The market extended its northward journey into the second consecutive session on January 3 with the Nifty closing above the 18,200 mark for the first time in the last two weeks. The buying in banking & financial services, technology, and pharma stocks supported the market.

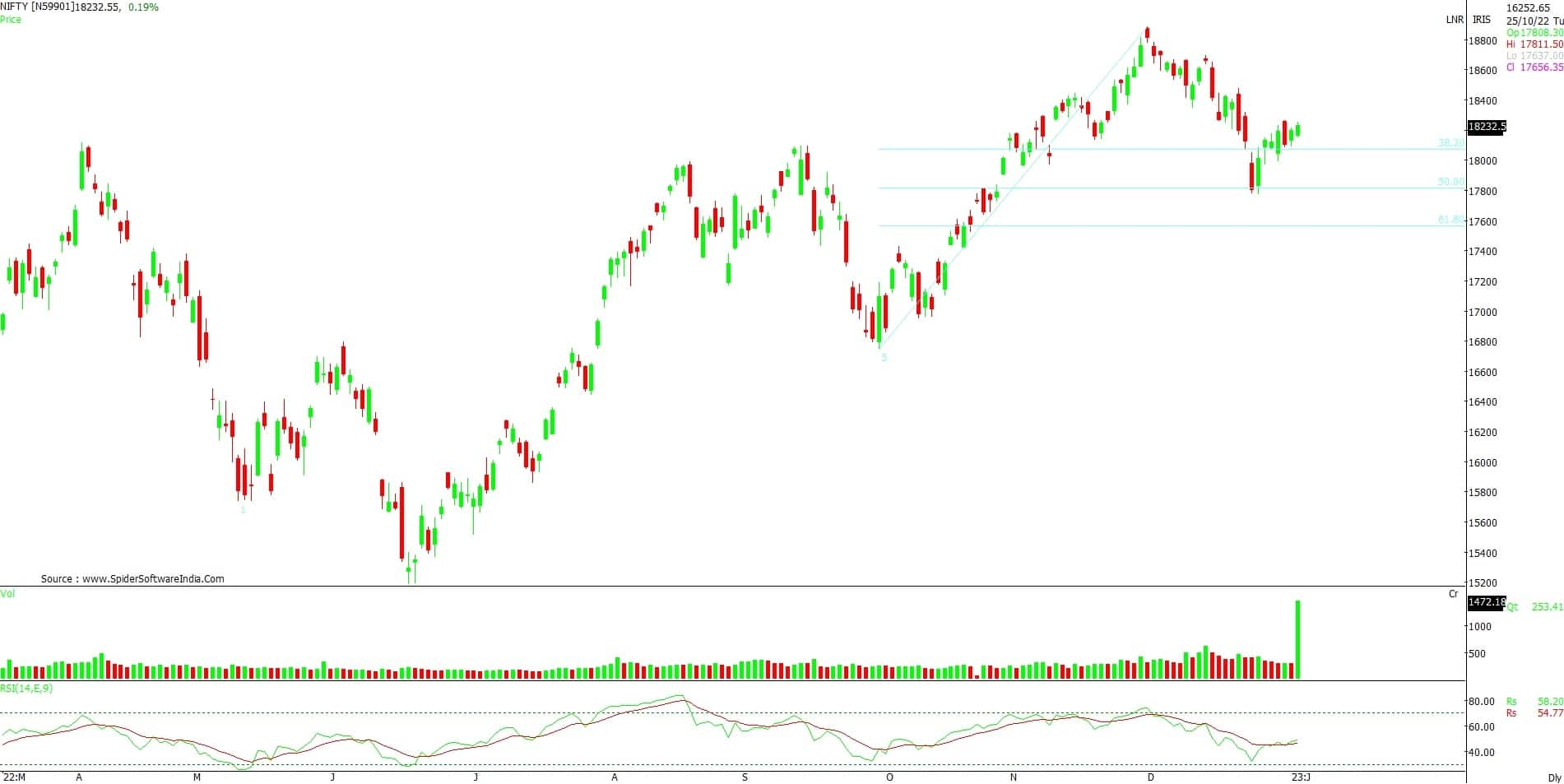

The BSE Sensex gained 126 points to close at 61,294, while the Nifty50 rose 35 points to 18,232 and formed a bullish candle on the daily charts by making higher high higher low formation.

"On the daily charts, the Nifty formed a bullish candle but it is still moving in a range of 18,080 – 18,265 levels indicating consolidation for the short term," Vidnyan Sawant, AVP - Technical Research at GEPL Capital said.

The momentum indicator RSI (relative strength index) is moving upward but still sustaining below the 50 mark which indicates a lack of positive momentum.

