The selling pressure extended for a second consecutive session, pulling down the benchmark indices by more than six-tenth of a percent, while the pressure was more in broader space as the Nifty Midcap 100 index fell nearly 2 percent and Smallcap 100 index slipped 1.6 percent.

The BSE Sensex dropped nearly 400 points to 58,576, while the Nifty50 declined 145 points to 17,530 and formed small bearish candle which resembles Hammer kind of pattern formation on the daily charts.

"A reasonable negative candle was formed on the daily chart with minor lower shadow. Technically, this pattern indicates continuation of weakness in the market. After sliding below the initial support of 17,600 levels, Nifty is now placed at the next lower support of around 17,500-17,450 levels," said Nagaraj Shetti, Technical Research Analyst at HDFC Securities.

He further said though, Nifty placed at the support, still there is no indication of any convincing bottom reversal pattern at the lows and one may expect further weakness in the short term. "The market could possibly find support around 17,300 levels and is expected to bounce from the lows."

After showing resilience in the last few sessions, the overall market breadth has turned into negative on Tuesday and broad market indices have closed in the red. "This is not a good sign and one may expect further weakness ahead," said Shetti.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 17,450, followed by 17,370. If the index moves up, the key resistance levels to watch out for are 17,603 and 17,676.

However, there was outperformance by Bank Nifty, which gained 134 points to close at 37,747 on April 12. The important pivot level, which will act as crucial support for the index, is placed at 37,368, followed by 36,988. On the upside, key resistance levels are placed at 38,024 and 38,300 levels.

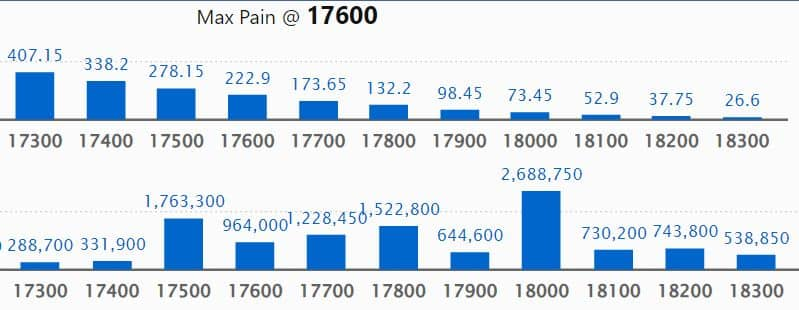

Maximum Call open interest of 26.88 lakh contracts was seen at 18,000 strike, which will act as a crucial resistance level in the April series.

This is followed by 19,000 strike, which holds 21.2 lakh contracts, and 17,500 strike, which has accumulated 17.63 lakh contracts.

Call writing was seen at 17,500 strike, which added 5.85 lakh contracts, followed by 17,600 strike which added 4.84 lakh contracts, and 17,800 strike which added 4.65 lakh contracts.

Call unwinding was seen at 18,700 strike, which shed 1.6 lakh contracts, followed by 18,500 strike which shed 1.36 lakh contracts and 18,800 strike which shed 75,700 contracts.

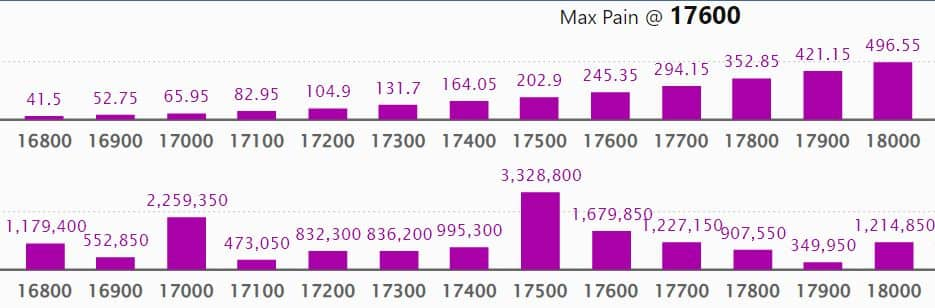

Maximum Put open interest of 33.28 lakh contracts was seen at 17,500 strike, which will act as a crucial support level in the April series.

