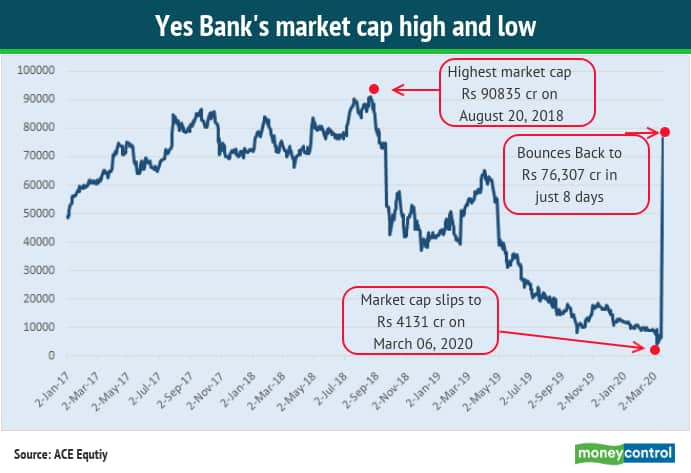

Yes Bank's market-cap has gained 1,747 percent between March 6 and March 18. The up move was a result of Cabinet approving the Reserve Bank of India’s restructuring plan for the private lender.

The moratorium implemented by the central bank on March 5 was also removed on March 18, ahead of stipulated time.

The RBI, State Bank of India and the new CEO & MD Prashant Kumar’s assurances to depositors were enough to boost investor confidence. The up move in the stock comes at a time when the market has been crashing over the coronavirus outbreak.

Yes Bank’s journey:

On August 20, 2018, Yes Bank had touched its highest market cap at Rs 90,835 crore and on that day it was the 7th largest bank in India in terms of market cap. HDFC Bank, SBI and Kotak Mahindra Bank were the top three banks on that day.

Since then it has been a rollercoaster ride for the bank's management, its stock, and its investors.

On August 30, 2018, RBI gave a go-ahead to Rana Kapoor to continue as MD and CEO of Yes Bank.

On September 25, 2018, Yes Bank's board sought another extension of Kapoor’s term, till April 2019, and said it will form a committee to find a successor.

Once the central bank denied an extension to Kapoor in October 2018, the bank has been in the limelight.

The Yes Bank’s stock price started to decline since its loan book divergences for FY19 came to light. From then onwards, the stock price has seen a major downtrend and volatility.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.