquisition. The leverage has increased post the acquisition and the standalone debt at the end of December stood at Rs 276 crores (i.e. euro 34 million) while the international debt (euro denominated) around 32 million euros. The interest rate for domestic is 8.6 percent while the interest costs for euro debt has been recently refinanced at 1.6 percent (vs 3.25 percent earlier).

- The bottomline for Q3 has also been affected by forex loss of Rs 7.5 crore linked to the funding of the acquisition. The company had recorded a forex gain of same quantum in previous quarter but the same has been reversed in this quarter.

Outlook and Recommendation

- The company has benefitted from the introduction of Goods & Services Tax (GST) and the management expects the growth momentum to continue as the company enjoys a very strong relationship with its dealers and is consistently expanding its product portfolio to cater to the growing demand of the building materials industry. On the demand front, we expect the company to benefit from the improving rural demand on account of recently announced government schemes and packages for farmers.

- From a valuation standpoint, the stock is trading at nearly 10 times FY20 price-earnings on a standalone basis. Consolidation of Parador's financials into the parent entity would further aid the operational profits. HIL (CMP: 1,584 ; Market cap: Rs 1,183 crore) is a market leader in the building materials industry and the current stock valuations (post Q3 result sell-off) appear fairly attractive for building fresh positions from a medium to long- term view.

For more research articles, visit our Moneycontrol Research page

(Moneycontrol Research analysts do not hold positions in the companies discussed here)

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!