This is followed by 17,000 strike, which holds 22.59 lakh contracts, and 16,500 strike, which has accumulated 21.59 lakh contracts.

Put writing was seen at 17,500 strike, which added 3.71 lakh contracts, followed by 16,800 strike, which added 2.11 lakh contracts and 16,400 strike which added 1.81 lakh contracts.

Put unwinding was seen at 18,000 strike, which shed 3.58 lakh contracts, followed by 17,900 strike which shed 78,400 contracts, and 19,000 strike which shed 57,050 contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in Honeywell Automation, Alkem Laboratories, Larsen & Toubro, Power Grid Corporation of India, and Max Financial Services, among others.

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks including Aditya Birla Capital, PVR, PI Industries, Bandhan Bank, and GNFC, in which a long build-up was seen.

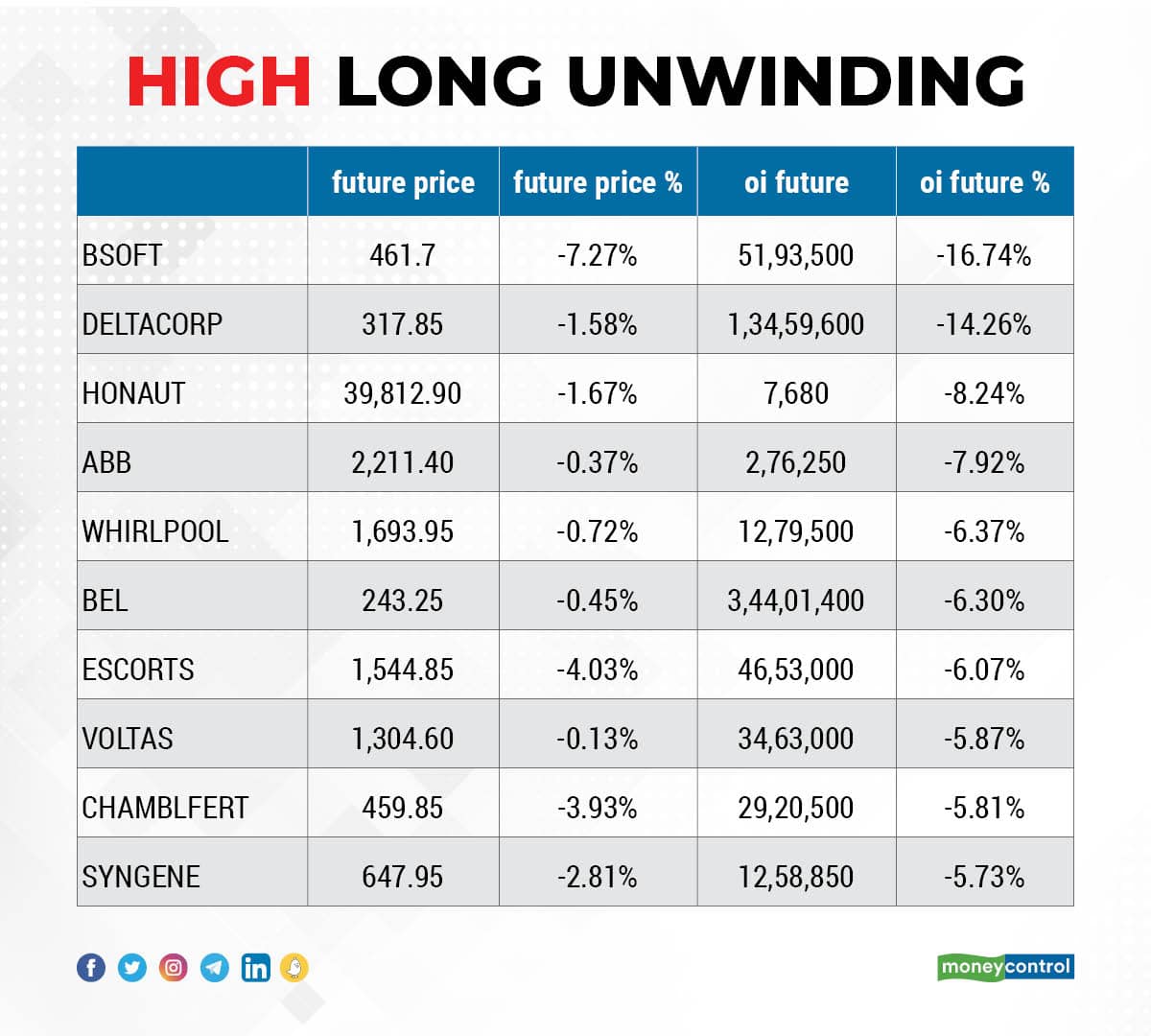

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks including Birlasoft, Delta Corp, Honeywell Automation, ABB India, and Whirlpool, in which long unwinding was seen.

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks including Intellect Design Arena, Persistent Systems, Hindalco Industries, United Breweries, and Infosys, in which a short build-up was seen.

16 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks including Nifty Financial, RBL Bank, Astral, SBI Life Insurance Company, and TCS, in which short-covering was seen.

