Even as disappointing numbers from two index heavyweights - Infosys and Hindustan Unilever, have triggered a slight retreat in the unstoppable Nifty which is at a close distance from 20,000, there is one parameter that signals green all the way: the dollar index.

The dollar index which was around 104 at the start of June has now come down to flirt with the 100-mark. A weaker dollar index is generally seen as a boon for equity markets, especially emerging markets. Historically too, a weaker dollar index has usually coincided with an increase in foreign inflows within emerging markets like India.

The dollar index , which measures the US dollar against a basket of currencies, is in a downturn after it recently slipped to its lowest level in 15-months, even breaking below the psychological mark of 100. Cooling US inflation and growing expectations of a possible end to the Federal Reserve's rate hike campaign has triggered a consistent moderation in the dollar index.

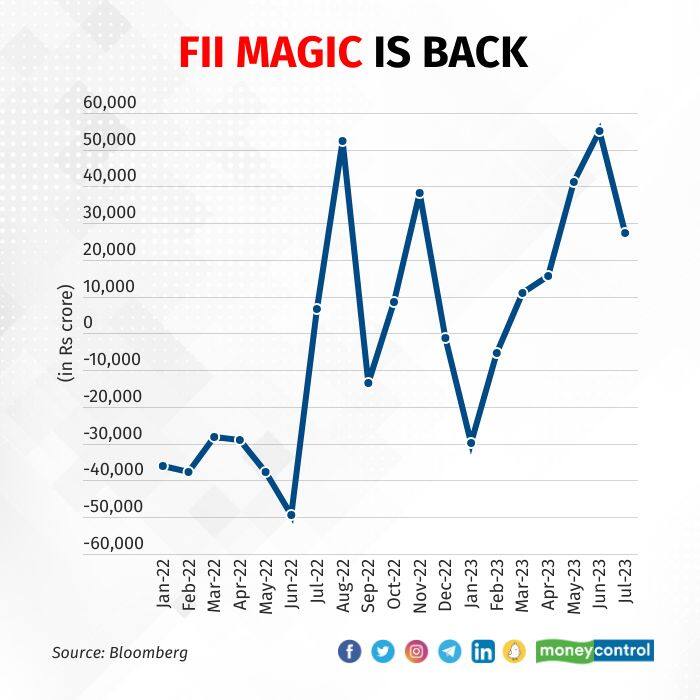

A glimpse of that trend was also seen within the Indian equity market as FII inflows have touched Rs 19,696.66 crore in July so far. Moreover, India has also been among the largest recipients of FPI flows this year to date among emerging markets.

Several analysts believe that a slower recovery in China has prompted foreign investors to allocate funds to markets that will benefit from foreign inflows. "After China's reopening post COVID, its recovery has been slow and that has made India a beneficiary when it comes to foreign inflows, a trend that is likely to continue in the coming years as well," says Amit Kumar Gupta, founder, Fintrekk Capital. Gupta also pointed that it was not just India, but all emerging markets have received strong foreign inflows in recent months.

