Billionaire investor Warren Buffett once said that be fearful when others are greedy. Be greedy when others are fearful. You might not see merit in this statement but most seasoned investors which manage multi-crore worth of portfolio do exactly the same.

A close look at the portfolio changes of Vijay Kedia, who is known on Dalal Street for spotting multibaggers, pared his holding in almost 40 percent of the stocks in his portfolio for the quarter ended September 2017, and added 1 stock to his portfolio.

The market has been hitting record highs since September. The S&P BSE Sensex rallied over 26 percent so far in the year 2017 to hit Mount 33K.

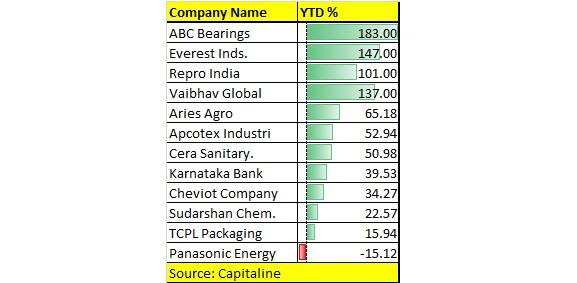

Almost 11 out of 12 stocks in his portfolio where shareholding exceeds 1 percent in the companies for the September quarter gave positive returns.

ABC Bearings rose up to 183 percent, followed by Everest Industries which gained 147 percent, Repro India gained 101 percent, and Vaibhav Global rose 137 percent so far in the year 2017.

“My cost price for Vaibhav Global is much lower than the currently quoted price. As on today, I intend to hold for another 5 to 10 years and expect handsome returns,” said Kedia.

He further added that ABC is merging with Timken which is a multinational and a conglomerate, although it is a bit expensive.

Vijay Kedia, MD, Kedia Securities who has been part of D-Street for the last 28 years, added one stock to his portfolio in the September quarter while increased his stake marginally in another.

Kedia added Everest Industries to his portfolio and increased his stake in Cheviot Company. He reduced his stake in 5 out of 12 companies in which he holds more than 1 percent which include names like ABC Bearings, Sudarshan Chemicals, TCPL Packaging, Repro India, and Cera Sanitary.

“Everest was added 3-month ago. The main reason for adding Everest was the product which the company produces,” said Kedia. “It is used in villages, towns and metropolitan cities. It touches the lives of lower, middle and upper classes of the society,” he said.

Kedia maintained his stake in 5 out of 12 companies which include names like Panasonic Energy, Apcotex Industries, Karnataka Bank, Aries Agro, and Vaibhav Global.

Commenting on the future outlook for his portfolio, Kedia said that he is an optimist. “I think all my stocks would multiply manifold in the next few years. Because, a majority of them are from the consumption theme. And, in my view, this theme, in general, will keep on flourishing for many decades to come,” he said.

Disclaimer: The stocks listed above are not recommendations. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.