Domestic equity benchmarks -- Sensex and Nifty -- closed in the red on May 11 despite a positive trend in other Asian markets.

The Sensex closed the day with a loss of 81 points, or 0.26 percent, at 31,561.22 and the Nifty settled 12 points, or 0.13 percent, lower at 9,239.20.

Analysts believe the market will continue to remain volatile in the near term, reacting to the spread of novel coronavirus, or COVID-19, newsflow regarding development of its vaccine and government's measures on stimulus and restarting the economy.

"Technically, we maintain our negative to rangebound stance. We expect the Nifty to fall towards 9,000, then 8,800, in coming days. On the upside, immediate resistance is placed at 9,400 and then 9,550-9,600,” said Siddhartha Khemka, Head - Retail Research, Motilal Oswal Financial Services.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-months data and not of the current month only.

Key support and resistance level for Nifty

According to pivot charts, the key support level for Nifty is placed at 9,159.47, followed by 9,079.73. If the index moves up, key resistance levels to watch out for are 9,379.42 and 9,519.63.

Nifty Bank

The Nifty Bank closed 2.08 percent lower at 18,950.50. The important pivot level, which will act as crucial support for the index, is placed at 18,656.47, followed by 18,362.43. On the upside, key resistance levels are placed at 19,488.97 and 20,027.43.

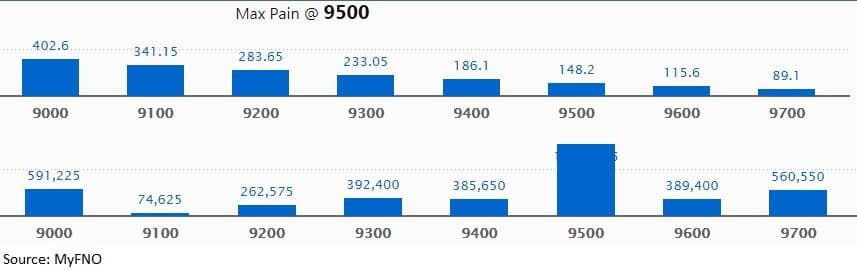

Call option data

Maximum call OI of 15.33 lakh contracts was seen at 9,500 strike, which will act as crucial resistance in the May series.

This is followed by 9,000, which holds 5.91 lakh contracts, and 9,700 strikes, which has accumulated 5.61 lakh contracts.

Significant call writing was seen at the 9,400, which added 1.01 lakh contracts, followed by 9,700 strikes that added 86,100 contracts.

Call unwinding was witnessed at 9,200, which shed 8,550 contracts.

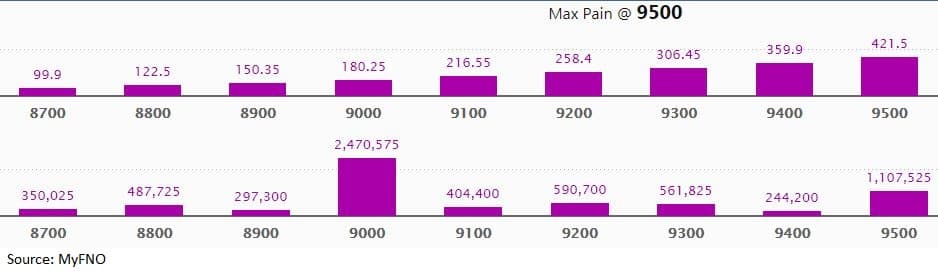

Put option data

Maximum put OI of 24.71 lakh contracts was seen at 9,000 strike, which will act as crucial support in the May series.

This is followed by 9,500, which holds 11.08 lakh contracts, and 9,200 strikes, which has accumulated 5.91 lakh contracts.

Significant Put writing was seen at 9,300, which added 9.63 lakh contracts, followed by 9,400 strikes, which added 5.72 lakh contracts.

Put unwinding was seen at 9,100, which shed 45,375 contracts, followed by 9,600 strikes that shed 16,950 contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

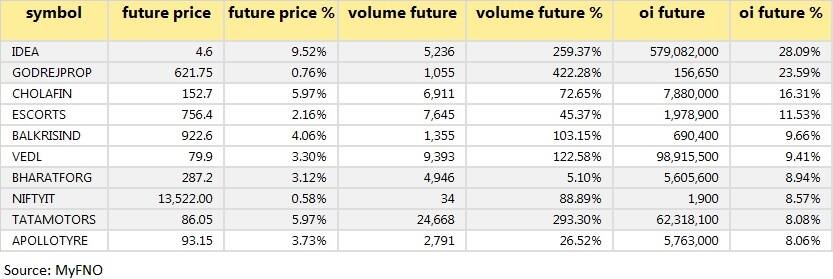

59 stocks saw long build-up

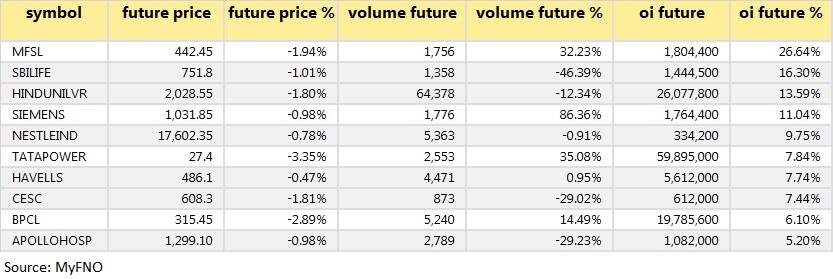

Based on OI future percentage, here are the top 10 stocks in which long build-up was seen.

