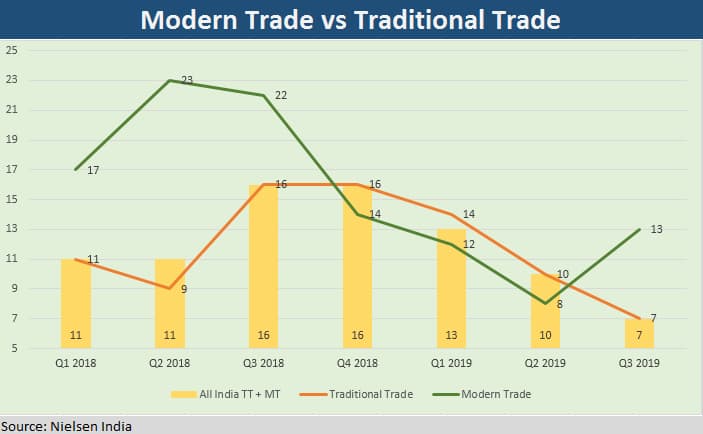

Nielsen data reveals that in the July-September quarter, modern trade grew at double the rate of traditional trade, despite an otherwise trying time for the FMCG sector.

Modern Trade (MT) consists of supermarkets and hypermarkets, catering to most household needs under a single roof.

From Spencers markets and Nilgiri stores in South India to the game-changer Big Bazaar, Tata Croma, Vijay Sales and the likes, the modern trade model has held ground.

Nielsen Q2 FY 2019 data bears out good days for the modern trade model, reporting a 13 percent growth during July-September 2019 quarter against 8 percent growth registered during April-June 2019. This growth in Q3 is 1.9X of traditional trade.

Nielsen attributes this resurgent growth trend to urbanised tier-2 towns, increasing footprints in these towns and big discount day events. Also, continuous increase in new products and revival in sales are key drivers of modern trade. The current size of the modern trade market for fast-moving consumer goods categories is around Rs 40,000 crore.

"The Indian consumer is price conscious and maximum buys occur in value for money segment is well established. Diwali dhamaka discounts and mid-week discounts run by Big Bazaars to Sahkari Suvidha do bring in customers for mass buys of groceries and household items," said an analyst from a well-known brokerage firm.

Also, a key reason for the modern trade of sales models to survive and thrive is the assurance of touch and feel factor. The online models operate of goods return policy but that itself is a hassle in minds of the simplistic consumer and smells lack of trust in high-value products.

According to another report, by RedSeer Consulting & bigbasket, India’s organized food and grocery sectors are poised for growth over the next five years. The modern retail share has increased from 1.6 percent in 2013 to 3.5 percent in 2018 and is expected to grow at a CAGR of 25 percent to reach 6.7 percent of the food and grocery market by 2023 and amount to $ 60 billion.

Online food and grocery retail, though at a nascent stage, with only 0.2 percent penetration is expected to grow at a whopping 55 percent to reach 1.2 percent of the overall market in 2023 and amount to $10.5 billion.

"Increased comfort and trust of customers in e-tailing, especially electronics and fashion coupled with strong value proposition of e-grocery players, wide varied assortment and express delivery options, will drive this growth," RedSeer Consulting & bigbasket report stated.

Drop in rural demand

Most companies in the FMCG sector is facing a slowdown in demand from rural areas. Weakness in sentiment along with stress in agriculture segment, liquidity crunch and irregular monsoon in most parts of the country have continued to affect the rural demand. This is evident from the data provided by Nielsen.

Growth in sales per store in rural areas in July-September of 2019 became one-fourth vs July-September of 2018, reflecting a significant drop in demand among rural consumers.

In addition, rural distribution growth has continued to inch downwards.

"Small manufacturers have seen the biggest drop in cumulative distribution growth which has moved from 18 percent in Q3 2018 to no growth in Q3 2019, while for large manufacturers, the cumulative distribution growth has halved," the report stated.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.