As per the overall price structure and indicator's set-up, the market expert feels if the Nifty sustains above the 18,265 level then it will move towards 18,473 followed by the 18,700 mark. On the flip side, if the Nifty breaches below the 17,967 level then the positive view will be negated, Sawant added.

The broader markets also traded higher with the Nifty Midcap 100 index rising 0.23 percent and Smallcap 100 index gaining 0.27 percent on positive breadth. About 1,131 shares advanced against 879 declining shares on the NSE.

Per the pivot charts, we have the key support level for the Nifty at 18,172, followed by 18,148, and 18,109. If the index moves up, the key resistance levels to watch out for are 18,250, followed by 18,274 and 18,313.

The Nifty Bank index climbed 222 points to 43,425 on January 3 and formed a bullish candlestick pattern on the daily charts by making higher high-higher low formation.

The important pivot level, which will act as crucial support for the index, is placed at 43,224, followed by 43,145, and 43,018. On the upside, key resistance levels are placed at 43,480, followed by 43,559, and 43,686.

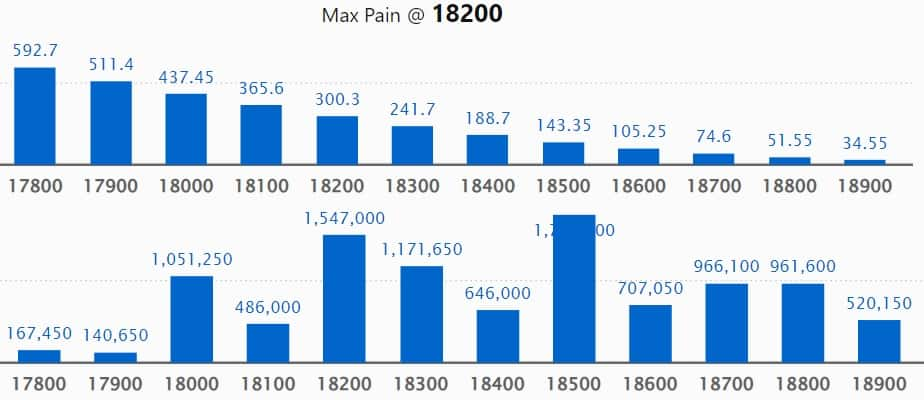

Call option dataWe have seen the maximum Call open interest (OI) at 19,000 strike, with 26.78 lakh contracts, which can act as a crucial resistance level in January series.

This is followed by an 18,500 strike, comprising 17.89 lakh contracts, and an 18,200 strike, where we have more than 15.47 lakh contracts.

Call writing was seen at 18,200 strike, which added 2.94 lakh contracts, followed by 18,500 strike, which added 1.76 lakh contracts, and 19,000 strike, which added 1.33 lakh contracts.

Call unwinding was seen at 18,000 strike, which shed 89,250 contracts, followed by 19,100 strike, which shed 34,450 contracts, and 17,500 strike, which shed 17,900 contracts.

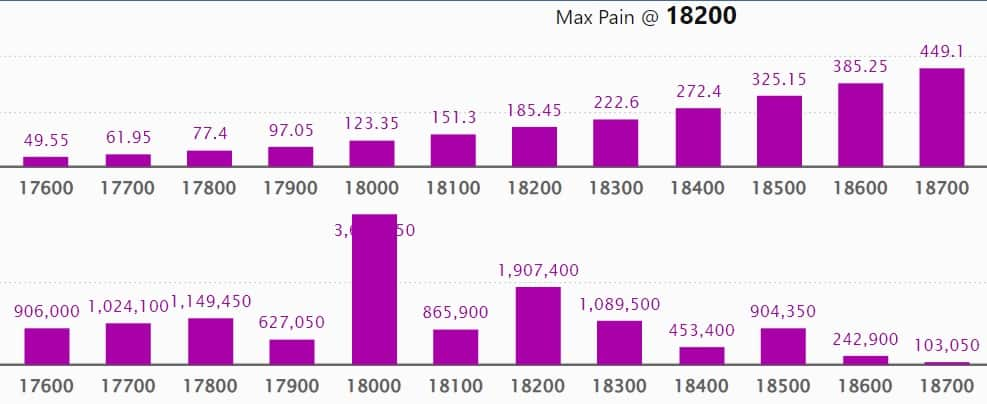

We have seen maximum Put OI at 18,000 strike, with 36.36 lakh contracts, which can act as a crucial support level in January series.

This is followed by 17,500 strike, comprising 30.01 lakh contracts, and 17,000 strike, where we have 29.27 lakh contracts.

