Benchmark indices ended with strong gains a day ahead of May series F&O expiry with the Sensex closing the day with a robust gain of 996 points, or 3.25 percent at 31,605.22 and Nifty surging 286 points, or 3.17 percent, to 9,314.95.

"Benchmark indices staged a rally in sync with global cues, as some pockets of value buying emerged. Inspite of the rising number of infections, markets expect slow return to normalcy, when lockdown 4.0 ends this week. The volatility is expected to continue, ahead of tomorrow’s F&O expiry," said Vinod Nair, Head of Research at Geojit Financial Services.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three- months data and not of the current month only.

Key support and resistance level for Nifty

According to pivot charts, the key support level for Nifty is placed at 9,101.47, followed by 8,887.98. If the index moves up, key resistance levels to watch out for are 9,431.22 and 9,547.48.

Nifty Bank

The Nifty Bank vaulted 7.28 percent to 18,710.55. The important pivot level, which will act as crucial support for the index, is placed at 17,889.2, followed by 17,067.8. On the upside, key resistance levels are placed at 19,203.1 and 19,695.6.

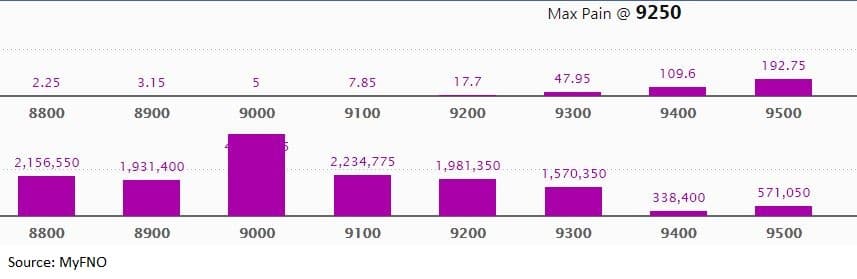

Call option data

Maximum call OI of 27.91 lakh contracts was seen at 9,500 strike, which will act as crucial resistance in the May series.

This is followed by 9,300, which holds 19.65 lakh contracts, and 9,400 strikes, which has accumulated 16.12 lakh contracts.

Call writing was seen at the 9,500, which added 80,475 contracts, followed by 9,600 strikes that added 22,800 contracts.

Call unwinding was witnessed at 9,200, which shed 19.86 lakh contracts, followed by 9,100 strike which shed 15.13 lakh contracts.

Put option data

Maximum put OI of 43.81 lakh contracts was seen at 9,000 strike, which will act as crucial support in the May series.

This is followed by 9,100, which holds 22.35 lakh contracts, and 8,800 strikes, which has accumulated 21.57 lakh contracts.

Significant Put writing was seen at 9,200, which added 14.11 lakh contracts, followed by 9,100 strikes, which added 12.84 lakh contracts.

Put unwinding was seen at 9,500, which shed 71,700 contracts, followed by 9,700 strikes that shed 62,850 contracts.

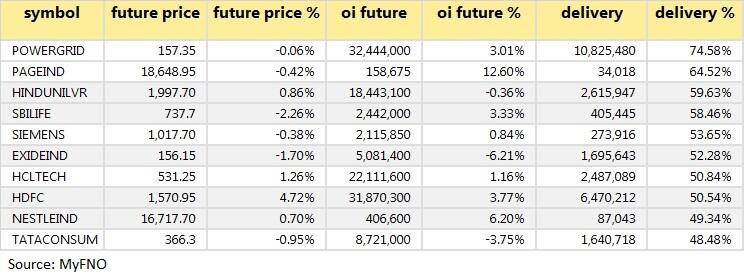

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

44 stocks saw long build-up

Based on the OI future percentage, here are the top 10 stocks in which long build-up was seen.

25 stocks saw long unwinding

Based on the OI future percentage, here are the top 10 stocks in which long unwinding was seen.

11 stocks saw short build-up

An increase in OI, along with a decrease in price, mostly indicates a build-up of short positions.

66 stocks witnessed short-covering

A decrease in OI, along with an increase in price, mostly indicates a short-covering. Based on the OI future percentage, here are the top 10 stocks in which short-covering was seen.

Bulk deals

(For more bulk deals, click here)

Results on May 28

Lupin, Federal Bank, TVS Motor Company, CEAT, Automobile Corporation of Goa, Agro Tech Foods, Benares Hotels, Chembond Chemicals, LT Foods, Heidelbergcement India, Hindusthan National Glass, IIFL Finance, Inditrade Capital, Muthoot Capital Services, Radico Khaitan, Rain Industries, Tata Steel Long Products, Wendt (India)

Stocks in the news

United Spirits Q4: Profit at Rs 58.4 cr versus Rs 123 cr, revenue at Rs 6,419 cr versus Rs 7,283 cr YoY.

Vedanta: India Ratings downgraded the rating of the company to AA- with a negative outlook.

Indostar Capital Finance: Company completed an equity raise of Rs 1,225 crore from Brookfield Business Partners.

Tube Investments of India: Company approved fresh long-term borrowing of up to Rs 200 crore.

KPIT Technologies: Company sees a significant impact of COVID-19 in H1FY21 and expects the recovery to commence from Q3FY21.

Aditya Birla Fashion and Retail Q4: Loss at Rs 146 cr versus profit at Rs 202.64 cr, revenue at Rs 1,832 cr versus Rs 1,915 cr YoY.

Filatex India: Anil Dutt Mohla resigned as Chief Financial Officer.

Sun Pharma Q4: India sales up 8% at Rs 2,365 crore, US finished dosage sales down 15% to $375 million, Emerging Markets sales up 8% at $187 million YoY.

Fund flow

FII and DII data

Foreign institutional investors (FIIs) sold shares worth Rs 334.74 crore, while domestic institutional investors (DIIs) bought shares worth Rs 2,408.85 crore in the Indian equity market on May 27, provisional data available on the NSE showed.

Stock under F&O ban on NSE

Vodafone Idea is under the F&O ban for May 28. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!