U.S. President Donald Trump is set to unveil reciprocal tariffs on April 2. So far, President Trump’s inconsistent messaging on the tariffs have roiled the international landscape, sending shockwaves, as caution and volatility dictate the market sentiment. Fears of a global trade war have sent investors rushing to the safety of safe-haven assets such as gold and government securities.

President Trump has repeatedly condemned the tariffs India imposes on U.S. products, saying, “India is one of the highest tariffing nations in the world… it’s brutal, it’s brutal.”

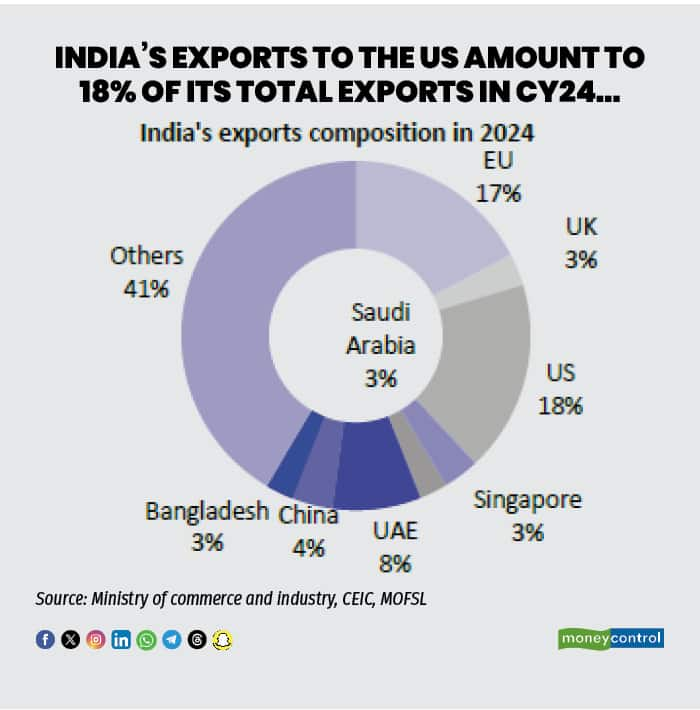

India runs a large trade surplus with the U.S. International brokerage Morgan Stanley suggested that India's trade-weighted import tariff on the U.S. is ~10.5 percent, higher than the corresponding US tariff rate at 2.7 percent.

Therefore, on the domestic front, a day ahead of the tariff announcements, negativity reigned. The Nifty 50 and Sensex have crumbled one percent each, with billions wiped away in wealth, as investors offload their holdings.

While Nifty 50 and Sensex sailed through the month of March with six percent gains, snapping out of a five-month corrective phase, experts suggest that the recovery might be temporary as economic growth could take a hit following the implementation of the levies.

While the benchmark indices gained in March, export-oriented sectors, such as IT and pharmaceuticals, saw a sell-off. Apparel and jewellery are also among the most exposed sectors, which also have a high tariff differential with the U.S.