Put writing was seen at 18,200 strike, which added 2.36 lakh contracts, followed by 17,500 strike, which added 1.81 lakh contracts, and 18,000 strike, which added 1.58 lakh contracts.

Put unwinding was seen at 17,200 strike, which shed 1.14 lakh contracts, followed by 17,700 strike, which shed 79,050 contracts, and 17,000 strike which shed 51,000 contracts.

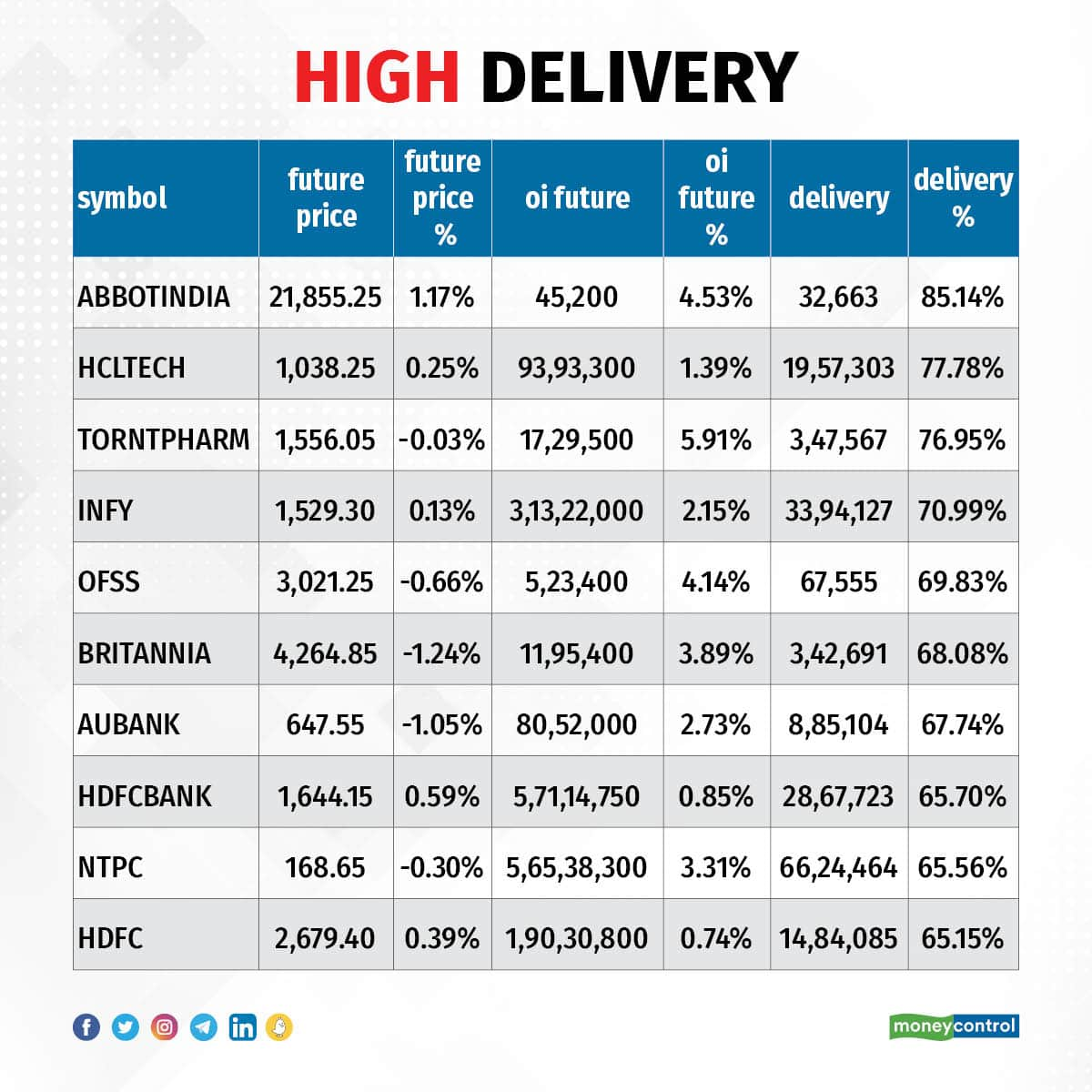

A high delivery percentage suggests that investors are showing interest in these stocks. We have seen the highest delivery in Abbott India, HCL Technologies, Torrent Pharma, Infosys, and Oracle Financial, among others.

