It was yet another record closing day for the market yesterday as bulls dominated on weekly F&O expiry, taking the Nifty50 very close to much-awaited psychological 20,000-mark on July 20.

The BSE Sensex rallied 475 points to 67,572, while the Nifty50 rose 146 points to 19,979 and formed long bullish candlestick pattern on the daily charts. Also, the index was observed making higher tops, higher bottoms for a sixth straight session. Now the main question arises that will Nifty is touch the 20,000 level in July 21's trading session?

The pivot point calculator suggests that the Nifty may get support at 19,821 followed by 19,766 and 19,676. In case of an upside, 19,999 can be a key resistance area followed by 20,054 and 20,143.

Raj Deepak Singh, Derivatives Research Head at ICICI Securities, stated that FIIs continued buying in Indian equities is expected to help Index to move beyond 20,000 levels tomorrow. "Short covering ahead of key results during weekend should be visible. With no call base in sight, one should remain positive with trail stop losses and ride the momentum", Singh added.

According to Santosh Pasi, derivatives trader and analyst, option chain data suggests that NIFTY is showing 19,800 and 20,000 levels for the month-end options. "We are expecting market to touch 20,000 and stay there for some sometime. The highest OI is at 20,000 strike and we don't expect it to cross more than 20,050", added Pasi.

Derivatives strategy recommendation

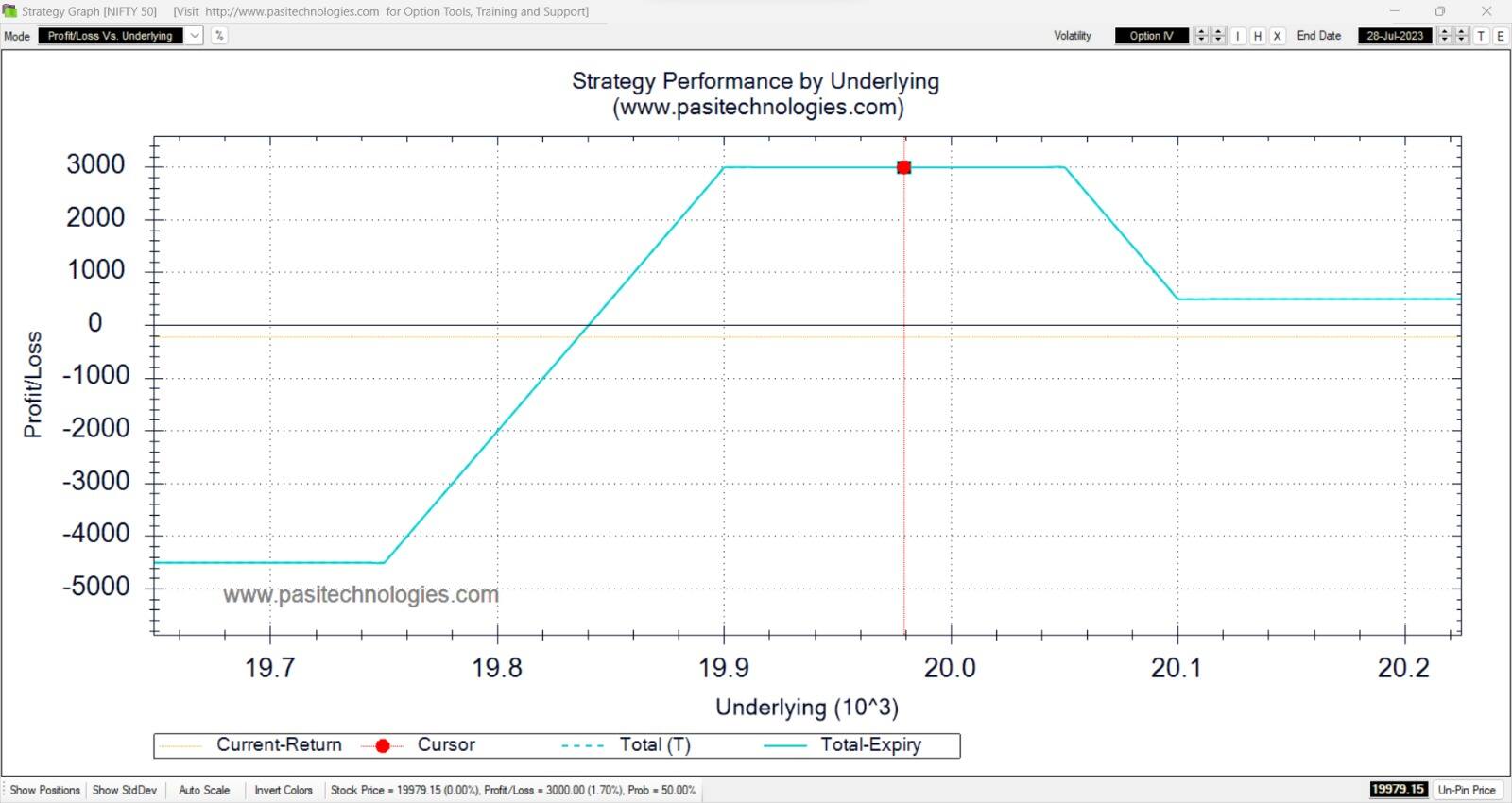

Santosh Pasi suggests a Broken-wing Iron Condor strategy.

The Broken Wing Condor Spread, also known as a Skip Strike Condor Spread, is neutral options strategy and is a variant of the Condor Spread options trading strategy. It is simply a Condor Spread which has risk inclined to one side. A regular Condor Spread makes a loss when the stock breaks out to either direction. A Broken Wing Condor Spread enables you to totally transfer the risk of one direction onto the other. This is useful when you wish to speculate on a stock being stagnant but that you are confident that if the stock should break out, it will do so only in a certain direction.

Short PUT 19,900, Long PUT 19,750Short CALL 20,050, Long CALL 20,100

Broken-wing iron condor strategy payoff chart

Broken-wing iron condor strategy payoff chart

All trades to be executed at same time and same levels. Per lot maximum risk is around Rs 4,500 and maximum reward is Rs 3,000, based on closing price of July 20. There is no up-side risk.

"While market participants wait for a dip or consolidation, the bulls remain firmly in control, indicative of a strong ongoing bull trend. From a technical standpoint, there are no signs of weakness, but it's crucial to remain vigilant as markets have a tendency to surprise participants off guard," Rajesh Bhosale, technical analyst at Angel One said.

He further said it would be wise to wait for some consolidation or profit booking before entering long positions as the market is in a super bull trend.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.