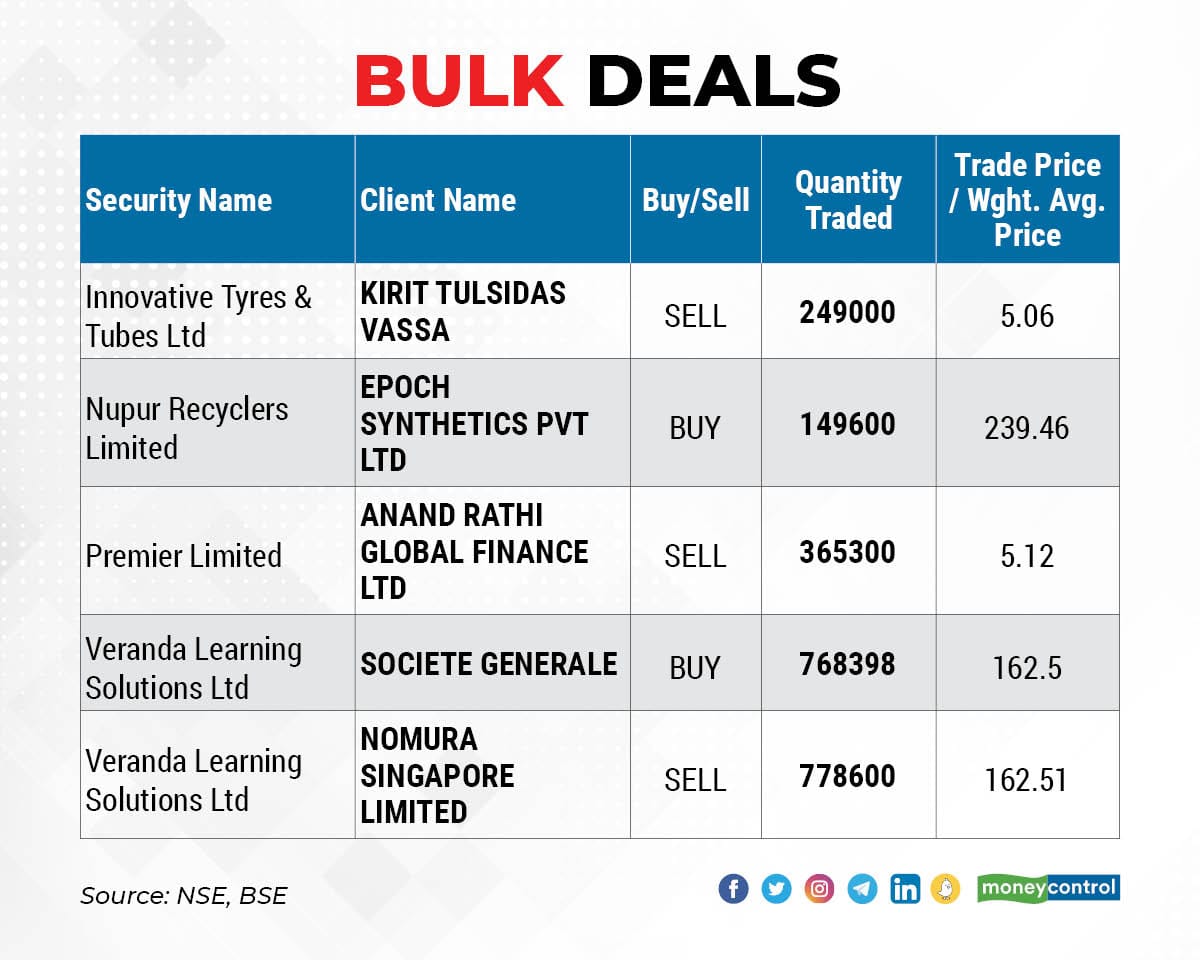

Veranda Learning Solutions: Nomura Singapore exited the company by selling additional 7,78,600 equity shares at an average price of Rs 162.51 per share, via open market transactions. However, European financial services group Societe Generale acquired 7,68,398 equity shares in Veranda at an average price of Rs 162.50 per share.

On Monday, the listing day for Veranda, Nomura Singapore had sold 9.78 lakh shares in the learning solutions provider.

(For more bulk deals, click here)

Results on April 13 & April 16

Infosys, Den Networks, and Lesha Industries will release its quarterly earnings on April 13, while HDFC Bank, ICICI Prudential Life Insurance Company, and Integrated Capital Services will announce its quarterly results on April 16.

Stocks In News

Anand Rathi Wealth: Profit in Q4FY22 grew at a healthy space, rising 239 percent year-on-year to Rs 35 crore and revenue increased 49 percent YoY to Rs 115 crore with assets under management growing strong by 23 percent to Rs 32,906 crore compared to year-ago period.

Simplex Infrastructures: The company in a BSE filing said the board has approved raising of funds up to Rs 421.8 crore by issuing equity shares and warrants at a price of Rs 56.61 per share, to Swan Constructions.

TVS Motor Company: Swiss E-Mobility Group (Holding) AG, a subsidiary of the company, has acquired 100 percent shareholding in Alexand'Ro Edouard'O Passion Vélo Sàrl. The acquired company is primarily engaged in the sale of e-bikes as well as e-bike accessories across a range of premium e-bike brands such as TREK, Riese & Muller, Cannondale, Moustache and others. The arm acquired company for CHF 2.79 million.