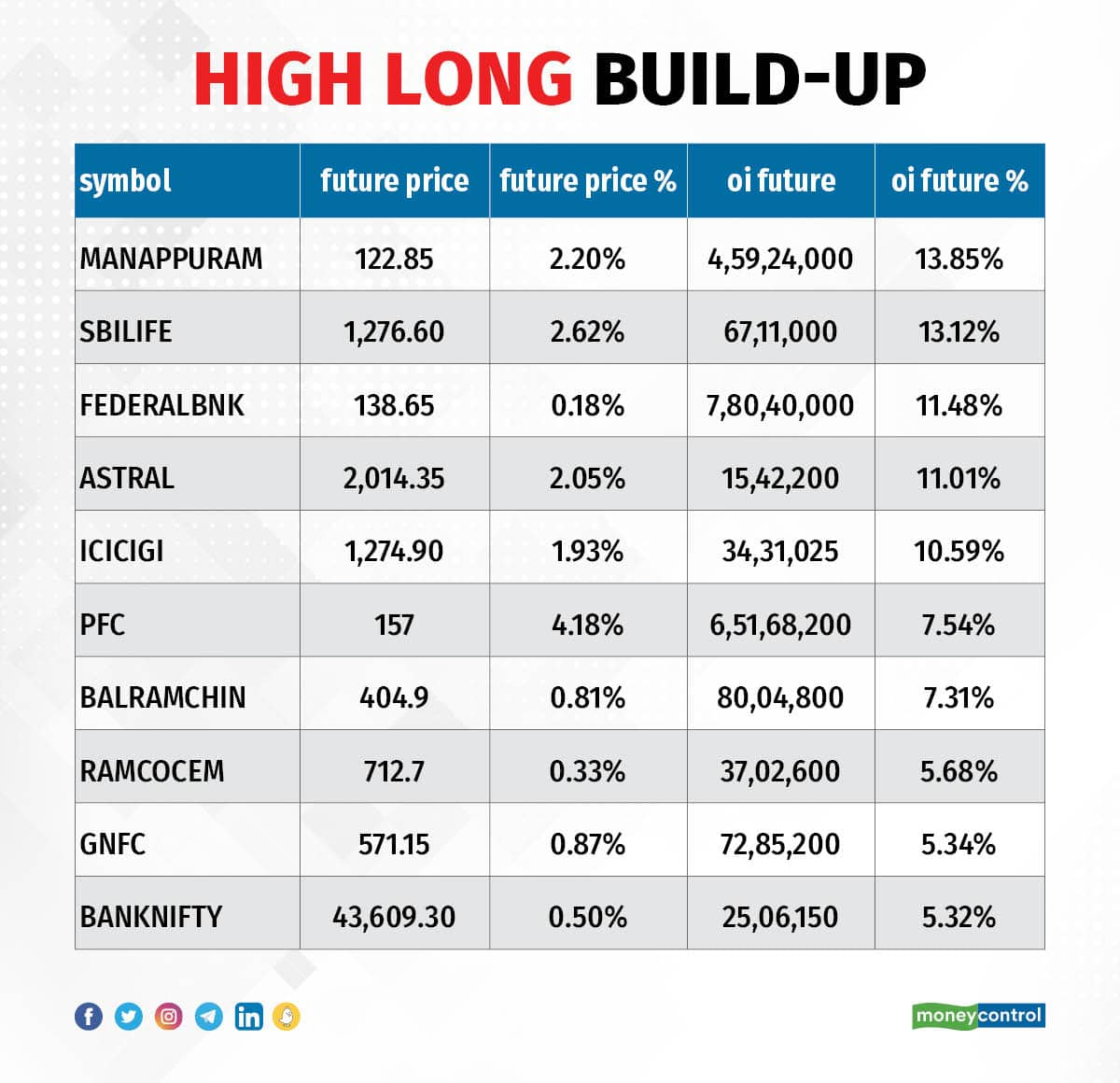

An increase in OI, along with an increase in price, mostly indicates a build-up of long positions. Based on the OI percentage, a long build-up was in 75 stocks on Tuesday, including Manappuram Finance, SBI Life Insurance Company, Federal Bank, Astral, and ICICI Lombard General Insurance.

