The late hour sell-off due to weak global cues amid intensified Ukraine war dragged the market down for the fifth consecutive session on April 19. All sectors, barring oil and gas, closed in red with FMCG and IT being the top losers falling around 3 percent each.

The BSE Sensex fell more than 700 points or 1.2 percent to 56,463, while the Nifty50 corrected over 200 points to 16,959 and formed a bearish candle on the daily charts, indicating the trend in favour of bears.

"A long negative candle was formed on the daily charts, which indicates an attempt for a downside breakout of the support 17,000-16,800 levels. The display of violent declines in the last two sessions indicates a steep downtrend is on the way," Nagaraj Shetti, Technical Research Analyst at HDFC Securities said.

He says that a move below the support of 16,800 levels could open the door down to lower 16,200-16,000 levels in the near term. "Any pullback rally could find resistance around 17,100 levels," he said.

The broader space, too, was under pressure. The Nifty Midcap 100 index fell 1.4 percent and the Smallcap 100 index was down 1.7 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 16,764, followed by 16,569. If the index moves up, the key resistance levels to watch out for are 17,215 and 17,471.

The Bank Nifty also extended its fall, declining 387 points or 1.05 percent to 36,342 on April 19. The important pivot level, which will act as crucial support for the index, is placed at 35,804, followed by 35,267. On the upside, key resistance levels are placed at 37,001 and 37,661 levels.

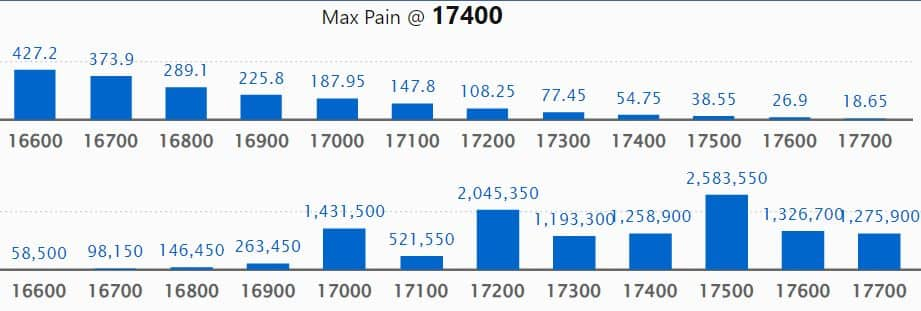

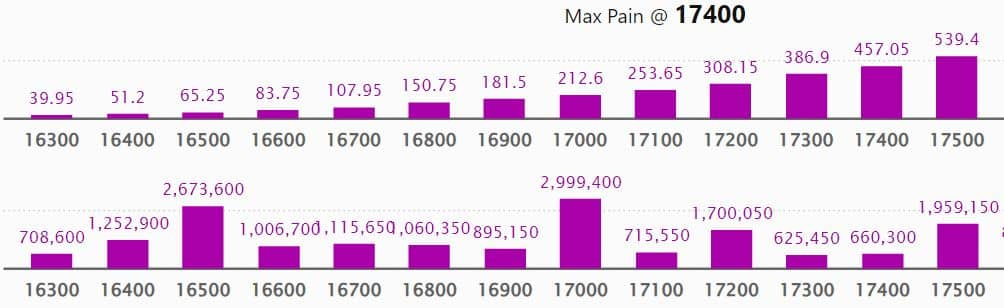

Maximum Call open interest of 30.03 lakh contracts was seen at 18,000 strike, which will act as a crucial resistance level in the April series.

This is followed by 17,500 strike, which holds 25.83 lakh contracts, and 17,200 strike, which has accumulated 20.45 lakh contracts.

Call writing was seen at 17,200 strike, which added 8.35 lakh contracts, followed by 17,000 strike which added 5.48 lakh contracts, and 17,300 strike which added 3.81 lakh contracts.

Call unwinding was seen at 17,700 strike, which shed 1.2 lakh contracts, followed by 17,600 strike which shed 77,300 contracts and 18,000 strike which shed 74,250 contracts.

Maximum Put open interest of 29.99 lakh contracts was seen at 17,000 strike, which will act as a crucial support level in the April series.

This is followed by 16,500 strike, which holds 26.73 lakh contracts, and 16,000 strike, which has accumulated 19.1 lakh contracts.