Hathway Cable & Datacom: The digital cable TV & broadband internet service provider recorded lower consolidated profit at Rs 28.42 crore for quarter ended March 2022, down 60.6 percent compared to Rs 72.14 crore profit in year-ago period due to tepid revenue growth. Revenue during the quarter increased by 2.3 percent YoY to Rs 448.8 crore in Q4FY22.

HeidelbergCement India: The cement company has commissioned a 5.5 Mega Watt (MW) solar power plant in its mining area in Damoh, Madhya Pradesh. The said solar plant is expected to generate 10 gigawatt hours per annum solar energy and the same will replace electricity purchased under short term open access and from grid.

Duroply Industries: Ace investors Porinju Veliyath & his wife Litty Thomas bought 7,000 equity shares in the company via open market transactions on April 12. With this, their shareholding in the company stands increased to 5.61 percent, up from 5.5 percent earlier.

Choice International: The company in a BSE filing said subsidiary Choice Consultancy Services has received a contract worth Rs 107 crore from public sector undertaking. The arm will provide support for various rural water supply scheme under Indian government's 'Jal Jeevan Mission'. The scope of work included services of preparing detailed project reports and project management services for Maharashtra and West Bengal.

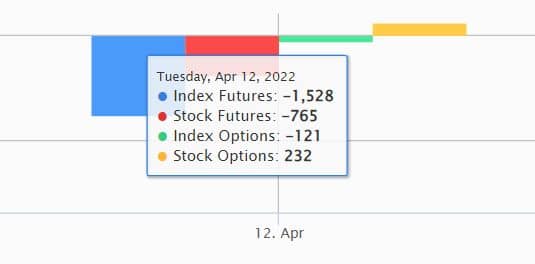

Fund Flow

Foreign institutional investors (FIIs) have net sold shares worth Rs 3,128.39 crore, while domestic institutional investors (DIIs) have net bought shares worth Rs 870.01 crore on April 12, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

One stock - RBL Bank - is under the F&O ban for April 13. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!