Systematic investment plans, better known as SIPs, are in the news again as their collections rose in the first seven months of FY19, despite the market grappling with volatility in that period.

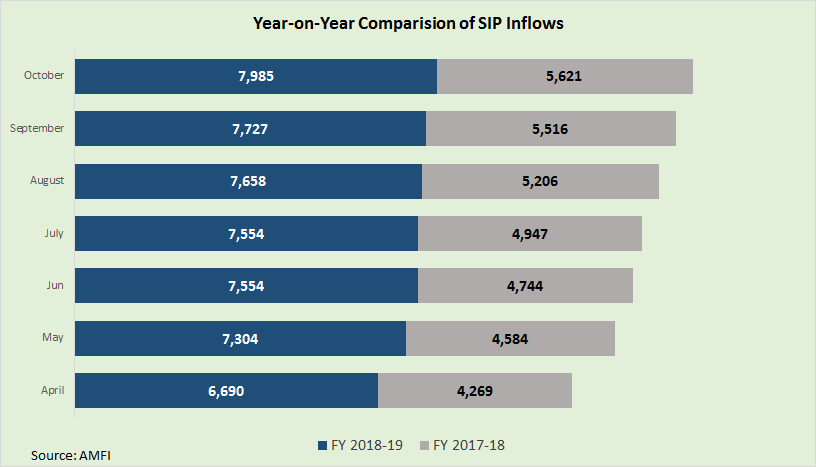

According to data provided by Association of Mutual Funds in India, in April-October FY19, mutual funds collected a total of Rs 52,472 crore through SIPs, around 50 percent higher than the Rs 34,887 crore they collected in the same period last year.

The data reveals that the MF industry has added 10.05 lakh SIP accounts each month on average so far this fiscal year. The average SIP size stood at around Rs 3,200 per account.

At present, domestic mutual funds have about 2.49 crore SIP accounts through which investors regularly invest in Indian mutual fund schemes.

In the first seven months of FY19, the S&P BSE 100 has fallen marginally but the S&P BSE 150 MidCap Index has plunged over 12 percent.

Foreign institutional investor outflows, high crude oil prices and the depreciation of the rupee against the dollar have kept Indian equity markets volatile.

The data by AMFI clearly shows that despite the markets being volatile, investors are not shunning SIPs. Experts said investors are becoming more savvy and mature.

SIPs are investment plans offered by MFs wherein one can invest a fixed amount in a scheme periodically at fixed intervals, say once a month, instead of making a lump-sum investment.

The SIP instalment amount could be as small as Rs 500 per month. SIP is similar to a recurring deposit offered by banks wherein you deposit a small/fixed amount every month.

SIP is a very convenient method of investing in MFs. By issuing standing instructions to your bank to debit your account every month, one can avoid the hassle of having to write out a cheque.

This method has been gaining popularity among Indian MF investors, as it helps in rupee cost averaging and also in investing in a disciplined manner without worrying about volatility and timing the market.

SIPs help investors average their cost over a period of time, fetching more units when prices are low and fewer units when prices are high.

In the current scenario, buying at low prices and selling at higher prices works brilliantly because the volatility means you buy more units at a lesser price and hence, your ultimate returns will be better.

Experts also feel that investor education initiatives by AMFI and industry players are aiding SIP flows. Over the years, investors have also matured and have learnt to ignore the market noise and continue investing through SIPs month after month.

This unwavering discipline has helped many SIP investors build an impressive portfolio. This provides confidence to MF officials who now feel that SIP flows will remain steady and will not go away when the market is volatile.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.