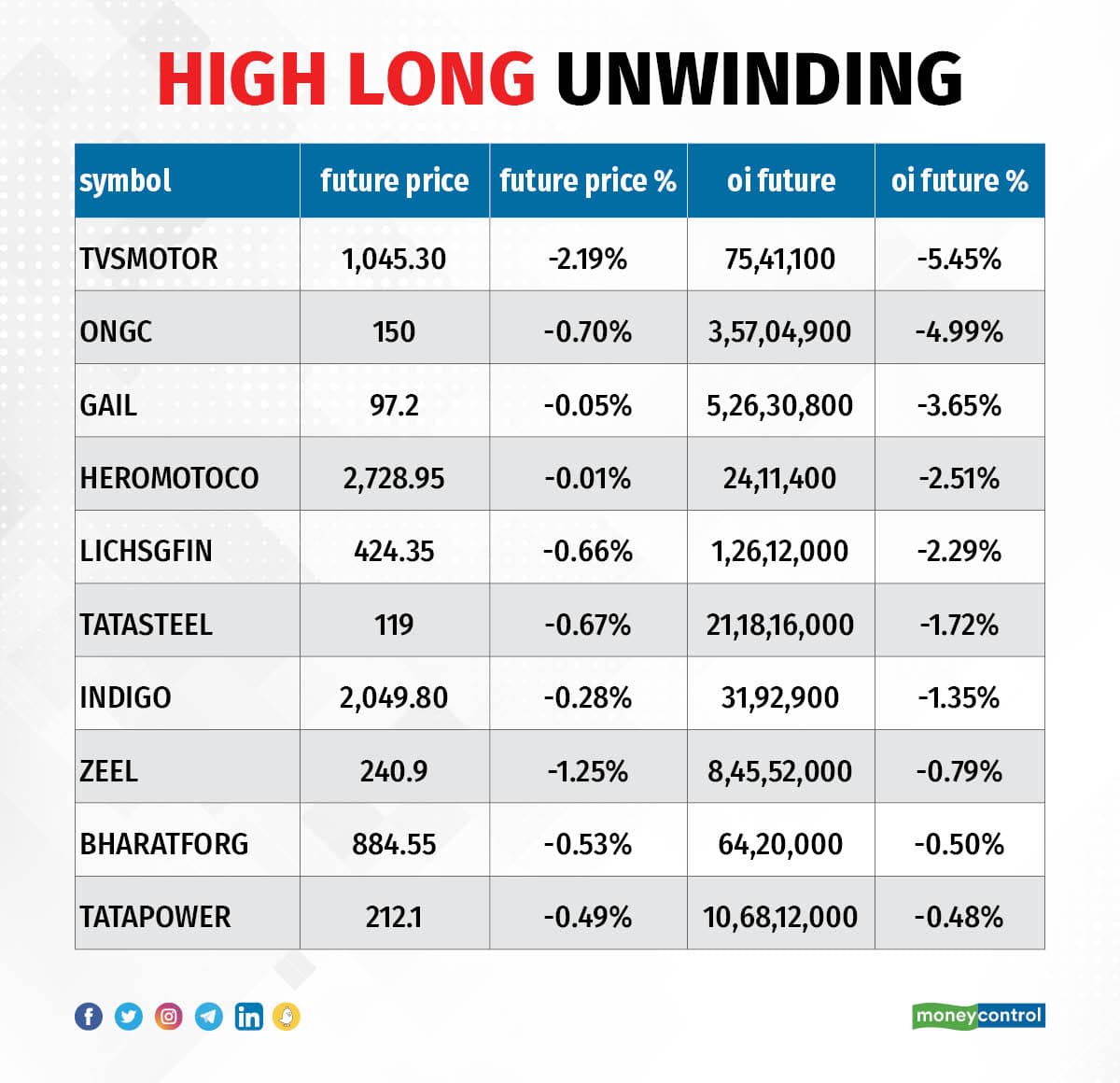

A decline in OI, along with a decrease in price, mostly indicates long unwinding. Based on the OI percentage, 15 stocks saw long unwinding on Tuesday, including TVS Motor Company, ONGC, GAIL India, Hero MotoCorp, and LIC Housing Finance.

