On August 24, T Rabi Sankar, a deputy governor at the Reserve Bank of India (RBI), while delivering a speech on the challenges and prospects of the corporate bond market, highlighted the need to examine why firms prefer private placement of bonds over public issues.

Sankar noted that there exists an “overwhelming preference” for private placement of corporate bonds, and that there was a need to build the corporate debt market in India.

So what is all the fuss about? Let us break it down.

What is private placement of bonds?A private placement is a sale of bonds to select investors and institutions instead of the open market. Typically, a private placement is defined as an issuance of securities to less than 50 persons.

Unlike a public offering, private placements are exempt from having to file an offer document with the Securities and Exchange Board of India (SEBI) for comments. Further, it may not involve any form of general announcement, solicitation, advertising, any seminar, or meeting to publicise such an offering.

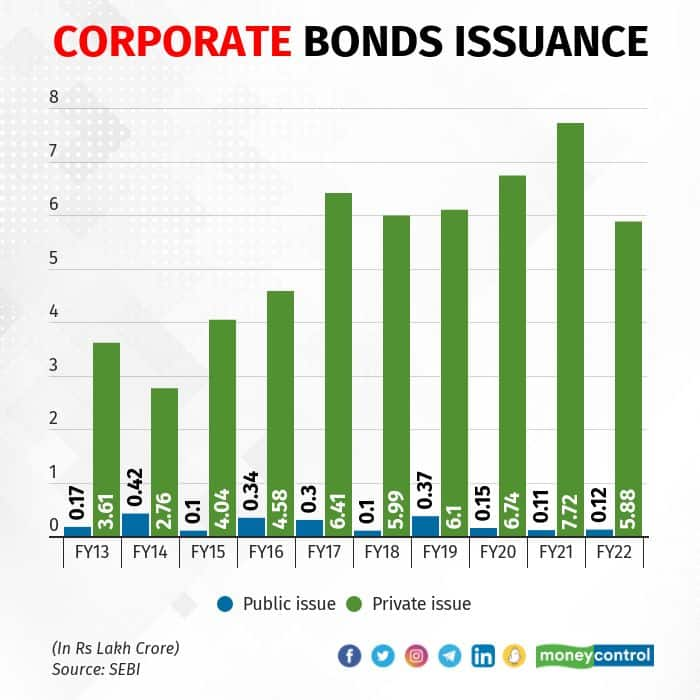

What do the numbers show?The outstanding stock of corporate bonds in India has increased four-fold, from Rs 10.51 lakh crore as at end of FY12, to Rs 40.20 lakh crore as at end of FY22. Annual issuances during this period have increased from Rs 3.80 lakh crore to close to Rs 6 lakh crore.

However, a majority of fund raises have been through private placement.

In FY22, the amount of money raised through public issuances of corporate bonds was Rs 11,589 crore – just about two percent of the amount raised through private placement at Rs 5.88 lakh crore, according to SEBI data.

Corporates access the private placement market because of its inherent advantages. First, it is a cost- and time-effective method of raising funds. Second, it can be structured to meet the needs of entrepreneurs and investors. Third, private placement does not require detailed compliance as with a public issue.

“Private placement is preferred as it requires less stringent disclosure, is economical, saves time, and makes it easy to raise a large amount from a small set of investors,” said Sanjay Pawar, fund manager - fixed income, at LIC Mutual Fund Asset Management.

“Also, there are many intermediaries for private placements, who help reach the target audience, and facilitate price discovery and negotiations.”

Pawar explained that in case of private placement, allocation of securities to investors happens comparatively quicker than with a public issue. Hence, funds do not remain blocked. Quicker allocation also helps mitigate market volatility or event risk, he added.

Does the pricing differ?Through the private placement route, an entity is able to finalise the price, yield, and structure the terms quickly during volatile markets, based on specific interests mutually agreed upon. They are easy to manage and service and are comparatively cost-effective for issuers.

In case of a public issue, rates tend to be higher to allure more investors. This becomes expensive for issuers. Making retail participants aware about a public issue also adds to the costs.

“With private placement, most issuers have an in-house team that handles capital-raising, hence the costs are minimum,” said Umesh Kumar Tulsyan, managing director, Sovereign Global.

“In a public issue, on the other hand, the cost of marketing is very high, and even the issuer is not sure whether retail investors will subscribe to the issue.

“Moreover, in a public issue, one has to appoint merchant bankers, pay underwriting fees, spend a lot on marketing, and give a high coupon to allure investors. All of these increase the overall cost of capital,” Tulsyan added.

What can be done to boost public issues?Money market experts said that in order for public issuances to increase, there is a need to make the corporate bond market more liquid. Moreover, retail investors will have to be brought into the market through awareness, education, and incentives, they added.

“Retail investors are used to traditional fixed deposits as these instruments are more secure and liquid. This has to change,” said Venkatakrishnan Srinivasan, founder and managing partner at Rockfort Fincap, a Mumbai-based debt advisory firm.

“They have to be encouraged to participate in public issues of bonds, for which reducing the time (to launch), easing regulations, and announcing tax sops for retail investors is critical,” he added.

In such a scenario, developing the market is critical in the long-run, with focus on bonds exclusively for retail investors, added Srinivasan.

Besides bond portals, banks and NBFCs should be incentivised to sell bonds to their customers just like they sell mutual funds and fixed deposit products over the counter.

Another way is for regulators to allow issuances similar to 54EC capital gains bonds via private placement, said Srinivasan. These bonds are specifically meant for investors seeking exemption on long term capital gains.

Through this route, the bonds shall have the same coupon for both private and retail lots, Srinivasan added.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.