Highlights:

Ruchi Agrawal

Moneycontrol Research

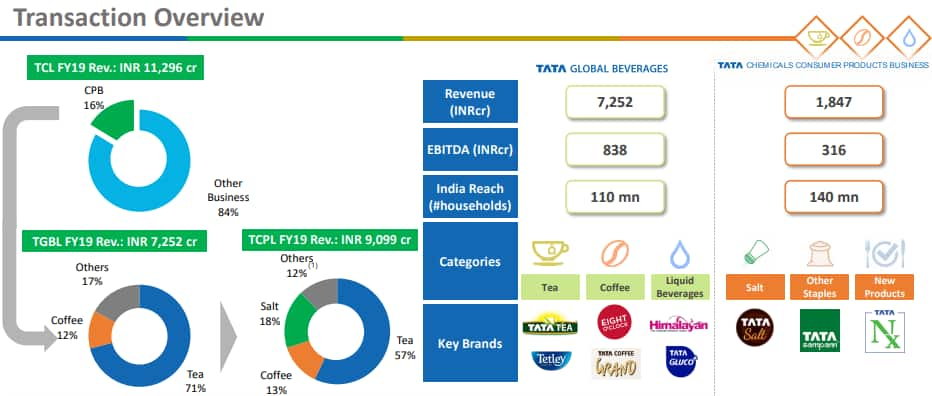

As part of the group-wide restructuring, the Tata group has announced demerger of the consumer product business from Tata Chemicals (TCL) into Tata Global Beverages (TGBL) in an all-equity swap transaction.

Market watchers had been expecting the move for the past 18 months when the management had hinted at a demerger. We believe that the deal could bring in significant value unlocking for shareholders of TCL.

The proposal

TCL and TGBL have announced plans to demerge the rapidly growing consumer segment business from TCL and merge it with TGBL.

The demerger will include sourcing, packaging, marketing, distribution and sale of vacuum-evaporated edible common salt, spices, protein foods and certain other food items and products. Salt manufacturing facility, basic chemistry products and specialty products business will continue to remain with TCL.

Post completion of the deal, TGBL will be renamed as Tata Consumer Products Ltd. The transaction is expected to be completed by Q4 FY20 - Q1 FY21. While the board of the two companies have approved the deal, approvals from NCLT and minority shareholder are still to come by.

Deal and valuation details

The swap ratio for the deal has been announced at 1.14 share of TGBL for every 1 share held in TCL. At Wednesday’s close price of Rs 199 for TGBL, the value of the consumer business stands at around Rs 5,779.4 crore, implying a trailing EV (enterprise value)/EBITDA (Earnings before interest, tax, depreciation and amortisation) of 18.2x. The segment’s contribution to TCL’s share price works out to Rs 226 per share.

The consumer business forms around 16 percent of the consolidated turnover of TCL and 45 percent of the standalone turnover. It forms 18.5 percent of consolidated earnings, which will now move to TGBL.

This leaves the remaining business at TCL at Rs 434 per share, which implies a trailing EV/EBITDA of 5.7x. At this valuation, we believe that the deal would bring in significant value unlocking for TCL.

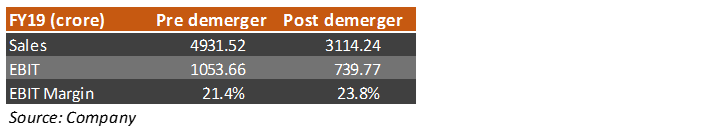

Prima facie, the deal appears to be margin accretive for TCL. An improving outlook on soda ash cycle and gradual progress on expansion projects will drive further earnings growth.

As part of the deal, all working capital, assets and liabilities associated with the consumer segment will move to TGBL. As of March 2019, total assets and liabilities of the consumer segment stood at Rs 220 crore and Rs 180 crore respectively, implying insignificant impact on net capital employed of TCL. No significant assets or liabilities are part of the deal.

Road ahead for Tata Chemicals

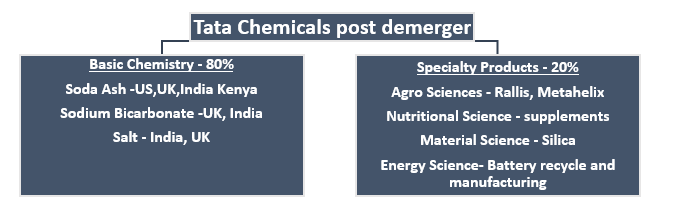

- After the demerger, TCL would become a more chemistry oriented businesses, with portfolio focussed on basic chemistry, speciality chemicals and other speciality products like highly dispersible silica, lithium battery and nutritional supplements.

- The salt manufacturing business will continue to stay with TCL, which will work out a long-term arrangement with TGBL to sell salt under the current inter-segment pricing. TCL will be allowed to gain a portion of upside on potential rise in TGBL’s salt realisations in future.

- The basic chemistry forms around 80 percent of the demerged TCL business. Going ahead, the management intends to rapidly invest and expand in the speciality product business (nutritional supplements, silica, lithium ion batteries) and take the ratio to 50:50.

- In basic chemistry, TCL has plans to invest and expand in all geographical segments in a bid to improve scale and efficiency.

- With aggressive plans to expand in specialty products, the management has plans of substantial capex in all four verticals of the segment, namely agri science (Rs 800 crore), nutrition science (Rs 250 crore), highly dispersible silica (HDS) and the lithium-ion battery business (ramping up capacity to 10 GW after an initial foray with 2 GW).

- The management also indicated willingness to consider monetising cross-holdings within group companies. The company’s current cross holding in group companies is to the tune of around Rs 3,360 crore. Any step in this direction might unlock further value.

Outlook

On a longer term, while the deal demerges the high growth consumer segment from TCL, it helps the company deploy resources to scale up its chemical portfolio towards high-margin products. The remainder business is set to be a pure-play chemistry-focussed entity where the company has plans to expand the specialty product business.

We see the near term to be capex intensive. The management has highlighted that the entire capex will be funded via internal accruals and we do not expect any substantial debt to enter the business.

The benefits of the expansion would have some gestation period and might take some time before they start contributing positively to growth.

At current valuation, the deal has priced the consumer business at attractive multiples, which would bring in substantial value unlocking for TCL shareholders and a potential rerating of the remaining business. This is a probable reason for the stock price to surge substantially on Thursday.

The stock has corrected substantially from its 52-week high and trades at sub-10 multiple, which appears to be an interesting level to accumulate. Pre-deal, the stock was valued around 8x EV/EBITDA.

Attractive valuation of the consumer business has left the remainder at an EV/EBITDA of 5.7x, which is at a discount to peers. At this valuation, it can be considered as a potential investment pick.

We expect a few more value unlocking opportunities like monetising cross-holdings in the near term. In the medium term, we believe that the company’s plan for expanding specialty products business share to 50 percent of sales could help in re-rating.

In particular, Highly Dispersible Silica (HDS) and the lithium-ion battery business are two key categories to watch out for.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.