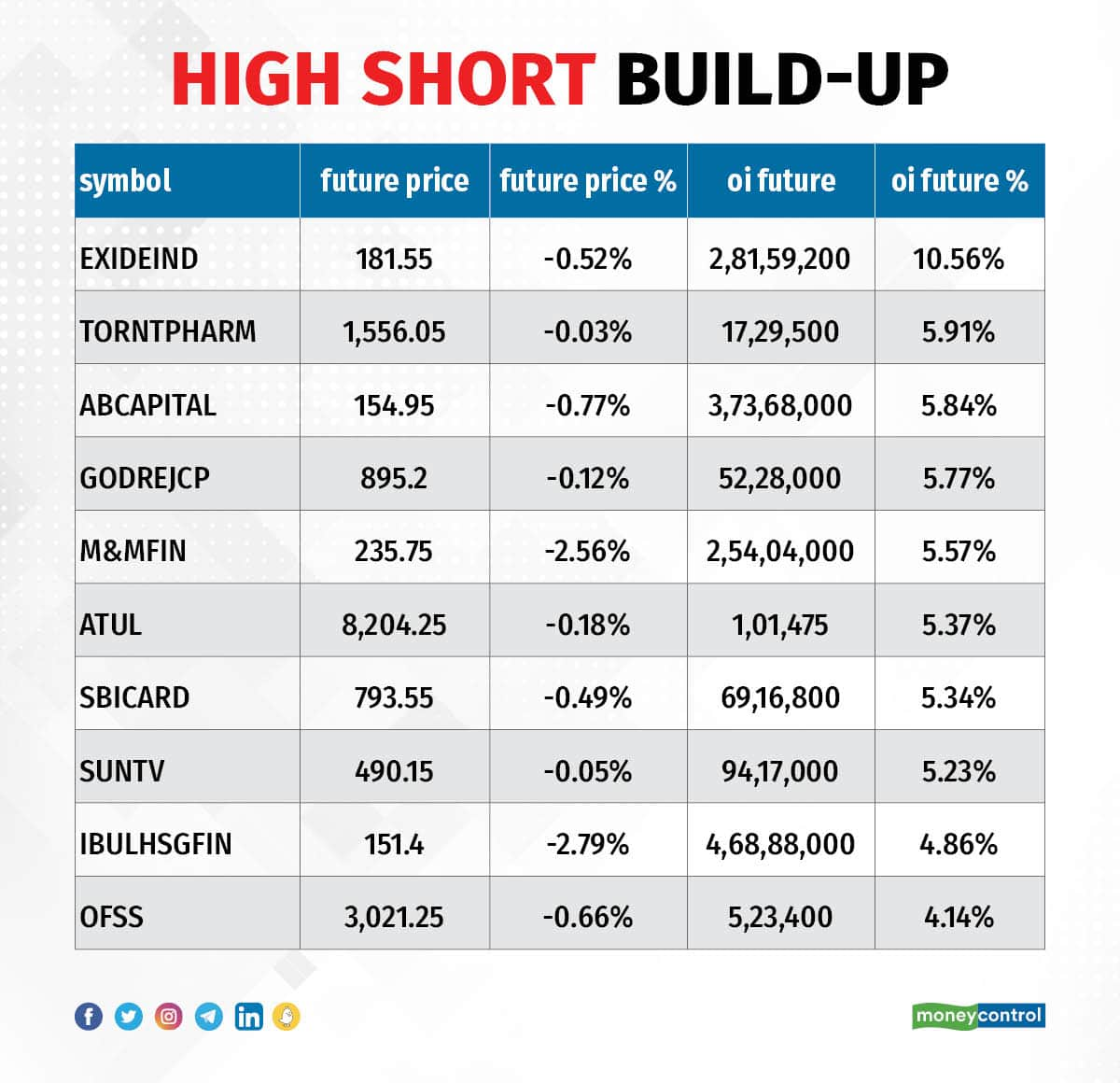

An increase in OI, along with a decrease in price, mostly indicates a build-up of short positions. Based on the OI percentage, a short build-up was seen in 49 stocks on Tuesday, including Exide Industries, Torrent Pharma, Aditya Birla Capital, Godrej Consumer Products, and M&M Financial Services.