Put writing was seen at 17,200 strike, which added 5.07 lakh contracts, followed by 16,300 strike, which added 2.32 lakh contracts and 16,900 strike which added 2.11 lakh contracts.

Put unwinding was seen at 17,500 strike, which shed 8.93 lakh contracts, followed by 16,800 strike which shed 5.16 lakh contracts, and 17,600 strike which shed 3.32 lakh contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in ICICI Bank, Lupin, Larsen & Toubro, Honeywell Automation, and HDFC, among others.

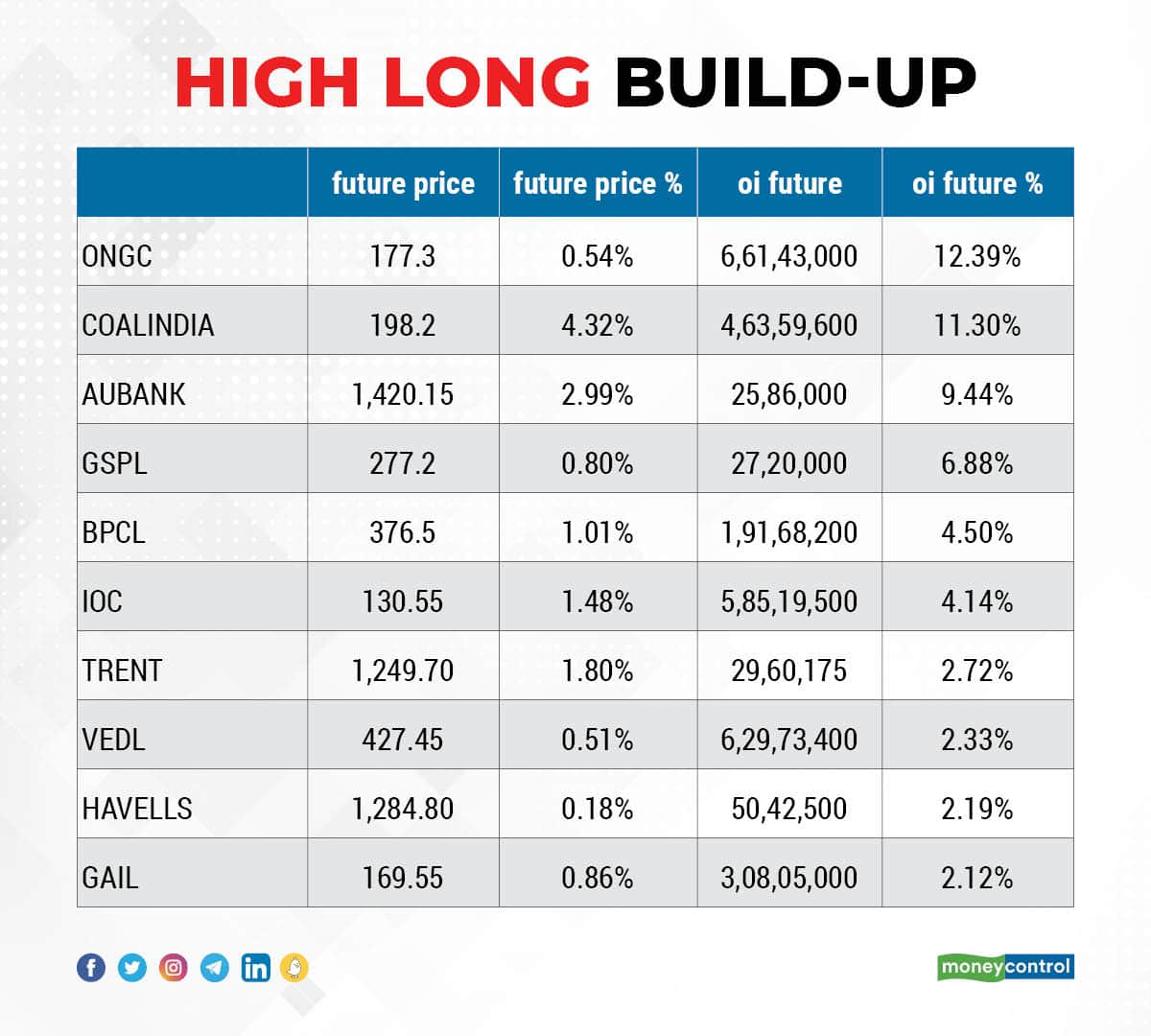

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks including ONGC, Coal India, AU Small Finance Bank, Gujarat State Petronet, and BPCL, in which a long build-up was seen.