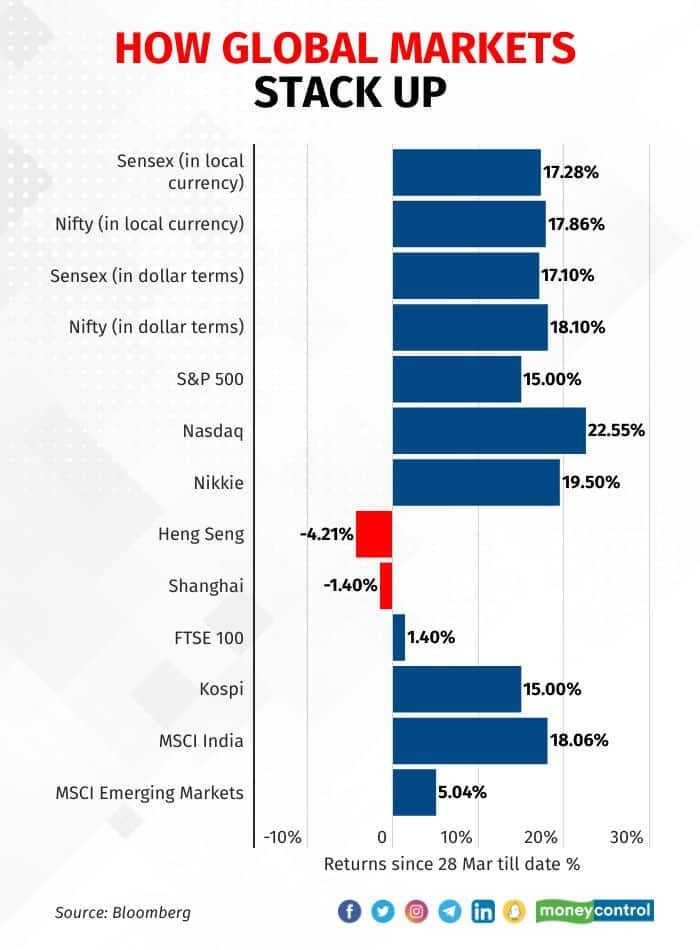

More important than that is the fact that a reading below 100 has historically coincided with a bullish phase in most emerging markets. Reflections of the historical trend was also seen in the performance of domestic equities in recent months.

The rebound in the domestic market began in March, at a time when the dollar index was approaching the 100 mark. During the period when the dollar index remained above 100, the Indian markets were also caught up in a phase of consolidation, with a slight downward trend.

Based on historical trends, a decline in the dollar index typically bodes well for equity markets. Currently, with the markets reaching new highs, this development lines up another positive factor that could potentially drive the equity markets even higher.

Will the dollar index sustain below 100?

There is, however, one stumbling block - the US Fed's monetary policy meeting on July 25-26 which still poses a threat of disruption for this trend.

The decision of the Fed's rate-setting committee is most likely to have an impact on the dollar index. The market is largely factoring in another rate hike from the Fed, but any negative commentary from the US central bank threatens to initiate a knee-jerk reaction across markets, including the dollar index.

On that account, Gupta anticipates the dollar index to witness a short-term spike towards 105 following the Fed's rate outcome. Following that, he predicts a gradual decline in the dollar index and expects it to eventually settle below 100.

However, with the US inflation for June easing off, there is more reason to believe the worst of the rate hike cycle may be over, and that the dollar may actually stabilise or head lower.

Also Read: Nifty derivatives strategy as it inches towards 20,000 mark

If the dollar index actually bases out below 100, analysts see a high possibility of it becoming a big blessing for emerging markets, gifting them with a bull rally.

Indian market at lifetime highs, will this sustain?

Indian equities have witnessed a strong run in recent months, so much so that some even believe that it has come too far too soon. However, several analysts have reasons to believe that this bull run will stretch further in the coming time.

Even though phases of consolidation in the near-term cannot be ruled out, analysts do not see any fundamental triggers that may halt the upward trajectory of the market. Rajesh Agarwal, head of research, AUM Capital Markets, believes the market is fundamentally on a strong footing at the current juncture, with easing inflation, pauses in rate hikes from RBI and the Fed, and solid FII inflows working in its favour.

As for valuations after the recent run, Agarwal doesn't see any warning signs yet of weakening. ``The valuations in the market are still lower than their historic highs. Moreover, this time around we also have better earnings which are supporting the valuation metrics," Agarwal added.

Sham Chandak, head of institutional broking at Elios Financial Services also outlines a key differentiator in the recent bull run in Indian markets. "Unlike the previous rally, this time we've seen broad-based support from all segments of the market, along with a strong sectoral churn. The overall market has supported the rally and hence the momentum is even stronger this time," he says.

To round it up, the growth forecasts for the domestic equity market remain strong, and the easing dollar index just adds another reason to believe so.

Also Read: The Underachievers: These 8 Nifty stocks are yet to join the bull run

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!