Krishna KarwaMoneycontrol Research

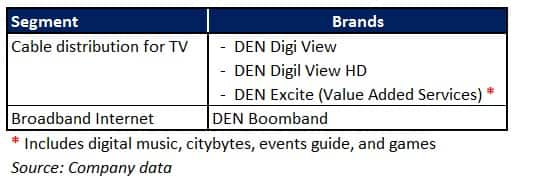

Den Networks, a digital cable TV service provider with market cap of Rs 2,400 crore, reported a robust set of earnings in Q3FY18.

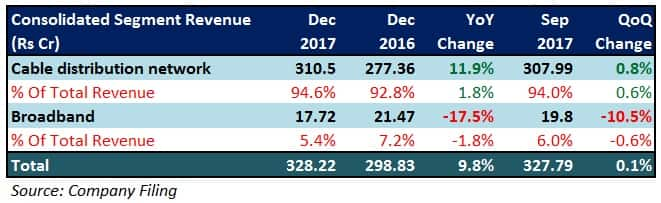

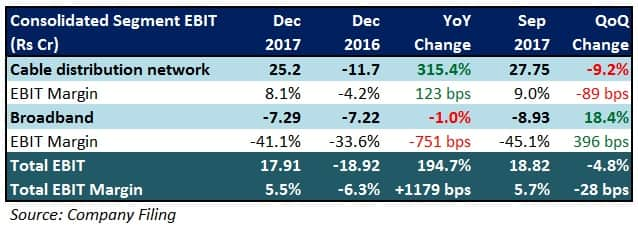

The YoY earnings uptick, prima facie, was largely attributable to a low base in Q3FY17 (due to demonetisation). Den’s cable distribution segment had a key role to play in the improved performance as well. However, the company’s broadband services segment continued to post subdued numbers.

Which tailwinds may augur well for Den?

Emphasis on phase 3/4 markets

Den aims to capitalise on the government’s push towards digitisation (transition from analog networks to digital set-top boxes) in the relatively under-penetrated/unpenetrated regions of India. The company's set-top box base 1.12 crore only, implying that the growth potential is immense.

Impetus will be particularly laid on STBs in phase 3 and 4 geographies since there is some good upside potential in connection with average revenue per user (ARPUs) when compared to phase 1 and 2 zones of the country. Den hopes to derive a significant proportion of such stimulus through high definition STBs that are apparently more margin-accretive than standard STBs.

Higher realisations

Net realisations — which is arrived at after deducting taxes and share of local cable operators — have been improving across its phase 1/2/3/4 locations.

Collection efficiency measures adopted by Den in the past few quarters seem to be yielding the requisite results. The company’s competitors have been forced to raise their net realisations owing to low margins in a highly competitive TV content distribution domain, thus bridging the pricing gap.

The company expects a 6-7 percent Q0Q growth in cable subscription incomes over the next 4-6 quarters. Moreover, since cost optimisation processes are almost complete by now, going forward, operating leverage will be driven by revenue growth.

Broadband segment revival

Den rolled out its broadband services to 10 new towns in H1FY18, and will add 10 more to the tally in H2. Wider coverage in these towns should lead to a meaningful ramp-up over the next 6-12 months. The company intends to spend most of the future capex largely for this segment.

Furthermore, the target is to increase the percentage of active subscribers from the current level of 60 percent, besides reducing the monthly churn (represents the number of existing subscribers that switch to other internet service providers) of 4 percent in New Delhi, one of the company’s core hubs. Announcement of a mega broadband plan in February 2018 is also on the agenda.

No wireless threat

Den’s management team believes that wireless internet connectivity is unlikely to disrupt the company’s cable segment materially because of the high costs involved therein, coupled with other disadvantages such as installation/support service complexities and lack of adequate technological infrastructure.

GST transition

Unorganised players, that are highly active in the cable network space pan-India, will gradually lose market share to organised entities like Den in due course by virtue of strict compliance norms and gradual elimination of analog technology (which will work in favour of digital STBs, where tax leakages are lower and viewership/advertisement transparency is higher). The effect of this will be particularly seen in the last-mile connectivity areas of India.

Which headwinds may impact profitability?

Though Den’s strategies appear good on paper, a slower than expected scale-up of operations and/or realisations from phase 3/4 cities and towns (this holds key to the company’s success) may have an adverse bearing on the financials.

Issues pertaining to declining ARPUs in the broadband segment, unless addressed quickly enough, could be a cause of concern, too.

An increase in content costs — paid to production majors such as Zee, Star, Sony, IndiaCast — as has been the trend during 9MFY18 (gross/net content cost increased to the tune of 13.6/55 percent YoY, respectively), may lead to some margin pressure. Reliance Jio’s upcoming entry in the direct to home TV and high-speed internet turf could trigger problems similar to what we’ve witnessed in telecom.

Should you consider investing?

Den, among the market leaders as far as subscriber base is concerned, undeniably, has quite a few things going right for it. Nevertheless, in our view, the uncertainties and risk factors stated above outweigh the positives substantially, at least in the near-term.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.