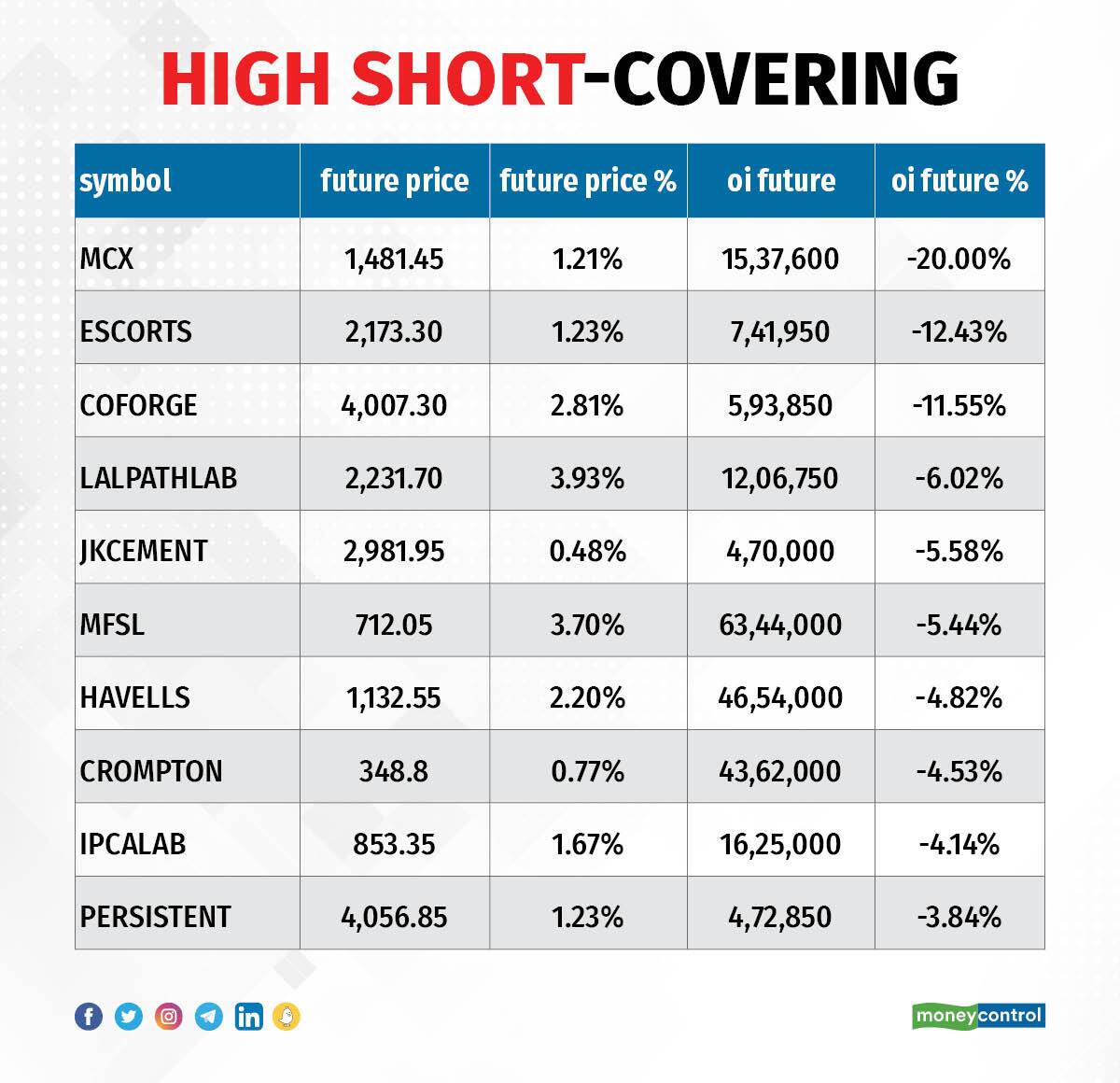

A decrease in OI, along with an increase in price, mostly indicates a short-covering. Based on the OI percentage, we have a total of 54 stocks in the short-covering list on Tuesday, including MCX India, Escorts, Coforge, Dr Lal PathLabs, and JK Cement.