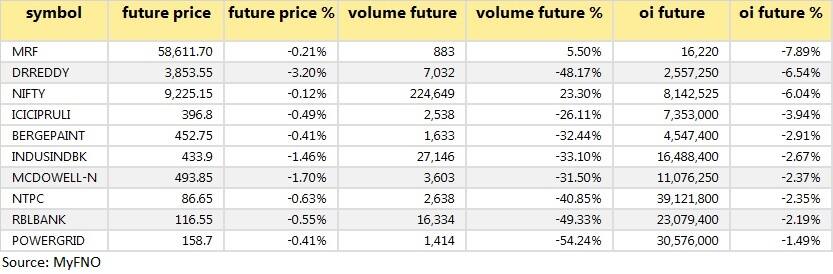

16 stocks saw long unwinding

Based on OI future percentage, here are the top 10 stocks in which long unwinding was seen.

36 stocks saw short build-up

An increase in OI, along with a decrease in price, mostly indicates a build-up of short positions. Based on the OI future percentage, here are the top 10 stocks in which short build-up was seen.

36 stocks witnessed short-covering

A decrease in OI, along with an increase in price, mostly indicates a short-covering. Based on OI future percentage, here are the top 10 stocks in which short-covering was seen.

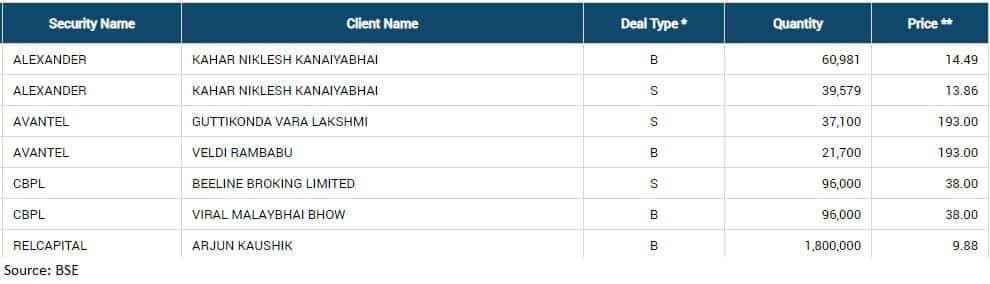

Bulk deals

(For more bulk deals, click here)

Results on May 12

Nestle India, Bandhan Bank, Havells, Blue Star, Sterlite Technologies, Syngene International, IndiaMART InterMESH and Shiva Cement.

Stocks in the news

Godrej Agrovet Q4: Profit fell to Rs 74.58 crore versus Rs 113.69 crore, revenue rose to Rs 1,627.68 cr versus Rs 1,390.91 crore YoY.

Piramal Enterprises Q4: Loss at Rs 1,702 crore versus profit of Rs 455 crore, revenue fell to Rs 3,341 crore versus Rs 3,408.52 crore YoY.

Ind-Swift Labs: Company received Establishment Inspection Report from USFDA for facility at Derabassi, Punjab.

Seamec: HAL Offshore placed a Notification of Award (NOA) for charter hire of SEAMEC III for 2 years, the value of the contract is about $22.98 million.

Century Plyboards: Company partially resumed operations at some manufacturing locations, warehouses, and offices.

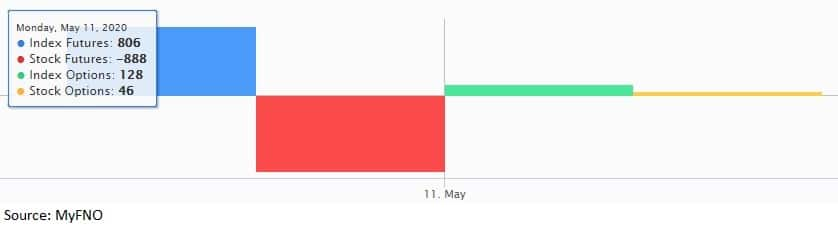

Fund flow

FII and DII data

Foreign institutional investors (FIIs) bought shares worth Rs 534.87 crore, while domestic institutional investors (DIIs) sold shares worth Rs 821.6 crore in the Indian equity market on May 11, provisional data available on the NSE showed.

Stock under F&O ban on NSE

Vodafone Idea is under the F&O ban for May 12. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!