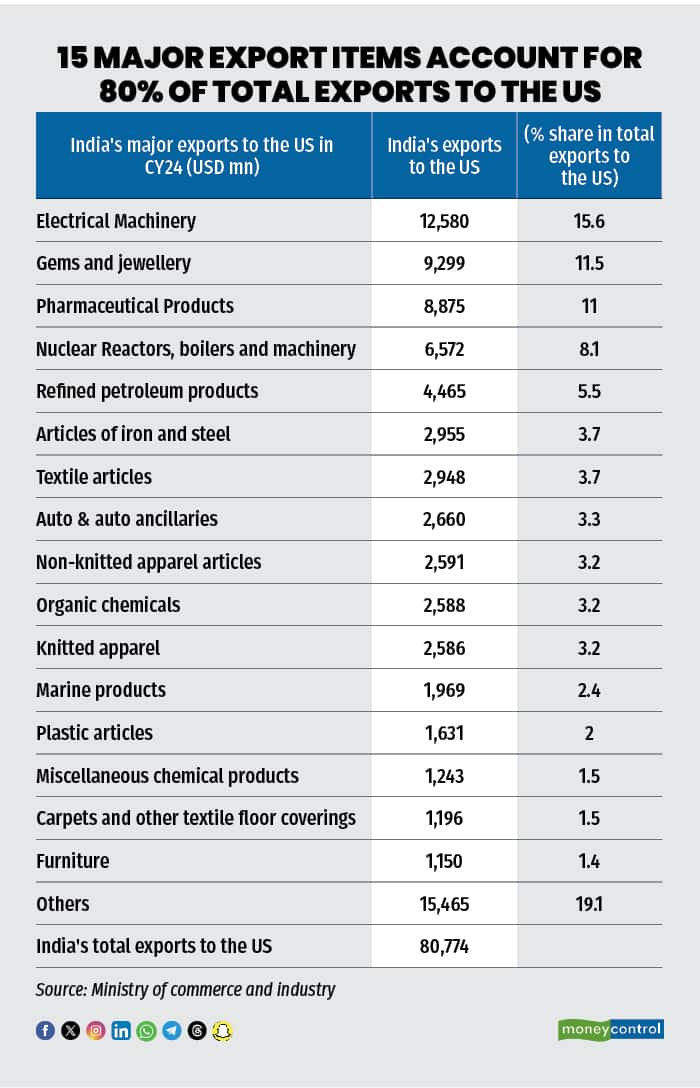

The most vulnerable sectors according to domestic brokerage Motilal Oswal are electrical machinery, gems and jewelry, pharma products, machinery for nuclear reactors, and iron & steel and seafood. These six items sum to $42.2 billion, amounting to 52 percent of the total exports to the US and 1.1 percent of India’s GDP.

Here’s a look at the sectors likely to see the highest impact:

Pharmaceuticals

These products could also potentially face increased import tariffs, with pharma outlined as one of the "critical imports" on which the US might impose hefty levies. However, with India’s exports to the U.S. being largely generic formulations, which would make drug access to American citizens more expensive, experts believe this sector could be more insulated.

Automobiles

On auto products, President Trump has already announced a blanket 25 percent tariff rate on all countries. India's auto and vehicle exports to the US consist mainly of auto accessories/parts ($2.6 billion in 2023), and are among the top 10 exports to the U.S., noted Barclays.

Prima facie, the Indian auto sector would face some of the highest reciprocal tariffs if these are imposed at a sectoral level. “However, digging deeper, we find that the Indian auto sector is relatively insulated from reciprocal tariffs due to the nature of trade between India and the US in this sector,” said Emkay Global.

Electrical machinery and equipment (including smartphones)

Tariffs could rise from an average of 1.2 percent currently (tariffs on India's exports to the US) to 10.8 percent (India's import tariff), noted Barclays.

A further breakdown of the export data reveals that over half of India’s electronics exports to the US are mobile phones. These are almost exclusively iPhones assembled in India and shipped for retail to the U.S.

“With India imposing 15 percent tariffs on fully assembled phone imports (vs zero tariffs on the same in the US), reciprocal tariffs on India at the same rate would only make these iPhones more expensive for US consumers,” noted Emkay Global.

Textiles and Apparel

In FY24, the U.S. accounted for 28 percent of India’s textile exports for FY24 amounting to $9.6 billion. India has a 9 percent share in U.S. imports of textiles and apparel. However, for apparel, India has only a ~6 percent share, with China (~21 percent), Vietnam (~19 percent), and Bangladesh (~9 percent) having larger shares.

“Despite this, India would remain competitive compared to China due to the 40 percent incremental tariffs levied on it now by the U.S. However, the likes of Vietnam and Bangladesh, which could see lower incremental tariffs, would be relatively more competitive than India,” noted Emkay.

Gems/Jewellery

This sector is likely to be the highest impacted, as its share in Indian exports to the U.S. is high. As of FY24, the U.S. accounted for ~30 percent of India’s total exports in this category. India’s tariffs on gold jewellery imports (20 percent) are far higher than US import tariffs (5.5-7 percent), while the US imposes no tariffs on cut and polished diamonds vs India’s 5 percent import tariff.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.