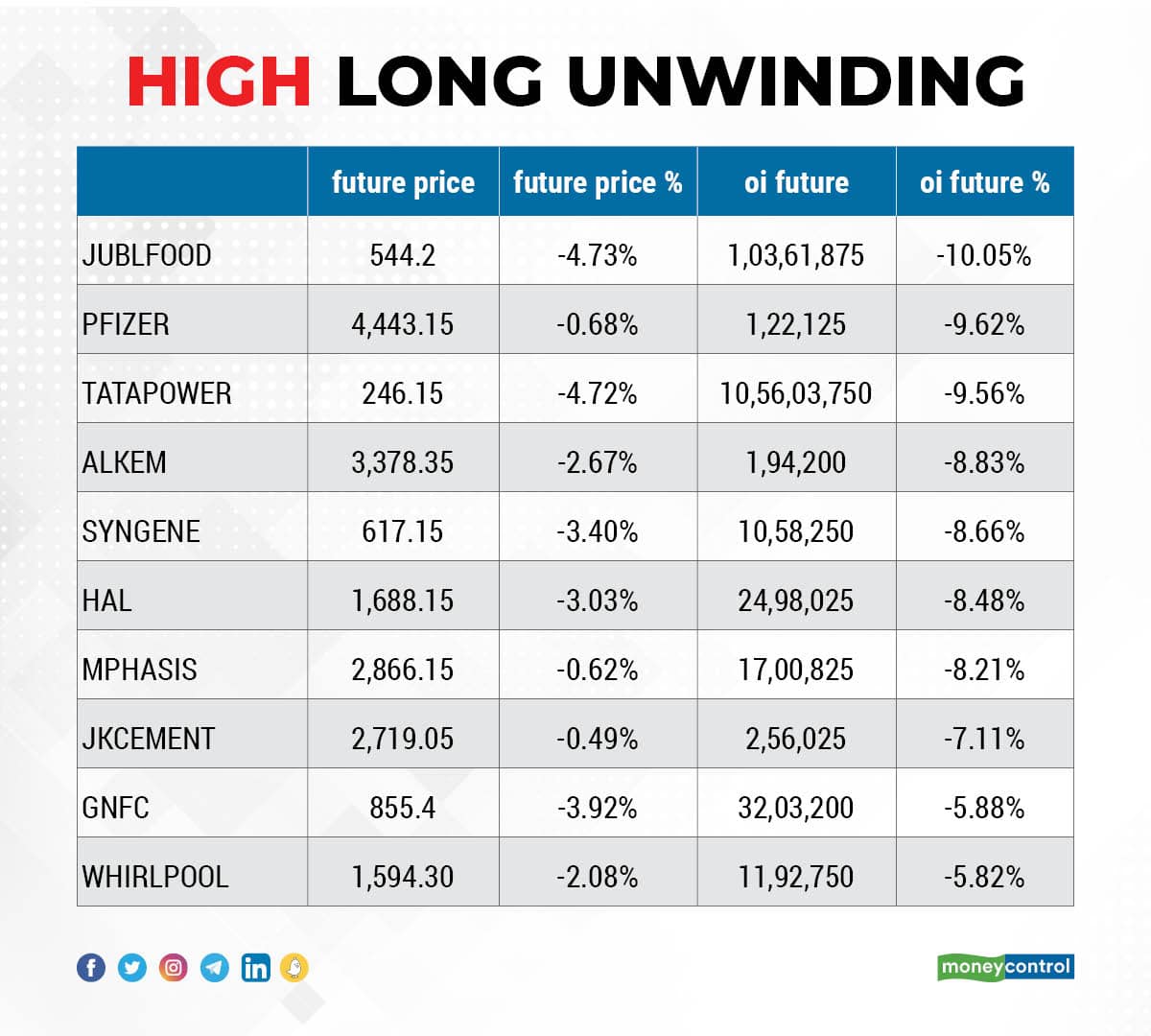

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks including Jubilant Foodworks, Pfizer, Tata Power, Alkem Laboratories, and Syngene International, in which long unwinding was seen.