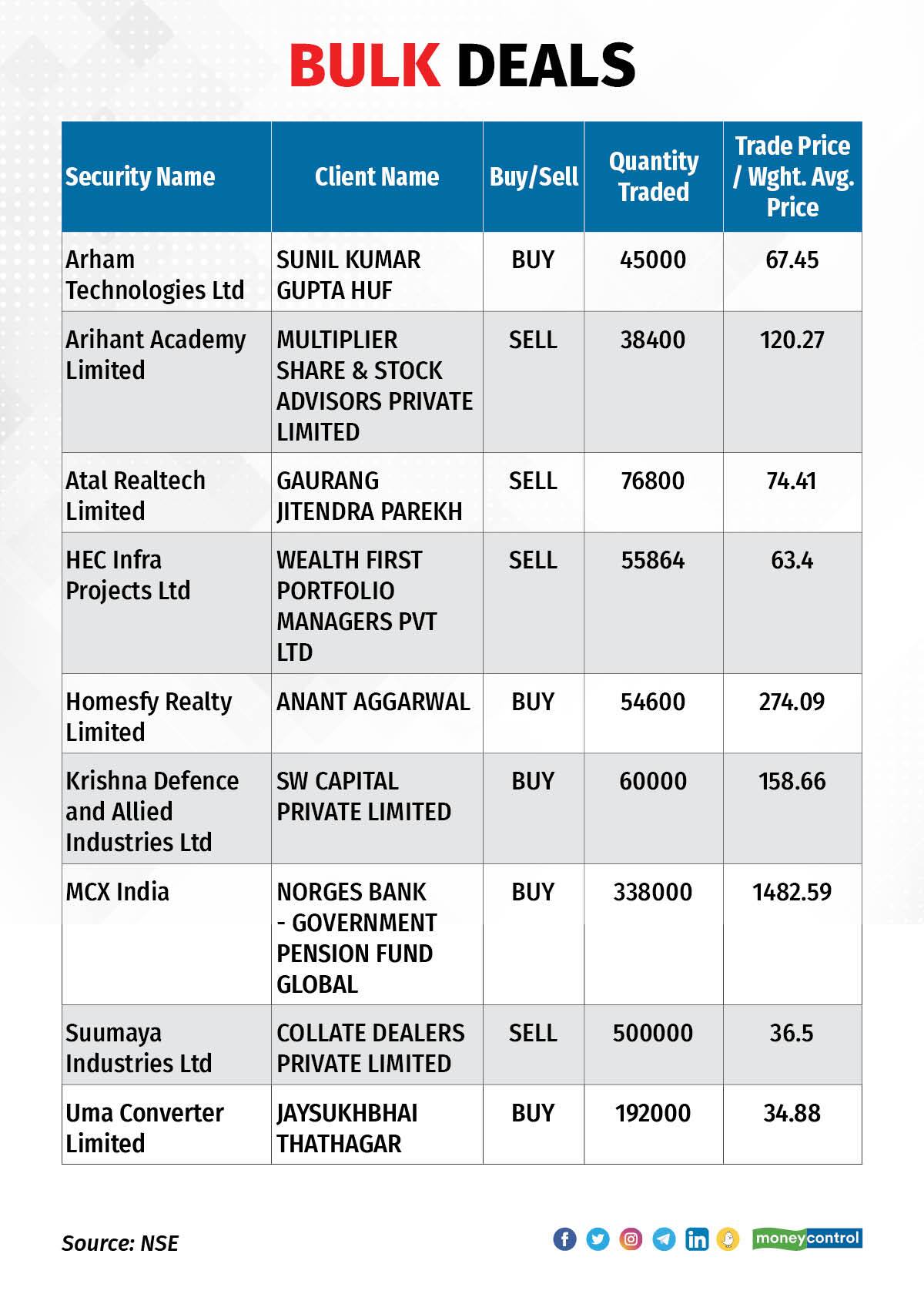

MCX India: Norges Bank - Government Pension Fund Global has bought 3.38 lakh shares in the company via open market transactions, at an average price of Rs 1,482.59 per share. These shares were worth Rs 50.11 crore.

(For more bulk deals, click here)

Investor meets on January 4

CreditAccess Grameen: Officials of the company will interact with Taiyo Pacific Partners.

Gati: Company's officials will interact with Equity Intelligence.

Safari Industries: Officials of the company will interact with HDFC Mutual Fund.

Stocks in the newsRadiant Cash Management Services: The company will make its debut on the bourses on January 4. The issue price is fixed at Rs 94 per share.

Avenue Supermarts: The hypermarket chain operator reported standalone revenue from operations at Rs 11,304.58 crore for quarter ended December FY23, increasing 25 percent from Rs 9,065 crore in same period last year. The total number of stores as of December 2022 stood at 306.

Vedanta: Alumina production at Lanjigarh refinery for quarter ended December FY23 fell by 6 percent YoY to 443kt due to maintenance activities in calciners, while zinc international production increased by 32 percent YoY to 70kt with continued ramp-up at Gamsberg, and total saleable steel production at 306kt was lower by 13 percent YoY due to maintenance activities in blast furnace in Q3FY23. Its overall power sales increased by 5 percent YoY to 3,616 million units.

LTIMindtree: Venugopal Lambu has resigned as Whole-time Director & President, Markets 11, to pursue opportunities outside the company. His last working day will be January 10, 2023.

Satin Creditcare Network: The board of directors of the company will meet on January 6 to consider raising of funds through private placement of non-convertible debentures.

RailTel Corporation of India: The state-run telecom infrastructure provider has received the work order from South Eastern Coalfields for providing MPLS VPN services at 529 locations under SECL command area for 5 years. The total value of the work is Rs 186.19 crore.

PNC Infratech: Subsidiary Akkalkot Highways received appointed date, from National Highways Authority of India, for construction of 6 lane with access controlled greenfield highway on hybrid annuity mode under Bharatmala Pariyojna. The construction period for the road project is 912 days from appointed date.

Fund Flow

Foreign institutional investors (FII) sold shares worth Rs 628.07 crore, while domestic institutional investors (DII) bought shares worth Rs 350.57 crore on January 3, as per provisional data available on the NSE.

Stocks under F&O ban on NSEThe National Stock Exchange has not added any stock under its F&O ban list for January 4. Securities thus banned under the F&O segment include companies where derivative contracts have crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.