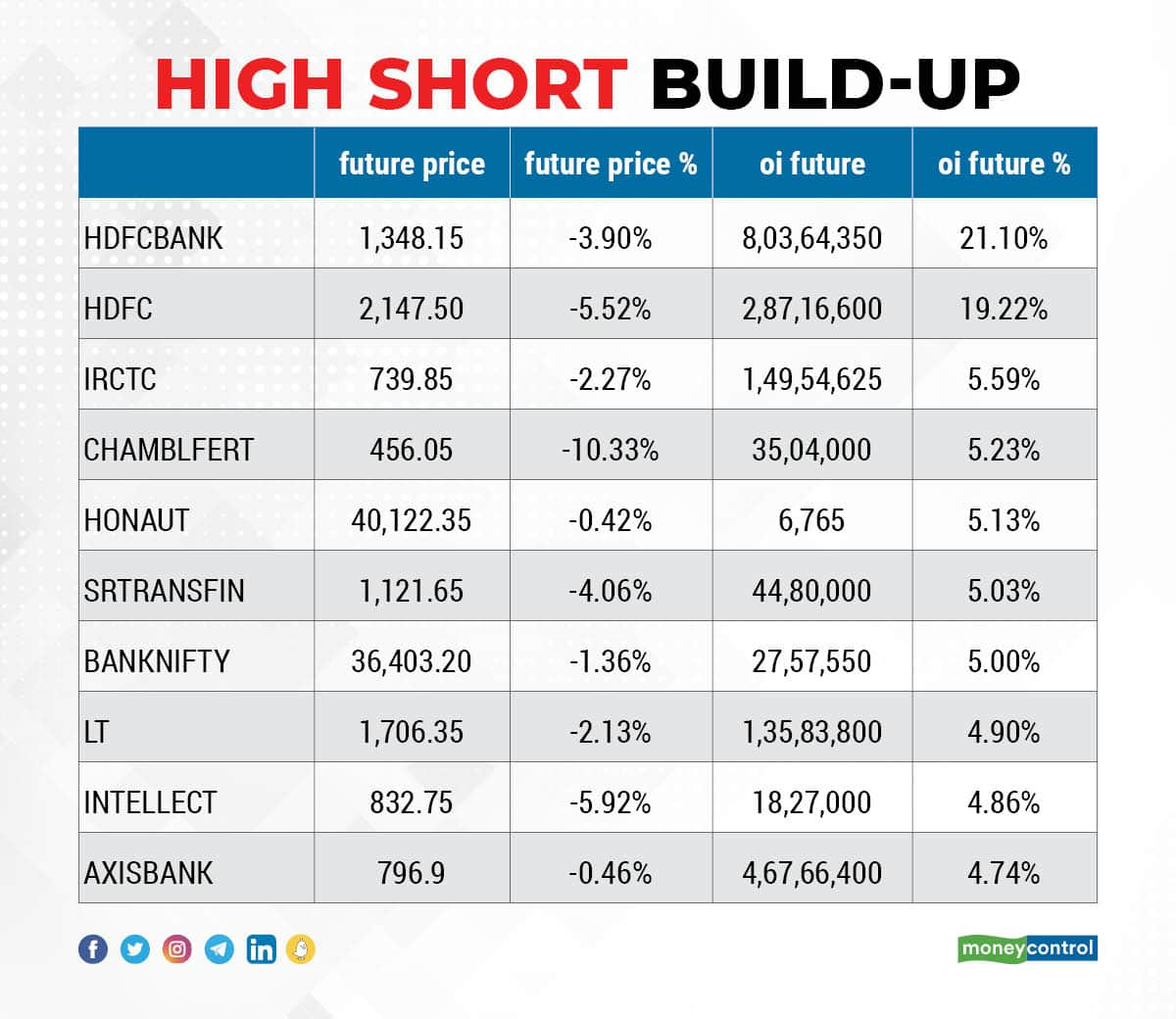

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks including HDFC Bank, HDFC, IRCTC, Chambal Fertilizers, and Honeywell Automation, in which a short build-up was seen.

12 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks including HPCL, Polycab India, Balkrishna Industries, Apollo Hospitals Enterprises, and Atul, in which short-covering was seen.

(For more bulk deals, click here)

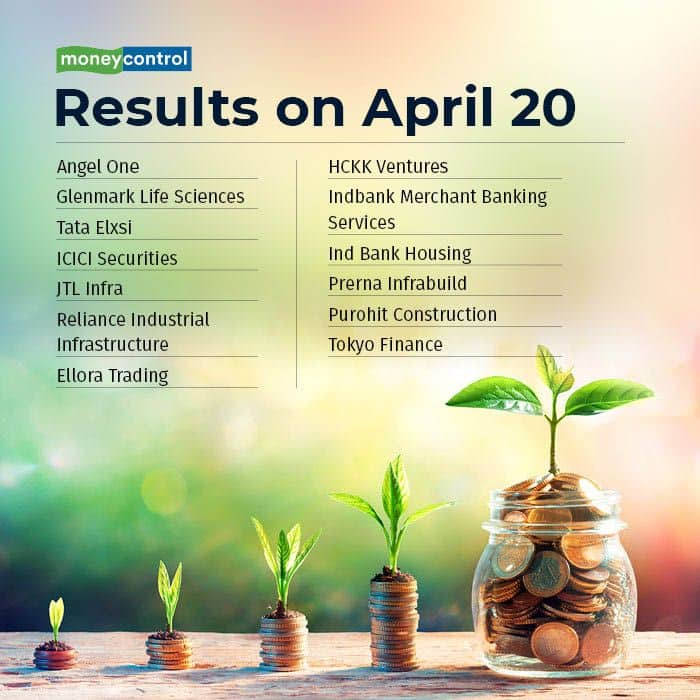

Angel One, Glenmark Life Sciences, Tata Elxsi, ICICI Securities, JTL Infra, Reliance Industrial Infrastructure, Ellora Trading, HCKK Ventures, Indbank Merchant Banking Services, and Ind Bank Housing will release quarterly earnings on April 20.

Stocks In News

ACC: The cement major recorded a 30 percent YoY decline in Q1CY22 profit at Rs 396 crore as operating income dropped 26 percent to Rs 635 crore due to a significant fuel cost increase. Revenue increased by 2.6 percent year-on-year to Rs 4,322 crore in March 2022 quarter, while cement sales volume dropped to 7.71 million tonnes, from 7.97 million tonnes YoY.

Larsen & Toubro Infotech: The IT services company registered a 4 percent sequential growth in profit at Rs 637.5 crore led by higher other income and revenue also grew by 4 percent QoQ to Rs 4,301.6 crore in Q4FY22. The company won 4 large deals with net new TCV (total contract value) of over $80 million. The dividend for financial year 2021-22 was Rs 30 per share.

HBL Power Systems: Banyantree Growth Capital, LLC offloaded a 2.55 percent equity stake in the company via open market transactions during April month. With this, its shareholding in the company stands reduced to 5.9 percent, down from 8.45 percent earlier.

Benares Hotels: Profit for the quarter ended March 2022 grew by 196 percent year-on-year to Rs 3.03 crore with EBITDA rising 68 percent to Rs 5.8 crore YoY, while revenue increased by 46.3 percent to Rs 16.12 crore in the same period. The company has announced a dividend of Rs 10 per share, which is subject to the approval of the shareholders.

Insecticides (India): The company has received the patent for an invention entitled 'Novel Granules and its pesticidal compositions', from Patent Office, The Government of India. This is valid for 20 years.

Punjab & Sind Bank: The company in a BSE filing said the NPA accounts - SREI Infrastructure Finance with outstanding dues of Rs 510.16 crore and SREI Equipment Finance with outstanding dues of Rs 724.18 crore -- have been declared as fraud. The bank has reported the same frauds to the RBI. Further, the accounts have been fully provided for.

Mahindra Lifespace Developers: The company's subsidiary Mahindra World City Developers has received a Rs 102 crore income tax notice. The amount included interest of Rs 43.1 crore against the return of income filed for the assessment year 2016-17 by Mahindra World.

Fund Flow

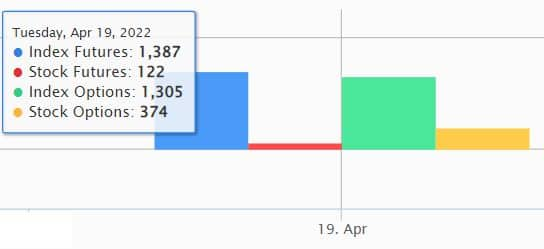

Foreign institutional investors (FIIs) have net sold shares worth Rs 5,871.69 crore, while domestic institutional investors (DIIs) have net bought shares worth Rs 3,980.81 crore on April 19, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

One stock - Tata Power - is under the F&O ban for April 20. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!